Tom Lee’s Bitcoin and Ethereum predictions have taken an extraordinarily bullish turn, with the veteran analyst suggesting that Bitcoin could soar to an unprecedented $250,000. This forecast represents not just optimism but a calculated assessment based on macroeconomic trends, institutional adoption patterns, and fundamental market dynamics that are reshaping the digital asset landscape in ways we haven’t seen before.

As someone who correctly predicted Bitcoin’s recovery from its 2018 bear market and has maintained a remarkably accurate track record in both traditional and cryptocurrency markets, Lee’s latest Tom Lee Bitcoin Ethereum predictions demand serious attention from investors, institutions, and anyone interested in the future of digital finance. His analysis comes at a pivotal moment when cryptocurrency adoption is accelerating across multiple sectors, regulatory clarity is emerging in major markets, and technological advancements are solving long-standing scalability challenges.

Tom Lee’s Analytical Framework for Cryptocurrency Forecasting

Tom Lee has distinguished himself in the financial analysis world by combining traditional market metrics with cryptocurrency-specific indicators to create comprehensive forecasting models. Unlike many crypto enthusiasts who rely primarily on sentiment and technical analysis, Lee’s approach incorporates macroeconomic conditions, institutional money flows, on-chain data, and historical market cycles to formulate his predictions.

His methodology for developing Tom Lee Bitcoin Ethereum predictions involves examining the relationship between Bitcoin’s halving cycles and subsequent price appreciation, analyzing the correlation between traditional market liquidity and cryptocurrency valuations, and studying the adoption curves of transformative technologies throughout history. Lee frequently draws parallels between Bitcoin’s current adoption phase and the internet’s growth in the late 1990s and early 2000s, suggesting that we are still in the early innings of a multi-decade transformation in how humanity stores and transfers value.

The veteran strategist also emphasizes the importance of regulatory developments in shaping cryptocurrency markets. His recent cryptocurrency market forecast takes into account the approval of Bitcoin spot ETFs in the United States, which he views as a watershed moment that legitimizes digital assets in the eyes of traditional finance and opens the floodgates for institutional capital that has been waiting on the sidelines.

The $250,000 Bitcoin Price Target Explained

When Tom Lee unveiled his Bitcoin price prediction 2026 calling for a potential rise to $250,000, the announcement sent ripples through both cryptocurrency and traditional financial markets. This figure isn’t pulled from thin air but represents the culmination of multiple bullish catalysts converging simultaneously in a way that rarely occurs in financial markets.

Lee’s analysis points to several fundamental drivers supporting this aggressive price target. First, the Bitcoin halving event that occurred in April 2024 has historically preceded massive bull runs as the reduction in new supply creation creates a supply shock while demand continues growing. According to his models, the full impact of halving events typically materializes twelve to eighteen months after the event, which would align perfectly with a massive price surge in 2026.

Second, the Bitcoin ETF impact on market dynamics cannot be overstated. The approval of spot Bitcoin ETFs has created a bridge between traditional finance and cryptocurrency markets, allowing pension funds, endowments, and wealth management platforms to allocate capital to Bitcoin without the complexities of custody and security that previously created barriers to entry. Lee estimates that if just a small percentage of the trillions of dollars managed by traditional financial institutions flows into Bitcoin, the resulting demand could easily support prices well above $200,000.

Third, the macroeconomic environment characterized by persistent inflation concerns, mounting government debt levels, and ongoing currency devaluation in various economies around the world is driving increased interest in Bitcoin as a store of value and inflation hedge. Lee’s Tom Lee Bitcoin Ethereum predictions factor in this fundamental shift in how investors view Bitcoin not as a speculative asset but as a strategic allocation for portfolio protection.

Ethereum’s Role in the Bullish Cryptocurrency Narrative

While Bitcoin often dominates headlines and discussions about Tom Lee Bitcoin Ethereum predictions, Ethereum plays an equally crucial role in the broader cryptocurrency ecosystem and Lee’s bullish thesis. The world’s second-largest cryptocurrency by market capitalization has undergone significant technological transformations that position it for explosive growth alongside Bitcoin.

Lee highlights several factors supporting his Ethereum price target within the broader bull market scenario. The successful transition to proof-of-stake consensus through the Merge has dramatically reduced Ethereum’s energy consumption while creating deflationary tokenomics through the burning mechanism that removes ETH from circulation with every transaction. This fundamental change transforms Ethereum from an inflationary asset into a potentially deflationary one, creating powerful supply-demand dynamics that support higher valuations.

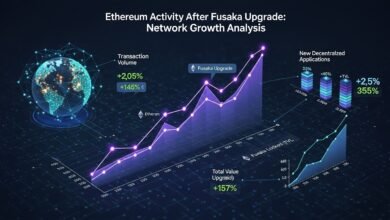

Additionally, Ethereum network growth continues accelerating across multiple dimensions. The network processes billions of dollars in decentralized finance transactions daily, hosts the majority of NFT activity, serves as the foundation for countless Web3 applications, and is increasingly being adopted by traditional enterprises for tokenization projects and supply chain solutions. Lee argues that as Ethereum evolves from a speculative technology platform into essential financial infrastructure, its valuation should reflect this utility premium.

The emergence of Ethereum ETFs following Bitcoin’s approval creates another powerful catalyst. Lee’s analysis suggests that Ethereum could capture a significant portion of the institutional capital flowing into cryptocurrency markets, particularly from investors who see greater growth potential in Ethereum’s expanding ecosystem compared to Bitcoin’s more established position.

Institutional Adoption as the Primary Growth Driver

Perhaps the most compelling aspect of Tom Lee Bitcoin Ethereum predictions centers on institutional adoption trends that are fundamentally altering cryptocurrency market dynamics. Unlike previous bull markets driven primarily by retail speculation, the current cycle is characterized by sophisticated institutional investors bringing unprecedented levels of capital, legitimacy, and staying power to digital assets.

Major financial institutions including BlackRock, Fidelity, and Franklin Templeton have launched Bitcoin ETF products that have accumulated billions of dollars in assets within months of approval. These products provide seamless exposure to Bitcoin for investors who might never have considered purchasing cryptocurrency directly, dramatically expanding the potential investor base. Lee estimates that institutional demand could absorb the equivalent of several years’ worth of Bitcoin’s new supply creation, creating the supply squeeze necessary to support dramatically higher prices.

Beyond ETFs, institutional Bitcoin adoption manifests in corporate treasury allocations, with publicly traded companies adding Bitcoin to their balance sheets as a hedge against inflation and currency devaluation. This trend validates Bitcoin’s role as a legitimate financial asset and encourages other corporations to follow suit, creating a virtuous cycle of adoption and price appreciation.

Sovereign wealth funds and national governments are also entering the cryptocurrency space, with several countries accumulating Bitcoin reserves and exploring central bank digital currencies that legitimize blockchain technology. Lee views these developments as indicators that cryptocurrency has crossed the chasm from fringe technology to mainstream financial infrastructure, supporting his aggressive price targets.

Technical Analysis Supporting the Bullish Outlook

While Tom Lee’s approach emphasizes fundamental analysis, his Tom Lee Bitcoin Ethereum predictions also incorporate technical factors that suggest markets are positioned for significant upside movement. Historical analysis of Bitcoin’s price cycles reveals consistent patterns where each bull market peak exceeds the previous cycle’s high by orders of magnitude, and each bear market low remains above the previous cycle’s peak.

Applying these historical patterns to current market conditions, Lee’s technical framework suggests that Bitcoin reaching $250,000 would represent a relatively modest multiple compared to previous bull market peaks relative to starting points. The crypto bull market of 2017 saw Bitcoin rise from under $1,000 to nearly $20,000, while the 2021 cycle took prices from approximately $10,000 to $69,000. A move to $250,000 from current levels would maintain similar proportional gains while occurring from a much higher base supported by dramatically increased adoption and institutional participation.

Ethereum’s technical picture appears equally compelling. The cryptocurrency has consistently demonstrated the ability to outperform Bitcoin during bull market peak phases, with the ratio between Ethereum and Bitcoin prices expanding significantly as investor attention shifts from store of value narratives to platform utility and growth potential. Lee’s analysis suggests that if Bitcoin reaches $250,000, Ethereum could achieve proportional gains that would significantly exceed previous all-time highs.

On-chain metrics further support the bullish technical outlook. The amount of Bitcoin held in long-term storage continues increasing, indicating that existing holders have conviction in significantly higher future prices and are unwilling to sell at current levels. Similarly, Ethereum staking participation removes substantial supply from circulation while generating yield for holders, creating additional supply constraints that support price appreciation.

Macroeconomic Conditions Favoring Digital Assets

The broader economic environment plays a crucial role in shaping Tom Lee Bitcoin Ethereum predictions, and current macroeconomic conditions appear exceptionally favorable for cryptocurrency appreciation. Global central banks have injected trillions of dollars into financial systems over the past decade through quantitative easing and emergency stimulus programs, creating concerns about long-term currency devaluation and inflation that drive investors toward alternative stores of value.

Lee emphasizes that Bitcoin emerged from the 2008 financial crisis as a response to monetary system failures, and its fundamental value proposition as a non-sovereign, mathematically limited currency becomes increasingly compelling as government debt levels reach unprecedented levels. The digital asset investment thesis centers on Bitcoin and Ethereum serving as hedges against monetary debasement, portfolio diversifiers uncorrelated with traditional assets, and vehicles for preserving purchasing power in an era of financial uncertainty.

Interest rate policies also factor prominently into cryptocurrency valuations. As central banks navigate the delicate balance between controlling inflation and avoiding recession, the resulting volatility in traditional markets may drive increased allocation to alternative assets, including cryptocurrencies. Lee’s models suggest that cryptocurrency performs particularly well during periods of monetary policy uncertainty, as investors seek assets that exist outside traditional financial system control.

Geopolitical tensions and de-dollarization trends further support the bullish case for cryptocurrencies. As various nations explore alternatives to dollar-dominated international trade and payment systems, Bitcoin and blockchain-based solutions offer neutral, borderless options that don’t depend on any single nation’s economic or political stability. This dynamic could accelerate cryptocurrency adoption at the sovereign and institutional levels far faster than most analysts currently anticipate.

Technological Advancements Enabling Mass Adoption

Beyond financial and economic factors, technological improvements across cryptocurrency networks are removing barriers to adoption that previously limited mainstream usage. Ethereum network growth has been particularly impressive, with Layer 2 scaling solutions like Arbitrum, Optimism, and Base dramatically reducing transaction costs while maintaining security and decentralization. These technological breakthroughs make Ethereum practical for everyday transactions and applications that weren’t feasible when network fees regularly exceeded hundreds of dollars during peak congestion periods.

Bitcoin’s Lightning Network continues expanding, creating payment channels that enable instant, low-cost Bitcoin transactions for everyday purchases. This development transforms Bitcoin from solely a store of value into a medium of exchange, expanding its utility and supporting higher valuations. Lee’s cryptocurrency analyst predictions factor in these technological improvements as catalysts that will drive adoption beyond speculation into practical utility.

The emergence of user-friendly interfaces and custody solutions has also lowered barriers to cryptocurrency entry. Platforms now offer experiences comparable to traditional banking apps, making it feasible for non-technical users to participate in cryptocurrency markets safely. This accessibility expansion dramatically increases the potential user base and supports Lee’s thesis that we remain in the early stages of a mass adoption curve.

Interoperability solutions connecting different blockchain networks are creating a more cohesive cryptocurrency ecosystem where assets and information flow seamlessly between platforms. This development enhances the overall utility of cryptocurrency networks and positions them to capture a larger share of global financial activity.

Risk Factors and Potential Obstacles to Consider

While Tom Lee’s Bitcoin and Ethereum predictions paint an exceptionally bullish picture, responsible analysis requires acknowledging potential risks and obstacles that could derail or delay the projected price appreciation. Regulatory uncertainty remains perhaps the most significant wildcard, as governments worldwide continue grappling with how to regulate cryptocurrency markets effectively without stifling innovation.

Adverse regulatory developments in major markets could temporarily suppress prices and adoption rates. However, Lee argues that the trend toward regulatory clarity is generally positive, with most developed nations moving toward frameworks that acknowledge cryptocurrency as a legitimate asset class worthy of investor protection rather than attempting to ban or severely restrict usage.

Technical risks including potential security vulnerabilities, network attacks, or major hacking incidents could undermine confidence in cryptocurrency systems. While blockchain networks have proven remarkably resilient over fifteen years of operation, the possibility of unforeseen technical challenges always exists in rapidly evolving technologies.

Competition from central bank digital currencies represents another potential headwind. If governments successfully deploy digital versions of sovereign currencies that offer some benefits of cryptocurrency while maintaining state control, they could capture adoption that might otherwise flow to Bitcoin and Ethereum. Lee’s view is that decentralization and censorship resistance remain unique value propositions that government-controlled currencies cannot replicate, limiting the competitive threat.

Market manipulation concerns, although decreasing as markets mature and institutional participation increases, could still create volatility and temporary price dislocations. The cryptocurrency market’s relative youth compared to traditional financial markets means that price discovery mechanisms are still developing and maturing.

Investment Strategies Aligned With Bullish Predictions

For investors convinced by Tom Lee Bitcoin Ethereum predictions, the question becomes how to position portfolios to capitalize on potential upside while managing downside risks. Lee advocates for systematic accumulation strategies rather than attempting to time market entries perfectly, arguing that the long-term trajectory matters far more than short-term price fluctuations for investors with multi-year time horizons.

Dollar-cost averaging into Bitcoin and Ethereum positions allows investors to build exposure gradually while mitigating the risk of entering at local price peaks. This approach suits most investors better than attempting to predict exact bottom or top prices, which even professional traders struggle to accomplish consistently.

For more sophisticated investors, Lee suggests considering allocation strategies that balance Bitcoin’s relative stability and store of value characteristics with Ethereum’s higher growth potential but correspondingly higher volatility. A portfolio weighted toward Bitcoin provides foundational exposure to digital asset investment while Ethereum exposure offers leveraged upside if the broader cryptocurrency ecosystem expands as projected.

Risk management remains crucial regardless of bullish conviction. Lee emphasizes that cryptocurrency should represent a proportional allocation within diversified portfolios rather than concentrated all-or-nothing bets. Even with aggressive price targets, the journey toward those levels will likely include significant volatility and periodic drawdowns that test investor conviction.

Tax-efficient implementation through retirement accounts where permitted or strategic use of tax-loss harvesting during market volatility can significantly enhance after-tax returns. Investors should consult with financial advisors and tax professionals to structure cryptocurrency investments optimally within their overall financial plans.

Comparing Tom Lee’s Predictions With Other Prominent Analysts

Tom Lee’s bullish stance on cryptocurrencies isn’t isolated, though his specific price targets represent the upper end of professional analyst forecasts. Comparing cryptocurrency analyst predictions across the industry provides useful context for evaluating the reasonableness of Lee’s projections and understanding the range of potential outcomes.

Cathie Wood of ARK Invest has published similarly aggressive Bitcoin price targets, with her firm’s research suggesting Bitcoin could reach $1 million per coin by 2030 under bullish adoption scenarios. While Wood’s timeline extends further than Lee’s $250,000 target for 2026, both analyses share fundamental assumptions about institutional adoption acceleration and Bitcoin’s role in future financial systems.

Other prominent analysts including Mike McGlone of Bloomberg Intelligence and Willy Woo take more moderate but still bullish stances, with price targets in the $100,000 to $150,000 range over similar timeframes. These forecasts incorporate similar catalysts as Lee’s analysis but apply more conservative assumptions about adoption rates and institutional capital flows.

Contrarian analysts including traditional finance skeptics like Peter Schiff maintain bearish views on cryptocurrency, arguing that Bitcoin lacks intrinsic value and that eventual regulatory crackdowns will limit long-term viability. Lee directly addresses these critiques by emphasizing Bitcoin’s demonstrated utility as a store of value, its fixed supply in an era of monetary expansion, and the increasing regulatory acceptance evidenced by ETF approvals and institutional adoption.

The consensus among cryptocurrency-focused analysts appears solidly bullish for the medium to long term, even if specific price targets vary significantly. Lee’s $250,000 forecast represents the optimistic end of mainstream predictions but remains grounded in fundamental analysis rather than pure speculation.

The Timeline for Reaching Ambitious Price Targets

Understanding the potential timeline for Tom Lee Bitcoin Ethereum predictions to materialize helps investors set appropriate expectations and maintain conviction during inevitable market volatility. Lee’s analysis suggests that the confluence of bullish catalysts could drive dramatic price appreciation within an eighteen to thirty-six month window from early 2026.

Historical Bitcoin market cycles provide a framework for timing expectations. Previous bull markets have typically lasted twelve to twenty-four months from initial breakout above previous all-time highs to ultimate cycle peaks. If the current cycle follows similar patterns, the bulk of price appreciation toward the $250,000 target would likely occur between mid-2026 and late 2027.

Ethereum’s price trajectory often lags Bitcoin’s initial moves before accelerating during bull market final stages as capital rotates from Bitcoin into higher-risk, higher-growth assets. This pattern suggests that Ethereum might achieve proportional gains relative to Lee’s predictions on a slightly delayed timeline compared to Bitcoin.

However, Lee emphasizes that predictions should be viewed as directional rather than precise timing forecasts. Market dynamics rarely follow perfectly predictable patterns, and unexpected events can accelerate or delay projected timelines. The fundamental catalysts supporting bullish predictions appear increasingly robust regardless of exact timing.

Investors should prepare psychologically for significant volatility along the path toward ambitious price targets. Corrections of twenty to thirty percent remain common even within strong bull markets, and maintaining conviction during temporary drawdowns separates successful long-term cryptocurrency investors from those who sell prematurely during inevitable turbulence.

Conclusion: Positioning for Potentially Historic Cryptocurrency Gains

Tom Lee Bitcoin Ethereum predictions represent more than mere speculation; they reflect comprehensive analysis from a respected Wall Street strategist with demonstrated forecasting ability across multiple market cycles. His $250,000 Bitcoin target and proportional Ethereum gains are grounded in observable trends including accelerating institutional adoption, favorable macroeconomic conditions, technological improvements enabling mass usage, and historical market cycle patterns.

Whether cryptocurrency markets ultimately reach Lee’s aggressive price targets or fall short, the fundamental transformation of global finance through blockchain technology and digital assets appears increasingly inevitable. Tom Lee Bitcoin Ethereum predictions highlight the potential scale of this transformation and the investment opportunities available to those who position themselves appropriately.

For investors considering exposure to cryptocurrency market forecast opportunities, the current moment offers a compelling risk-reward proposition supported by improving fundamentals, increasing institutional validation, and technological maturation. While past performance never guarantees future results and significant risks remain, the bullish case articulated by Tom Lee deserves serious consideration in portfolio planning.

As always, thorough research, appropriate risk management, and consultation with qualified financial professionals should precede any investment decisions. The cryptocurrency market’s potential for life-changing returns comes alongside significant volatility and risk that requires careful navigation.

See more;Bitcoin Price Drops Below $88K Ahead of $28.5B Options Expiry