MicroStrategy stock falling today, and the reasons behind this downturn are multifaceted and deeply interconnected with the cryptocurrency landscape. As one of the most prominent corporate holders of Bitcoin, MicroStrategy has transformed itself from a traditional business intelligence software company into a de facto Bitcoin investment vehicle, making its stock price extraordinarily sensitive to cryptocurrency market movements. Understanding why MicroStrategy stock is falling today requires examining not just the immediate catalysts but also the broader structural vulnerabilities that come with the company’s aggressive Bitcoin accumulation strategy.

The dramatic price action in MSTR stock reflects growing investor anxiety about Bitcoin’s recent volatility, regulatory uncertainties, and concerns about the sustainability of MicroStrategy’s debt-fueled Bitcoin acquisition model. Today’s selloff represents more than just a temporary market fluctuation—it signals deeper questions about whether the company’s unconventional corporate strategy can withstand prolonged cryptocurrency bear markets and rising interest rate environments.

MicroStrategy’s Bitcoin-Centric Business Model

Before diving into the specific reasons MicroStrategy stock is falling today, it’s essential to understand how fundamentally the company has repositioned itself around Bitcoin. Under the leadership of executive chairman Michael Saylor, MicroStrategy has accumulated over 190,000 Bitcoins, making it the largest corporate holder of the cryptocurrency. This massive position, worth billions of dollars at peak valuations, has essentially turned the company’s stock into a leveraged play on Bitcoin’s price movements.

The company’s core business intelligence software operations now pale in comparison to the balance sheet impact of its Bitcoin holdings. This transformation means that traditional metrics for evaluating software companies—such as recurring revenue growth, customer acquisition costs, or software margins—have become secondary to the single question that dominates investor thinking: what is Bitcoin’s price trajectory? When Bitcoin experiences significant declines, as it has in recent trading sessions, the impact on MicroStrategy’s stock price becomes amplified due to the sheer concentration of cryptocurrency exposure.

Bitcoin Price Volatility as the Primary Catalyst

The most immediate explanation for why MicroStrategy stock is falling today centers on Bitcoin’s recent price weakness. Cryptocurrency markets have experienced renewed selling pressure, with Bitcoin dropping below critical technical support levels that many traders had been monitoring closely. When Bitcoin declines by several percentage points, MSTR shares typically fall by an even greater magnitude due to the leveraged nature of the company’s Bitcoin exposure and the equity risk premium investors demand for holding a stock rather than the underlying cryptocurrency directly.

Today’s Bitcoin weakness stems from multiple converging factors. Regulatory scrutiny has intensified across multiple jurisdictions, with discussions about stricter oversight of cryptocurrency exchanges and concerns about the environmental impact of Bitcoin mining resurfacing in policy circles. Additionally, macroeconomic headwinds including persistent inflation concerns and central bank policy uncertainty have prompted investors to reduce exposure to risk assets broadly, and cryptocurrencies have been particularly affected given their classification as highly speculative investments.

The correlation between Bitcoin’s price movements and MicroStrategy’s stock performance has become increasingly tight over recent quarters. Academic research and market observations suggest that MSTR shares often trade at a premium or discount to the underlying Bitcoin holdings, with this relationship fluctuating based on investor sentiment, leverage concerns, and expectations about future Bitcoin acquisitions. When cryptocurrency sentiment deteriorates, as it has today, this relationship works against MicroStrategy shareholders, creating downward pressure that extends beyond what the Bitcoin price decline alone would suggest.

Debt Obligations and Financial Leverage Concerns

Another critical factor contributing to MicroStrategy stock falling today involves growing investor anxiety about the company’s substantial debt load, which was largely incurred to finance Bitcoin purchases. MicroStrategy has issued convertible notes and secured credit facilities totaling billions of dollars, using these proceeds to aggressively accumulate Bitcoin during both market upswings and downturns. While this strategy proved spectacularly profitable during Bitcoin’s bull runs, it introduces significant financial risk during extended cryptocurrency bear markets.

The convertible debt structure creates particular complications for MSTR investors. These instruments give bondholders the option to convert their debt into equity at predetermined prices, potentially diluting existing shareholders significantly if Bitcoin prices remain depressed and conversion becomes attractive relative to holding the bonds. Furthermore, if Bitcoin were to decline substantially below MicroStrategy’s average acquisition cost—which some analysts estimate in the range of thirty to forty thousand dollars per Bitcoin—the company could face margin calls or covenant violations on certain credit facilities.

Financial analysts have raised questions about MicroStrategy’s ability to service its debt obligations if both the cryptocurrency market remains weak and the company’s legacy software business fails to generate sufficient cash flow. While MicroStrategy has consistently maintained that its Bitcoin holdings provide adequate collateral and that the company maintains conservative debt-to-equity ratios when measured against cryptocurrency assets, critics argue that the extreme volatility of Bitcoin makes traditional financial metrics less reliable. This financial leverage concern becomes particularly acute during days like today when Bitcoin prices drop sharply, leading investors to reassess the sustainability of the company’s capital structure.

Market Sentiment and Institutional Investor Positioning

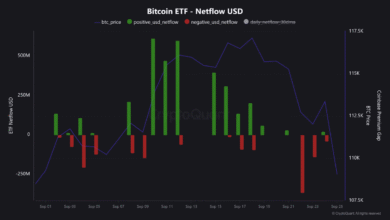

The decline in MicroStrategy stock today also reflects shifting sentiment among institutional investors who had previously embraced the company as a proxy for Bitcoin exposure within traditional equity portfolios. For portfolio managers who face restrictions on directly purchasing cryptocurrencies or who prefer the regulatory clarity of owning exchange-traded equities, MSTR shares had served as an attractive alternative vehicle for gaining Bitcoin exposure. However, recent months have seen the proliferation of Bitcoin ETFs and other cryptocurrency investment products that offer more direct exposure without the operational risks and debt complications associated with MicroStrategy’s business model.

This evolution in the cryptocurrency investment landscape has reduced some of the unique value proposition that MicroStrategy once offered. Institutional investors who can now access spot Bitcoin ETFs with lower expense ratios and without corporate governance complications may be reallocating capital away from MSTR stock and toward these newer investment vehicles. Today’s selloff may partially reflect this ongoing reallocation process, particularly as quarterly portfolio rebalancing deadlines approach and fund managers reassess their cryptocurrency allocation strategies.

Additionally, hedge funds and sophisticated traders who had used MicroStrategy shares for pairs trading strategies—simultaneously going long Bitcoin and short MSTR to capture the premium or discount between the stock price and underlying Bitcoin value—may be adjusting their positions. When these complex trading strategies unwind, they can create additional selling pressure that exacerbates the decline in MicroStrategy stock, creating a self-reinforcing downward spiral particularly during periods of low liquidity or heightened market stress.

Regulatory Uncertainty in the Cryptocurrency Ecosystem

Regulatory developments represent another significant factor explaining why MicroStrategy stock is falling today. The cryptocurrency industry continues to face evolving regulatory frameworks across global jurisdictions, and recent statements from financial regulators have introduced new uncertainties that affect all companies with substantial cryptocurrency exposures. Discussions about potential Bitcoin taxation changes, enhanced reporting requirements for cryptocurrency transactions, and debates about classifying certain digital assets as securities have all contributed to investor nervousness.

For MicroStrategy specifically, regulatory changes could impact both the company’s ability to continue accumulating Bitcoin and the tax treatment of its cryptocurrency holdings. The company has structured its Bitcoin purchases to qualify for specific accounting treatments and has developed strategies to minimize tax liabilities associated with these holdings. However, potential changes to cryptocurrency taxation or accounting standards could force MicroStrategy to recognize significant losses on paper or could alter the economics of its Bitcoin acquisition strategy in ways that reduce shareholder value.

Furthermore, if regulatory frameworks emerge that restrict corporate Bitcoin ownership or impose substantial compliance burdens on companies holding large cryptocurrency positions, MicroStrategy’s business model could face fundamental challenges. While such dramatic regulatory interventions remain speculative, the mere possibility contributes to the risk premium investors demand for holding MSTR stock, and any news flow that heightens these regulatory concerns can trigger significant selloffs like the one observed today.

Technical Analysis and Trading Dynamics

From a technical perspective, MicroStrategy stock’s decline today has breached several key support levels that traders had been monitoring, potentially triggering automated selling from algorithmic trading systems and stop-loss orders. Technical analysts who follow MSTR charts note that the stock has formed bearish patterns including descending triangles and breakdown patterns that often precede extended declines. When these technical levels are violated, momentum traders and quantitative funds programmed to respond to such signals often exit positions rapidly, creating cascading selling pressure.

The stock’s relative strength index and other momentum indicators had been showing weakness for several trading sessions before today’s sharp decline, suggesting that underlying buying pressure had been deteriorating even before the latest selloff. Volume analysis reveals that today’s trading has occurred on above-average volume, which technical analysts interpret as strong conviction behind the selling rather than merely a temporary bout of profit-taking. This combination of technical breakdown and heavy volume creates conditions where MicroStrategy stock could continue facing pressure in subsequent trading sessions unless significant positive catalysts emerge to reverse the momentum.

Options market activity surrounding MSTR stock has also contributed to today’s volatility. The company’s shares are among the most actively traded in the options market, with both bullish call buyers and bearish put buyers creating complex positioning dynamics that can amplify stock price movements. When market makers hedge their options exposure through buying or selling the underlying stock, this activity can create feedback loops that exacerbate declines during periods of heavy put buying or call selling, which appears to be occurring today based on options flow data.

Comparison with Other Bitcoin-Exposed Equities

Examining how MicroStrategy stock is performing relative to other Bitcoin-exposed public companies provides additional context for today’s decline. Companies like Coinbase, Marathon Digital, Riot Platforms, and other cryptocurrency-related equities are also experiencing selling pressure today, but the magnitude of decline varies significantly. MSTR shares are falling more sharply than many peers, suggesting that company-specific factors beyond general cryptocurrency market weakness are contributing to the outsized selloff.

This relative underperformance compared to other Bitcoin-correlated stocks raises questions about whether investors are specifically concerned about MicroStrategy’s unique risk factors—particularly its debt load and concentrated Bitcoin holdings—rather than simply reducing cryptocurrency exposure broadly. If today’s decline were purely a function of Bitcoin price weakness, one would expect more uniform performance across all Bitcoin-exposed equities. The fact that MicroStrategy is falling more dramatically than many comparable companies suggests that specific concerns about the company’s financial structure, strategy, or valuation are playing a meaningful role.

Analyst Ratings and Valuation Concerns

Recent analyst commentary has also influenced MicroStrategy stock’s trajectory today. Several Wall Street research firms have published reports questioning the company’s valuation, particularly after shares had rallied substantially during previous Bitcoin bull cycles. These analysts argue that MSTR stock trades at an unjustified premium to its underlying Bitcoin holdings when accounting for the legacy software business, debt obligations, and operational expenses. When such research reaches the market and gains traction among institutional investors, it can shift sentiment and contribute to selling pressure.

Valuation methodologies for MicroStrategy remain highly contested among analysts, with bulls and bears using fundamentally different frameworks to assess fair value. Bulls argue that the company deserves a premium valuation due to its pioneering role in corporate Bitcoin adoption, the expertise of its leadership in cryptocurrency markets, and the optionality embedded in its ability to access capital markets for future Bitcoin purchases. Bears counter that the company trades at an irrational premium that cannot be justified by any reasonable discounted cash flow analysis, particularly given the risks associated with cryptocurrency volatility and the company’s debt burden.

Today’s decline may reflect growing acceptance of the bearish valuation perspective, particularly as Bitcoin’s price has failed to break through resistance levels that would validate more optimistic price targets. If investors increasingly view MicroStrategy’s premium to net asset value as excessive, continued selling pressure would be expected until the stock price converges toward a level more closely aligned with the conservative valuation frameworks that skeptics employ.

Impact of Macroeconomic Conditions

Broader macroeconomic conditions contribute significantly to understanding why MicroStrategy stock is falling today. The global economic environment remains characterized by high interest rates compared to the ultra-low rate regime that prevailed during Bitcoin’s most spectacular rallies. Higher interest rates affect MicroStrategy through multiple channels: they increase the company’s cost of servicing its debt, they make yielding fixed-income investments more attractive relative to speculative assets like cryptocurrencies, and they reduce the present value of distant future cash flows, which particularly impacts growth-oriented technology stocks.

Inflation dynamics also play a crucial role in Bitcoin price movements and consequently in MicroStrategy’s stock performance. While Bitcoin proponents have long argued that the cryptocurrency serves as an inflation hedge similar to gold, the empirical evidence has been mixed, with Bitcoin sometimes declining during periods of high inflation alongside other risk assets. If investors lose confidence in Bitcoin’s inflation-hedging properties, or if deflationary economic conditions emerge, the rationale for corporate Bitcoin accumulation weakens, which would negatively impact MicroStrategy’s strategic positioning.

Additionally, concerns about potential recession risks have been mounting, and economic downturns historically correlate with risk-asset selloffs that disproportionately affect volatile assets like cryptocurrencies. If investors are positioning portfolios defensively in anticipation of economic weakness, reducing exposure to speculative positions like MSTR stock would be a logical step in risk management protocols.

Future Outlook and Investor Considerations

Looking beyond today’s decline, investors evaluating MicroStrategy stock must grapple with fundamental questions about the long-term viability of the company’s Bitcoin-centric strategy. The thesis behind corporate Bitcoin accumulation rests on beliefs about Bitcoin’s eventual adoption as a primary treasury reserve asset, its potential appreciation as a scarce digital commodity, and its role in a evolving financial system. If these premises prove correct over multi-year time horizons, MicroStrategy’s aggressive Bitcoin positioning could ultimately be vindicated despite short-term volatility.

However, the path forward contains numerous uncertainties. Bitcoin could face competition from other cryptocurrencies, could be disrupted by technological innovations like quantum computing, or could face regulatory restrictions that limit its growth potential. MicroStrategy’s debt obligations create a time pressure that pure Bitcoin holders do not face, meaning the company needs cryptocurrency appreciation to occur within specific timeframes to avoid financial distress. These factors create an asymmetric risk profile where downside scenarios could be more damaging to MSTR shareholders than upside scenarios are beneficial relative to simply holding Bitcoin directly.

For investors considering whether today’s decline represents a buying opportunity or a warning signal, the decision hinges on individual convictions about Bitcoin’s future and risk tolerance for the leverage and corporate structure complications that come with MicroStrategy’s investment vehicle. Conservative investors concerned about downside protection may find today’s weakness reinforces arguments for avoiding the stock, while contrarian investors with strong Bitcoin conviction might view discounts to underlying Bitcoin holdings as attractive entry points.

Conclusion

Understanding why MicroStrategy stock is falling today requires synthesizing multiple interconnected factors: Bitcoin’s price weakness, concerns about financial leverage, shifting institutional investor preferences, regulatory uncertainties, technical trading dynamics, and macroeconomic headwinds. The company’s transformation into a Bitcoin acquisition vehicle has created a unique investment profile that offers leveraged exposure to cryptocurrency markets but introduces substantial risks that extend beyond Bitcoin price movements alone.

For investors tracking MicroStrategy stock falling today, the immediate question becomes whether this represents a temporary setback within a longer-term cryptocurrency bull market or a warning signal about structural vulnerabilities in the company’s business model. The answer likely depends on time horizon, risk tolerance, and fundamental beliefs about Bitcoin’s future role in the global financial system.

As cryptocurrency markets continue evolving and as MicroStrategy’s Bitcoin holdings mature, investors should closely monitor debt covenant compliance, Bitcoin acquisition costs relative to current market prices, and any strategic pivots the company might consider. Whether MicroStrategy stock recovers from today’s decline will ultimately depend on Bitcoin’s price trajectory and the company’s ability to navigate the complex financial challenges that come with its unprecedented corporate cryptocurrency strategy. Stay informed about MicroStrategy’s latest developments and consider how Bitcoin market dynamics impact this unique investment opportunity.