The Bitcoin price target narrative for 2025 just changed in a big way. Institutional crypto firm Galaxy Digital has cut its end-of-year Bitcoin price target for 2025 from a lofty $185,000 down to $120,000—a steep revision that has grabbed the attention of traders, long-term holders, and skeptics alike.

This adjustment didn’t happen in a vacuum. It followed a sharp correction in the market, where BTC briefly fell below $100,000 for the first time in six months, triggering billions of dollars in liquidations and shaking investor confidence. Even after rebounding to roughly $103,000, Bitcoin still sits significantly below its all-time high near $126,000 set just a month earlier.

In a note to clients, Galaxy framed this shift not as the end of Bitcoin’s story, but as the beginning of a new chapter—a “maturity era” in which BTC volatility declines, institutional absorption increases, and price gains become slower and more measured. For anyone tracking Bitcoin price predictions, this is a powerful message: the days of 100x hype may be fading, but the asset itself may be growing up.

In this article, we’ll break down what Galaxy actually changed in its Bitcoin 2025 price forecast, why the firm believes BTC is entering a maturity phase, the forces reshaping the market, and what this all might mean for your own strategy. The goal is not to tell you whether to buy, hold, or sell, but to give you a clear, human-readable explanation of how Bitcoin’s price outlook is evolving—and why.

Galaxy’s New Bitcoin Price Target for 2025 Explained

Galaxy’s revised Bitcoin price target for 2025 is straightforward: the firm now expects BTC to finish the year around $120,000, down from its prior target of $185,000. That’s a roughly 35% cut in its forecast, which is significant for an institution that has historically been among the more bullish voices in the crypto space.

The downgrade came right after a sharp market shake-out in October, when a wave of leveraged liquidations and macro fears sent BTC below the key psychological level of $100,000. Galaxy noted that this event—and the broader conditions around it—marked a structural change in the Bitcoin market cycle, not just a random correction.

Despite the lower forecast, Galaxy is not turning bearish. In fact, the firm explicitly states it remains long-term bullish on Bitcoin, seeing it as a core digital asset with strong fundamentals. The new target is best read as a recalibration: a recognition that future gains may be slower, as BTC transitions from speculative rocket ship to large, globally held asset.

Put simply, Galaxy still expects Bitcoin’s price in 2025 to be significantly higher than today’s levels—but no longer anticipates a euphoric blow-off top.

What Galaxy Means by Bitcoin’s “Maturity Era”

Galaxy’s client note describes the current phase as Bitcoin’s “maturity era”, a term that carries a lot of weight. To understand it, you need to look at how BTC has evolved over the past decade—from a niche experiment to a major macro asset increasingly woven into the traditional financial system.

From Wild West Speculation to Institutional Integration

In its early years, Bitcoin traded like a tiny, thinly-liquid tech stock on steroids. Triple-digit volatility, sudden exchange collapses, and wild speculative manias were normal. The Bitcoin price target for many early adopters was basically “number go up,” with little emphasis on valuation models, macro conditions, or portfolio construction

These forces naturally dampen volatility. When a large macro player wants to buy, they often do it gradually. When passive funds accumulate, they tend to hold rather than flip. That makes the market less explosive but also less chaotic.

Lower Volatility, Slower but Steadier Growth

Galaxy’s Bitcoin price prediction doesn’t assume the asset stops appreciating. Instead, the firm argues that returns will likely normalize as Bitcoin becomes more like digital gold than a speculative micro-cap. Its note suggests that

Why Galaxy Slashed Its Bitcoin Price Target from $185K to $120K

If the long-term outlook remains bullish, why cut the Bitcoin 2025 price target so sharply? Galaxy cites a set of intertwined market forces that have cooled the near-term upside.

Leveraged Liquidations and the October Flash Crash

One of the most dramatic events was the October 10 flash crash, when a combination of macro headlines and overly leveraged positions triggered what analysts describe as one of the largest liquidation cascades in crypto history. Estimates put the total notional wiped out in liquidations around $19–20 billion in a short span.

As prices fell, long Bitcoin derivatives positions were forcibly closed, pushing BTC briefly below $100,000 and eroding confidence in the ongoing crypto bull market. Galaxy’s research team believes this event materially weakened the bullish trend structure, even if it didn’t end it outright.

Whale Distribution and Profit-Taking

Another factor Galaxy highlights is large-scale whale distribution. In October, big holders collectively sold an estimated 400,000 BTC into the market. Whether you see th em as smart money or simply early investors banking profits, the effect is the same: strong overhead supply.

This dynamic doesn’t invalidate bullish Bitcoin price forecasts, but it slows the pace. Galaxy’s $120K Bitcoin price target for 2025 reflects a world where whales continue to trim positions and the market digests that selling over many months.

Competition from Gold, AI Stocks, and Stablecoins

Galaxy also points to shifting capital flows across the broader investment landscape. Instead of rotating purely into BTC, many investors are diversifying into: In other words, Bitcoin is no longer the only star in the risk-on show. The Bitcoin price target for 2025 has to compete with the reality that investor attention—and capital—is spread across several powerful narratives.

What Galaxy’s New Bitcoin Price Target Means for Investors

So what does a $120,000 Bitcoin price target for 2025 actually mean for people building a strategy?

First, it’s worth noting that $120K is still above current prices. Galaxy isn’t forecasting collapse; it’s projecting a more tempered path upward. For long-term believers in digital scarcity and crypto adoption, this can even be seen as validation: Bitcoin is behaving more like a large, maturing asset and less like a speculative meme.

For Long-Term “Digital Gold” Holders

In this lens, Galaxy’s revision is a reminder to focus on time in the market rather than timing the market.

For High-Beta Traders and Speculators

If your approach is more short-term and speculative, betting heavily on high-beta moves, then a cooler Bitcoin price outlook can be frustrating. A few practical takeaways:Is the Bull Market Over, or Is Bitcoin Just Growing Up?

A natural question after any target cut is: Is the bull market over? Galaxy’s answer is essentially “no”—but it is changing character. Analysts cited by multiple outlets note that the recent 21% correction from Bitcoin’s all-time high is still within the normal range for a bull market pullback. Historically, Bitcoin has seen even deeper retracements (30–40%) during strong uptrends. In other words, Bitcoin may still be in a crypto bull cycle, but it’s unfolding against a much more mature backdrop. The Bitcoin price target for 2025 is now shaped by macro policy, regulation, and institutional flows just as much as by halvings and on-chain metrics.

How to Think About Bitcoin in Its “Maturity Era”

If Galaxy is right and BTC has entered a maturity era, the way you think about Bitcoin investing might need to evolve too. Galaxy’s revised Bitcoin price target is a reminder that responsible exposure in this asset class is more about thoughtful sizing and patience than chasing headlines.

Bitcoin 2025: Scenarios Beyond Galaxy’s $120K Target

Even though Galaxy’s $120K Bitcoin price target for 2025 is grabbing attention, it’s just one possible path among many. No single forecast can capture the full range of outcomes in a market as complex as crypto.

Here are three broad scenario buckets investors are quietly debating, alongside Galaxy’s more tempered view.

The Bullish Scenario: Structural Demand Breaks the Ceiling

Under this scenario, Bitcoin could overshoot Galaxy’s $120K target, potentially revisiting or exceeding prior price projections—especially if capital rotates back from AI stocks, stablecoins, or gold. The Bearish Scenario: Macro and Crypto-Native Risks Collide In this world, Bitcoin might struggle to hold six-figure levels, forcing analysts to cut Bitcoin price targets for 2025 even further. Galaxy’s “maturity” narrative would still be relevant, but the timeline for recovery might extend well beyond 2025. The key takeaway: a target like $120,000 is a base case, not destiny. Investors should treat it as one informed estimate among many, not a guaranteed outcome.

Conclusion

Galaxy’s decision to slash its Bitcoin price target for 2025 from $185,000 to $120,000 is more than a headline. It’s a signal that one of crypto’s most prominent institutional players believes BTC is entering a new, more measured phase of its life.

For traders, this may mean adjusting expectations around explosive upside. For long-term investors, it may actually be reassuring: Bitcoin is growing up, becoming a serious, globally watched asset that can sit alongside traditional holdings.

No one can say with certainty where the Bitcoin price in 2025 will land. But understanding why Galaxy cut its target—and what it means when analysts talk about a maturity era—can help you interpret the noise, set realistic expectations, and make decisions that fit your own risk profile and time horizon. If your approach is more short-term and speculative, betting heavily on high-beta moves, then a cooler Bitcoin price outlook can be frustrating. A few practical takeaways:

Is the Bull Market Over, or Is Bitcoin Just Growing Up?

Analysts cited by multiple outlets note that the recent 21% correction from Bitcoin’s all-time high is still within the normal range for a bull market pullback. Historically, Bitcoin has seen even deeper retracements (30–40%) during strong uptrends. In other words, Bitcoin may still be in a crypto bull cycle, but it’s unfolding against a much more mature backdrop. The Bitcoin price target for 2025 is now shaped by macro policy, regulation, and institutional flows just as much as by halvings and on-chain metrics.Galaxy’s revised Bitcoin price target is a reminder that responsible exposure in this asset class is more about thoughtful sizing and patience than chasing headlines.

Bitcoin 2025: Scenarios Beyond Galaxy’s $120K Target

Even though Galaxy’s $120K Bitcoin price target for 2025 is grabbing attention, it’s just one possible path among many. No single forecast can capture the full range of outcomes in a market as complex as crypto.

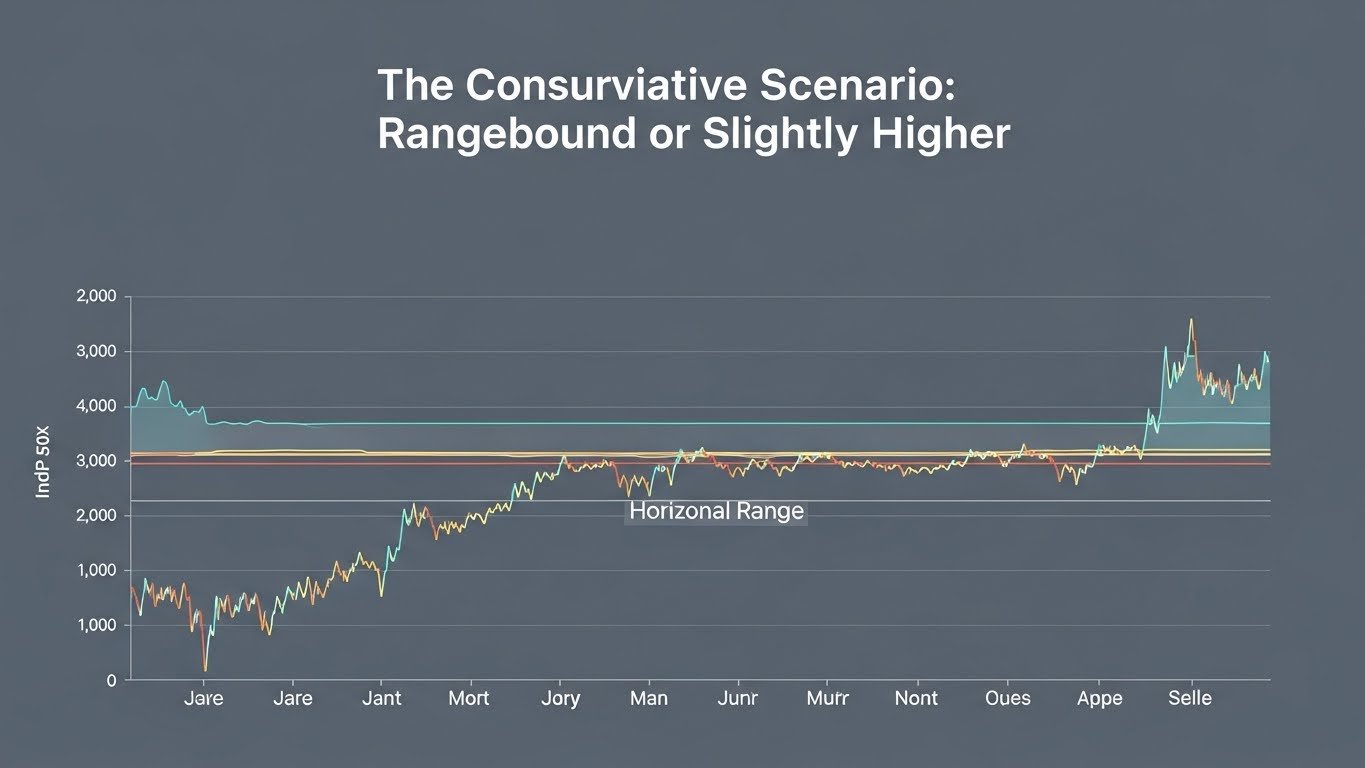

1. The Conservative Scenario: Rangebound or Slightly Higher

In this world, Bitcoin might struggle to hold six-figure levels, forcing analysts to cut Bitcoin price targets for 2025 even further. Galaxy’s “maturity” narrative would still be relevant, but the timeline for recovery might extend well beyond 2025. The key takeaway: a target like $120,000 is a base case, not destiny. Investors should treat it as one informed estimate among many, not a guaranteed outcome.

Conclusion

Galaxy’s decision to slash its Bitcoin price target for 2025 from $185,000 to $120,000 is more than a headline. It’s a signal that one of crypto’s most prominent institutional players believes BTC is entering a new, more measured phase of its life. For traders, this may mean adjusting expectations around explosive upside. For long-term investors, it may actually be reassuring: Bitcoin is growing up, becoming a serious, globally watched asset that can sit alongside traditional holdings. No one can say with certainty where the Bitcoin price in 2025 will land. But understanding why Galaxy cut its target—and what it means when analysts talk about a maturity era—can help you interpret the noise, set realistic expectations, and make decisions that fit your own risk profile and time horizon.

FAQs

Q. Why did Galaxy cut its Bitcoin price target for 2025 to $120,000?

Galaxy lowered its Bitcoin price target for 2025 from $185,000 to $120,000 after a sharp market correction that pushed BTC briefly below $100,000 and triggered billions in leveraged liquidations. The firm also cited whale distribution, shifting liquidity, and competition from assets like gold, AI stocks, and stablecoins. Despite the cut, Galaxy remains long-term bullish on Bitcoin, arguing that the asset is transitioning into a more mature, less volatile phase.

Q. What does Galaxy mean by Bitcoin’s “maturity era”?

The “maturity era” is Galaxy’s term for a new stage in Bitcoin’s evolution where institutional absorption, passive ETF flows, and reduced volatility dominate. In this phase, BTC behaves less like a speculative micro-cap and more like a large macro asset, with slower but steadier returns driven by long-term adoption and macro trends rather than constant retail mania.

Q. Is a $120K Bitcoin price target bearish?

Not necessarily. A $120K Bitcoin price target for 2025 is still above current prices and far higher than levels seen just a few years ago. It’s better understood as a tempered bullish view rather than a bearish one. Galaxy’s revision reflects a belief that Bitcoin can continue to appreciate, but not at the extreme pace some earlier forecasts implied, especially after recent liquidations and whale selling.

Q. Does the new target mean the bull market is over?

Galaxy does not argue that the bull market is over. Instead, it sees the recent roughly 20% pullback as a normal correction within a larger uptrend. The firm believes the bullish structure remains intact as long as Bitcoin holds above key levels (such as the $100,000 region), but expects the road higher to be more gradual and less explosive than in past cycles.

Q. How should investors react to Galaxy’s revised Bitcoin forecast?

Investors can treat Galaxy’s Bitcoin price prediction as one informed opinion among many. Rather than reacting emotionally to a single target cut, it’s more useful to:

Above all, remember that no Bitcoin price target for 2025 is guaranteed. Using multiple sources, staying diversified, and avoiding excessive leverage are generally more important than any single forecast—no matter how high-profile the source.

Q. Is a $120K Bitcoin price target bearish?

Not necessarily. A $120K Bitcoin price target for 2025 is still above current prices and far higher than levels seen just a few years ago. It’s better understood as a tempered bullish view rather than a bearish one. Galaxy’s revision reflects a belief that Bitcoin can continue to appreciate, but not at the extreme pace some earlier forecasts implied, especially after recent liquidations and whale selling.

Q. Does the new target mean the bull market is over?

Galaxy does not argue that the bull market is over. Instead, it sees the recent roughly 20% pullback as a normal correction within a larger uptrend. The firm believes the bullish structure remains intact as long as Bitcoin holds above key levels (such as the $100,000 region), but expects the road higher to be more gradual and less explosive than in past cycles.

Q. How should investors react to Galaxy’s revised Bitcoin forecast?

Investors can treat Galaxy’s Bitcoin price prediction as one informed opinion among many. Rather than reacting emotionally to a single target cut, it’s more useful to: Above all, remember that no Bitcoin price target for 2025 is guaranteed. Using multiple sources, staying diversified, and avoiding excessive leverage are generally more important than any single forecast—no matter how high-profile the source.

See more;Bitcoin ETF Approval News and Market Impact Complete 2024-2025 Analysis Spearcrypto