The financial world witnessed a dramatic shakeup as the Eric Trump cryptocurrency firm experienced a staggering decline of nearly forty percent, sending shockwaves through digital asset markets. World Liberty Financial, the cryptocurrency venture prominently associated with the Trump family, has become the latest casualty in what market analysts are calling an intensifying crypto winter.

This significant downturn raises critical questions about celebrity-backed digital currencies and the volatile nature of cryptocurrency investments during bearish market conditions. As investors watch their portfolios shrink and confidence wavers, the Eric Trump cryptocurrency firm collapse serves as a stark reminder of the inherent risks within the digital asset ecosystem.

The cryptocurrency landscape has witnessed numerous high-profile failures, but the involvement of the Trump name adds another layer of complexity to this unfolding financial drama. Understanding what led to this dramatic collapse requires examining multiple factors, from market sentiment to regulatory pressures and the fundamental challenges facing new cryptocurrency projects in an increasingly skeptical environment.

Understanding the Eric Trump Cryptocurrency Venture

The Eric Trump cryptocurrency firm, officially known as World Liberty Financial, emerged onto the digital asset scene with considerable fanfare and ambitious promises. Launched with the backing of the Trump family brand, the project positioned itself as a decentralized finance platform aimed at democratizing access to financial services through blockchain technology. The venture attracted attention not only because of its famous backers but also due to its bold claims about revolutionizing traditional finance.

World Liberty Financial marketed itself as a comprehensive DeFi ecosystem that would allow users to engage in lending, borrowing, and trading digital assets without traditional intermediaries. The platform launched its native token, which quickly became the focal point of investor interest and speculation. Initial promotional materials emphasized the project’s commitment to transparency, security, and creating value for token holders through various utility mechanisms within the ecosystem.

The cryptocurrency firm secured millions in initial funding through token sales, attracting both retail investors drawn to the Trump brand and crypto enthusiasts hoping to capitalize on the next major DeFi innovation. Marketing campaigns leveraged Eric Trump’s business profile and the family’s entrepreneurial reputation to build credibility within a market already saturated with thousands of competing projects. However, the connection between celebrity endorsement and actual technological innovation would soon face serious scrutiny as market conditions deteriorated.

The Dramatic 40% Decline: Breaking Down the Numbers

The nearly forty percent plunge in the Eric Trump cryptocurrency firm token value represents one of the most significant single drops among major celebrity-backed crypto projects this year. Market data reveals that the token, which once traded at peak valuations exceeding several dollars, has tumbled to unprecedented lows, wiping out hundreds of millions in market capitalization within a matter of weeks.

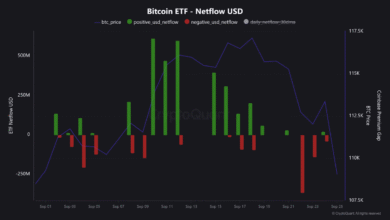

Trading volumes tell an equally concerning story, with daily transaction activity decreasing substantially as investor confidence eroded. The sharp decline began gradually but accelerated dramatically as broader cryptocurrency markets entered deeper bearish territory. Technical analysts point to multiple support levels being broken, triggering automated sell orders and creating a cascading effect that exacerbated the price collapse. The velocity of the decline caught many investors off guard, particularly those who had maintained positions expecting the Trump brand association to provide some insulation from market volatility.

Comparing this decline to other cryptocurrency projects during similar market downturns reveals both similarities and unique factors. While most digital assets have suffered during the current crypto winter, the Eric Trump cryptocurrency firm experienced disproportionate losses relative to established cryptocurrencies like Bitcoin and Ethereum. This outsized decline suggests factors beyond general market conditions contributed to investor flight, including concerns about project fundamentals, governance issues, and questions about long-term viability.

What Caused the Eric Trump Cryptocurrency Firm Collapse

Multiple interconnected factors contributed to the dramatic downturn facing the Eric Trump cryptocurrency firm, creating a perfect storm that decimated token values. Primary among these was the broader cryptocurrency market entering a prolonged bearish phase, characterized by declining prices across virtually all digital assets. When Bitcoin and Ethereum face sustained pressure, smaller altcoins and newly launched projects typically experience amplified volatility and steeper declines.

Regulatory uncertainty has cast a long shadow over cryptocurrency markets, and projects associated with high-profile political families face additional scrutiny. The Eric Trump cryptocurrency firm found itself navigating an increasingly hostile regulatory environment, with securities regulators examining whether certain token sales violated existing financial laws. This regulatory overhang created significant uncertainty among investors, many of whom grew concerned about potential enforcement actions that could further devalue their holdings or complicate their ability to trade tokens.

Technical issues and unfulfilled roadmap promises also eroded confidence in World Liberty Financial. The platform experienced several delays in launching promised features, and when certain functionalities did go live, they attracted far less usage than projected. Smart contract vulnerabilities discovered by independent security researchers raised additional red flags, causing some early supporters to question the technical competence of the development team. These operational challenges, combined with broader market pessimism, created conditions ripe for a significant price collapse.

Competitive pressures within the DeFi space intensified as established protocols with proven track records continued dominating market share. The Eric Trump cryptocurrency firm struggled to differentiate itself beyond its celebrity association, failing to demonstrate unique technological innovations or compelling use cases that would justify its valuation. As investors became more discerning and risk-averse during the crypto winter, projects lacking clear value propositions found themselves abandoned in favor of more established alternatives.

The Broader Crypto Winter Context

Understanding the decline of the Eric Trump cryptocurrency firm requires contextualizing it within the larger phenomenon known as crypto winter, a period of sustained bearish sentiment and declining prices across cryptocurrency markets. This current crypto winter represents the latest in a cyclical pattern that has characterized digital asset markets since Bitcoin’s inception, with periods of explosive growth followed by dramatic corrections.

The current downturn began after cryptocurrency markets reached all-time highs, fueled by institutional adoption narratives and retail investor enthusiasm. However, multiple macroeconomic factors reversed this momentum, including rising interest rates, inflation concerns, and traditional market volatility that reduced risk appetite across all asset classes. As capital fled speculative investments, cryptocurrencies faced sustained selling pressure that has persisted for months.

High-profile cryptocurrency failures throughout this period have intensified negative sentiment and raised questions about the viability of the entire sector. The collapse of major exchanges, the implosion of algorithmic stablecoins, and criminal charges against prominent crypto executives created a crisis of confidence that affected even legitimate projects. The Eric Trump cryptocurrency firm entered this environment at perhaps the worst possible time, launching when investor skepticism had reached peak levels and capital availability had severely contracted.

Regulatory crackdowns worldwide have added another dimension to the crypto winter, with authorities implementing stricter oversight and enforcement actions against projects deemed to violate securities laws. This regulatory pressure has particularly affected new token launches and celebrity-endorsed projects, which face heightened scrutiny regarding their marketing practices and token sale structures. The combination of unfavorable market conditions and increased regulatory risk created an exceptionally challenging environment for any new cryptocurrency venture to succeed.

Impact on Investors and Token Holders

The dramatic decline of the Eric Trump cryptocurrency firm has left thousands of investors facing substantial financial losses, with many retail participants particularly hard hit. Early investors who purchased tokens during initial sale periods at premium prices have watched their investments lose most of their value, creating financial hardship and frustration. These individuals often lacked the sophisticated understanding of cryptocurrency markets necessary to properly assess risk, instead relying on celebrity endorsement as a proxy for legitimacy. The resulting losses have created financial strain for families and individuals who could ill afford such setbacks, raising ethical questions about the responsibility of celebrity promoters when endorsing financial products.

The collapse has also trapped many investors in positions they cannot easily exit without realizing devastating losses. Limited liquidity in secondary markets means that selling even modest positions can drive prices lower, creating a situation where investors face choosing between holding worthless tokens or accepting catastrophic losses. This liquidity crisis has been exacerbated by major exchanges delisting the token or imposing trading restrictions, further constraining investor options for recovering any remaining value.

Long-term implications for affected investors extend beyond immediate financial losses. Many now face tax complications related to capital losses, require professional advice on how to properly account for worthless tokens, and carry emotional scars that may prevent them from participating in legitimate investment opportunities in the future. The Eric Trump cryptocurrency firm debacle has created a generation of skeptical investors who will approach future cryptocurrency projects with increased caution and distrust, particularly those involving celebrity endorsements.

Regulatory Scrutiny and Legal Implications

The troubles facing the Eric Trump cryptocurrency firm have attracted significant attention from regulatory authorities who view celebrity-backed cryptocurrency projects as particularly worthy of investigation. Class action lawsuits have become common following cryptocurrency project failures, and the Trump association provides both additional motivation for legal action and potentially deeper pockets for recovery. Plaintiffs’ attorneys have already begun examining whether marketing materials contained misleading statements or omitted material information about risks.

The regulatory implications extend beyond this specific project to broader questions about how authorities should approach celebrity endorsements in the cryptocurrency space. Several high-profile celebrities have faced enforcement actions or lawsuits related to crypto promotions, establishing precedents that could apply to the Eric Trump cryptocurrency firm situation. These cases have established that celebrities cannot simply claim ignorance about the projects they promote and may bear responsibility for ensuring marketing claims are accurate and substantiated.

International regulatory coordination has intensified regarding cryptocurrency projects, with authorities across multiple jurisdictions sharing information and coordinating enforcement strategies. The global nature of cryptocurrency markets means that projects like World Liberty Financial face potential legal exposure in numerous countries simultaneously, multiplying the complexity and cost of legal defense. This multi-jurisdictional challenge represents a significant ongoing risk for the Eric Trump cryptocurrency firm and its associated parties, potentially tying up resources in legal proceedings for years to come.

Celebrity Cryptocurrency Ventures: A Pattern of Failure

The decline of the Eric Trump cryptocurrency firm fits into a troubling pattern of celebrity-backed cryptocurrency ventures that have failed to deliver on their promises, leaving investors with significant losses. They attract retail investors who make purchasing decisions based on trust in the celebrity rather than rigorous analysis of project fundamentals. When market conditions deteriorate or technical challenges arise, these projects lack the solid foundation necessary to weather storms, resulting in catastrophic value destruction.

The regulatory response to celebrity cryptocurrency endorsements has evolved substantially as authorities recognize the outsized influence famous individuals exert over retail investors. New guidelines require clearer disclosure of compensation arrangements and material connections between celebrities and promoted projects. However, enforcement remains inconsistent, and many celebrities continue promoting cryptocurrency ventures with minimal disclosure about their financial relationships or understanding of the underlying technology. The Eric Trump cryptocurrency firm emerged during this transitional period, benefiting from relatively lax enforcement while simultaneously facing increased scrutiny.

Lessons from previous celebrity crypto failures provide valuable insights into factors that contributed to the Eric Trump cryptocurrency firm collapse. Projects succeeding long-term typically demonstrate genuine innovation, solve real problems, and maintain operations independent of celebrity involvement. In contrast, ventures relying primarily on celebrity status for legitimacy often struggle once initial excitement fades and investors demand substance over style. The correlation between celebrity involvement and project failure has become sufficiently strong that sophisticated investors now view celebrity endorsement as a potential warning sign rather than a positive indicator.

The Future of Trump-Associated Cryptocurrency Projects

The dramatic decline facing the Eric Trump cryptocurrency firm raises significant questions about the future of cryptocurrency ventures associated with the Trump family and brand. The Trump family maintains significant political influence and controversial public profiles that create additional risks for any business venture bearing their name. Supporters may be attracted to these projects precisely because of the political connection, while opponents may target them for criticism or regulatory action. This polarization creates volatility that extends beyond normal market dynamics, making Trump-branded cryptocurrency projects inherently more risky than comparable ventures without such political baggage.

The reputational impact on the Trump brand from the Eric Trump cryptocurrency firm failure represents another consideration for future ventures. While the Trump organization has survived numerous business setbacks over decades, cryptocurrency failures carry particular stigma given the retail investors affected and substantial losses involved. Continued association with failed crypto projects could damage the brand’s value and make future licensing arrangements more difficult or less lucrative across all business sectors.

Recovery prospects for World Liberty Financial remain highly uncertain, with most analysts skeptical about the Eric Trump cryptocurrency firm regaining significant value or functionality. The project would need to overcome not only general crypto winter conditions but also specific reputational damage, regulatory challenges, and technical shortcomings that distinguish it from competitors. While cryptocurrency markets have demonstrated ability to recover from severe downturns, individual projects that lose credibility rarely regain investor confidence, particularly when alternatives exist with stronger fundamentals and proven track records.

Investment Lessons from the Eric Trump Cryptocurrency Firm Collapse

The dramatic decline of the Eric Trump cryptocurrency firm provides valuable lessons for investors navigating cryptocurrency markets and evaluating investment opportunities. Primary among these is the critical importance of conducting thorough due diligence that examines project fundamentals rather than relying on celebrity endorsements or brand associations. The Trump name attracted many investors who overlooked red flags they might have otherwise noticed, demonstrating how cognitive biases can cloud judgment when famous individuals are involved.

Understanding cryptocurrency market cycles and timing considerations represents another crucial lesson from this debacle. The Eric Trump cryptocurrency firm launched during late-stage bull market conditions when euphoria had pushed valuations to unsustainable levels. Investors purchasing tokens near these peaks faced almost inevitable losses as markets corrected, regardless of project quality. Recognizing market cycle stages and adjusting risk exposure accordingly can help investors avoid the worst outcomes during inevitable downturns.

Diversification principles apply equally to cryptocurrency investments as to traditional assets, yet many investors in the Eric Trump cryptocurrency firm concentrated excessive capital in a single speculative position. This concentration magnified losses when the project collapsed, whereas diversified portfolios would have limited damage from any single investment failure. Prudent investors allocate only capital they can afford to lose entirely to highly speculative cryptocurrency positions, maintaining majority holdings in more stable assets.

The importance of exit strategies and risk management cannot be overstated, lessons painfully learned by Eric Trump cryptocurrency firm investors who watched profits evaporate after failing to take gains during favorable conditions. Establishing predetermined price targets for taking profits and cutting losses provides discipline that emotions often undermine during extreme market conditions. Investors who implemented such strategies may have escaped with smaller losses or even profits, while those who held expecting continued appreciation faced catastrophic outcomes.

Comparing World Liberty Financial to Other DeFi Failures

The Eric Trump cryptocurrency firm collapse invites comparison to other high-profile decentralized finance failures that have littered the cryptocurrency landscape with cautionary tales. Projects like Terra Luna, which lost billions in market value virtually overnight, share certain characteristics with World Liberty Financial, including ambitious promises, complex tokenomics, and insufficient stress-testing under adverse conditions. Examining these parallels reveals common vulnerabilities that investors should recognize in future projects.

Technical architecture differences distinguish the Eric Trump cryptocurrency firm from some other failed DeFi projects, though not necessarily in favorable ways. While Terra Luna’s collapse stemmed from fundamental design flaws in its algorithmic stablecoin mechanism, World Liberty Financial faced challenges related to insufficient utility, weak network effects, and failure to attract sustainable user adoption. Both failure modes ultimately produced similar outcomes for investors, demonstrating that multiple paths lead to project collapse in the unforgiving cryptocurrency ecosystem.

The role of celebrity involvement represents a distinguishing factor in the Eric Trump cryptocurrency firm case compared to many other DeFi failures. While some failed projects had prominent crypto industry figures as leaders, few mainstream celebrity-backed ventures have achieved the scale and visibility of World Liberty Financial. This celebrity dimension attracted a different investor demographic, many of whom had limited cryptocurrency experience and relied heavily on trust in the Trump brand rather than technical understanding of the project.

Recovery timelines from major DeFi failures vary considerably, with some projects eventually regaining functionality and value while others disappear entirely. The Eric Trump cryptocurrency firm currently appears on a trajectory more consistent with permanent failure than eventual recovery, particularly given the reputational damage and regulatory scrutiny involved. However, cryptocurrency markets have demonstrated capacity for surprising reversals, making absolute predictions difficult even when prospects appear grim.

Expert Analysis and Market Reaction

Financial analysts and cryptocurrency experts have weighed in extensively on the Eric Trump cryptocurrency firm collapse, offering perspectives that range from sympathy for affected investors to harsh criticism of the project’s conception and execution.

Critics point to specific marketing claims that proved overly optimistic or misleading, creating unrealistic expectations among investors who lacked the experience to properly evaluate these assertions. This criticism has fueled broader discussions about appropriate marketing standards for cryptocurrency projects and the need for enhanced investor protection measures.

Market reaction to the Eric Trump cryptocurrency firm collapse has been relatively contained, with limited contagion effects on broader cryptocurrency markets.

This isolation suggests that investors view the failure as project-specific rather than indicative of systemic problems affecting the entire cryptocurrency ecosystem. However, the incident has contributed to general skepticism about new token launches and celebrity-backed ventures, potentially making capital raising more difficult for legitimate projects seeking funding during challenging market conditions.

Technical analysts examining price charts and trading patterns for the Eric Trump cryptocurrency firm token identified multiple warning signals that preceded the major collapse, including decreasing trading volumes, inability to maintain support levels, and bearish technical indicators.

Traders who monitored these signals could have exited positions before the worst losses materialized, though hindsight makes such analysis appear more straightforward than real-time decision-making during volatile conditions. These technical patterns provide templates for identifying similar situations in future cryptocurrency investments.

Media Coverage and Public Perception

Media coverage of the Eric Trump cryptocurrency firm collapse has been extensive and largely critical, with major financial publications and cryptocurrency-focused outlets examining various aspects of the failure. Mainstream media has emphasized the investor losses and Trump family connection, often framing the story within broader narratives about cryptocurrency risks and celebrity responsibility. This coverage has reached audiences beyond typical cryptocurrency enthusiasts, raising public awareness about the dangers of speculative digital asset investments.

The Trump family’s controversial public profile has influenced how media outlets approach coverage of the Eric Trump cryptocurrency firm failure, with some publications emphasizing political dimensions while others focus solely on financial aspects. Conservative media has generally provided more sympathetic coverage, sometimes framing the collapse as primarily attributable to broader market conditions rather than project-specific failures. Progressive outlets have been more critical, highlighting what they characterize as exploitation of retail investors through misleading celebrity endorsements.

Social media reaction to the Eric Trump cryptocurrency firm collapse has been swift and often harsh, with cryptocurrency Twitter communities sharing analysis, criticism, and warnings about the project. Memes and satirical content mocking the failure have proliferated across platforms, contributing to reputational damage that extends beyond simple financial losses. This social media ecosystem plays an increasingly important role in shaping perceptions about cryptocurrency projects, with viral negative sentiment capable of accelerating investor flight and price declines.

Public perception of cryptocurrency investments generally has been negatively affected by high-profile failures like the Eric Trump cryptocurrency firm collapse, contributing to skepticism about the entire asset class among mainstream audiences. Surveys indicate declining public trust in cryptocurrencies following waves of project failures, exchange collapses, and regulatory enforcement actions. This erosion of confidence creates challenges for the entire industry, potentially slowing adoption and making recovery from crypto winter conditions more difficult and prolonged.

Conclusion

The dramatic decline of the Eric Trump cryptocurrency firm serves as a sobering reminder of the substantial risks inherent in cryptocurrency investments, particularly projects heavily reliant on celebrity endorsements rather than technological innovation and genuine utility. kets, exercising extreme caution with speculative cryptocurrency positions becomes increasingly important. The Eric Trump cryptocurrency firm failure demonstrates that even projects with famous backers and significant initial funding can collapse rapidly when facing adverse market conditions and operational challenges. Prospective investors should conduct thorough research, understand the technology behind projects they consider, evaluate team credentials and track records, and maintain realistic expectations about both potential returns and substantial risks.

However, this failure need not define the entire cryptocurrency industry, which continues evolving and demonstrating potential for genuine innovation in financial services and beyond. Separating legitimate technological advancement from speculative hype requires investor education, regulatory clarity, and industry maturity that develops gradually through cycles of innovation and correction.

If you’re considering cryptocurrency investments or hold positions in projects like the Eric Trump cryptocurrency firm, taking time to reassess your portfolio and risk tolerance is crucial.

See more;U.S. Sovereign Wealth Fund: A Game Changer for Crypto?