BTC ETFs’ net outflows reached a staggering $1.1 billion during a consecutive six-day period, marking one of the most substantial withdrawal streaks since the launch of spot Bitcoin exchange-traded funds. This dramatic reversal in investor sentiment has sent ripples through the digital asset markets, raising questions about the sustainability of institutional interest in Bitcoin ETF products. As cryptocurrency investment funds experience unprecedented redemptions, market analysts are scrambling to understand the underlying factors driving this mass exodus from what was once considered the gateway for traditional finance to enter the Bitcoin ecosystem.

The sustained period of Bitcoin ETF redemptions represents a stark contrast to the euphoria that surrounded the approval and launch of spot Bitcoin ETFs in early 2024. After months of robust inflows that helped propel Bitcoin to new all-time highs, the tide has turned dramatically, leaving investors and market observers questioning whether this signals a fundamental shift in how institutions view digital asset outflows or merely a temporary correction in an otherwise bullish trajectory.

Scale of BTC ETFs Net Outflows

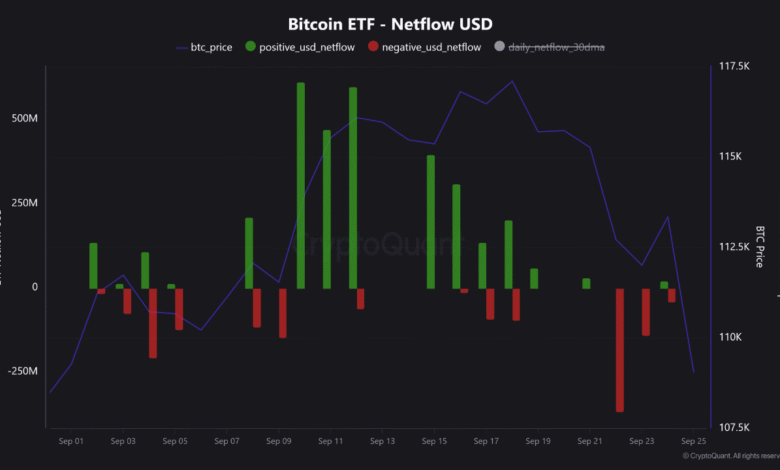

The magnitude of the $1.1 billion withdrawal from spot Bitcoin ETFs over six consecutive trading days cannot be understated in the context of cryptocurrency markets. This institutional Bitcoin selling pressure has created a cascading effect on Bitcoin’s price action, contributing to increased volatility and downward pressure on valuations. When examining the daily breakdown of these BTC ETFs net outflows, the pattern reveals a consistent trend rather than isolated incidents, suggesting coordinated or sentiment-driven decisions rather than random redemptions.

Market data shows that the outflow pattern began gradually before accelerating into a full-scale retreat from Bitcoin investment vehicles. The largest single-day redemption during this period exceeded $300 million, while the smallest still registered north of $100 million in net outflows. This consistency in withdrawal activity indicates that multiple investor classes, from retail to institutional participants, have simultaneously reassessed their positions in cryptocurrency investment funds.

The Bitcoin price decline that accompanied these outflows has created a feedback loop that some analysts believe may be self-reinforcing. As prices fall due to selling pressure from ETF redemptions, additional investors may choose to exit their positions to avoid further losses, creating additional digital asset outflows that perpetuate the downward cycle. This dynamic highlights the double-edged nature of ETF products in the cryptocurrency space, where they can amplify both positive and negative market movements.

Historical Context of Bitcoin ETF Market Trends

To fully appreciate the significance of the current BTC ETFs net outflows, examining the historical trajectory of Bitcoin exchange-traded funds provides essential context. The approval of spot Bitcoin ETFs represented a watershed moment for cryptocurrency legitimization, with billions of dollars flooding into these products during their initial months of operation. The honeymoon period saw consistent inflows that validated the investment thesis of Bitcoin as a mainstream asset class worthy of inclusion in diversified portfolios.

Previous outflow events, while notable, paled in comparison to the current six-day streak. Earlier redemption periods typically lasted one to three days and involved significantly smaller aggregate amounts. The extended duration and amplified scale of the present Bitcoin ETF redemptions suggest that this episode represents something more substantial than routine portfolio rebalancing or profit-taking activity.

ETF market trends in the broader financial landscape demonstrate that outflow periods are not unprecedented, even for successful products. Traditional equity and bond ETFs regularly experience redemption cycles tied to macroeconomic conditions, sector rotations, or changes in investor risk appetite. However, the cryptocurrency market’s inherent volatility means that crypto market sentiment can shift more rapidly and dramatically than in traditional asset classes, leading to more pronounced inflow and outflow cycles.

Factors Driving the Sustained Outflow Period

Multiple converging factors have contributed to the persistent BTC ETFs net outflows that have characterized recent trading sessions. Macroeconomic headwinds, including concerns about inflation persistence, central bank policy uncertainty, and global economic growth projections, have prompted investors to reassess risk assets broadly. Bitcoin investment vehicles have not been immune to this risk-off sentiment, as they are increasingly correlated with traditional risk assets like technology stocks.

Regulatory uncertainty continues to cast a shadow over cryptocurrency investment funds, with ongoing debates about digital asset classification, taxation frameworks, and potential restrictions on trading or custody arrangements. Some institutional investors who initially embraced spot Bitcoin ETFs may be pulling back in anticipation of more stringent regulatory requirements that could impact returns or create compliance complications.

Technical factors within the Bitcoin market itself have also played a role in driving Bitcoin ETF redemptions. Key support levels have been breached, triggering algorithmic selling and stop-loss orders that have accelerated the Bitcoin price decline. When combined with the outflow pressure from ETF redemptions, these technical breakdowns have created a challenging environment for maintaining bullish positions.

The opportunity cost of capital has become increasingly relevant as traditional fixed-income investments offer more attractive yields than in previous years. With government bonds and corporate debt providing risk-free or low-risk returns that compete with potential cryptocurrency gains, some investors have reallocated capital away from Bitcoin exchange-traded funds toward these more conservative alternatives.

Impact on Bitcoin Price and Market Dynamics

The relationship between BTC ETFs net outflows and Bitcoin’s price performance has been unmistakably direct during this six-day period. Each day of substantial redemptions has corresponded with downward pressure on Bitcoin’s spot price, as ETF sponsors must sell underlying Bitcoin holdings to meet redemption requests. This mechanical selling creates a supply-demand imbalance that has overwhelmed buying interest at certain price levels.

Market liquidity has been tested during peak outflow periods, with order books thinning on major exchanges as the combined selling pressure from ETF-related liquidations and opportunistic traders has created air pockets in price discovery. The Bitcoin price decline has been particularly pronounced during hours when both traditional markets and cryptocurrency exchanges experience peak activity, suggesting that the outflow impact extends across multiple trading venues and time zones.

Volatility metrics have spiked in response to the sustained digital asset outflows, with implied volatility indices for Bitcoin options reaching levels not seen since previous major market corrections. This elevated volatility environment creates challenges for risk management and position sizing, potentially discouraging new capital from entering Bitcoin investment vehicles until stability returns.

The psychological impact of watching institutional Bitcoin selling unfold in real-time through transparent ETF flow data has likely amplified the market’s negative response. Unlike traditional Bitcoin holders whose activities remain largely opaque, ETF flows are reported daily, creating a narrative of institutional retreat that influences broader crypto market sentiment.

Comparing Different Bitcoin ETF Products

Not all spot Bitcoin ETFs have experienced BTC ETFs net outflows uniformly during this period. Significant variations exist among different products, with some funds weathering the storm better than others based on factors including sponsor reputation, fee structures, and liquidity profiles. The largest funds by assets under management have generally seen the most substantial absolute outflows simply due to their size, though percentage-based comparisons reveal more nuanced performance differences.

Funds sponsored by established financial institutions with existing client relationships in traditional asset classes have demonstrated more resilience than newer entrants without comparable distribution networks. This suggests that investor decisions about Bitcoin ETF redemptions may be influenced by factors beyond Bitcoin’s fundamental value proposition, including trust in fund sponsors and the quality of investor services provided.

Fee compression has become increasingly important as cryptocurrency investment funds compete for investor capital. Products with lower expense ratios have generally retained assets more effectively during the outflow period, indicating that cost-conscious investors prioritize minimizing fees during market downturns. This dynamic may reshape the competitive landscape among Bitcoin exchange-traded funds as sponsors recognize that pricing power diminishes when market conditions deteriorate.

Trading liquidity and bid-ask spreads have also differentiated ETF performance during the outflow period. Funds with tighter spreads and more robust market-making support have provided better execution for investors looking to exit positions, potentially reducing the panic selling that can occur when liquidity evaporates. These operational considerations have become more prominent in investor decision-making as ETF market trends evolve beyond simply tracking Bitcoin’s price.

Institutional Investor Behavior and Sentiment Shifts

The sustained BTC ETFs net outflows offer valuable insights into how institutional investors approach Bitcoin investment vehicles during periods of market stress. Unlike retail participants who may make emotional decisions based on short-term price movements, institutional allocators typically operate within defined risk parameters and rebalancing schedules. The six-day outflow streak suggests that many institutions have reached predetermined risk thresholds or portfolio allocation limits that trigger mandatory redemptions.

Pension funds, endowments, and other conservative institutional investors who initially allocated small percentages of portfolios to spot Bitcoin ETFs may be reassessing the appropriateness of cryptocurrency exposure amid broader market volatility. The fiduciary responsibilities these institutions bear toward beneficiaries create additional layers of decision-making complexity that can lead to more cautious positioning during uncertain periods.

Family offices and high-net-worth individuals, another significant institutional investor category, appear to be taking diverse approaches to the current Bitcoin ETF redemptions environment. Some are viewing the Bitcoin price decline as an opportunity to accumulate at lower prices, potentially offsetting some of the outflow pressure, while others are reducing exposure in line with broader risk management protocols.

Crypto market sentiment among institutions has clearly shifted from the optimism that characterized early ETF adoption to a more measured and cautious stance. Conversations with institutional investment professionals reveal concerns about regulatory trajectory, competitive threats from alternative cryptocurrencies, and questions about Bitcoin’s utility beyond speculative investment, all of which contribute to redemption decisions.

Technical Analysis and Market Structure Considerations

From a technical perspective, the BTC ETFs net outflows have contributed to significant chart pattern developments that technical analysts are monitoring closely. Key support levels that previously held during minor corrections have been decisively breached, opening the possibility of further downside movement if additional selling pressure materializes. The volume profile during the outflow period shows elevated trading activity, confirming that the Bitcoin price decline reflects genuine distribution rather than low-liquidity anomalies.

Moving average configurations have turned bearish across multiple timeframes, with death crosses appearing on charts monitored by algorithmic trading systems. These technical signals can become self-fulfilling as trend-following strategies automatically adjust positioning based on these indicators, potentially amplifying the impact of institutional Bitcoin selling.

On-chain metrics provide complementary insights to the ETF flow data, revealing that long-term holders have generally maintained their positions despite the digital asset outflows from ETF products. This divergence between ETF investor behavior and direct Bitcoin holder behavior suggests different investment philosophies and time horizons between these participant groups. While ETF investors appear more reactive to short-term price movements, direct holders demonstrate greater conviction in long-term value propositions.

Market structure considerations including futures positioning, options open interest, and derivatives leverage ratios have all adjusted in response to the sustained Bitcoin ETF redemptions. Funding rates in perpetual futures markets have turned negative, indicating that short positions are paying long positions to maintain their bets against Bitcoin’s price, a configuration that typically emerges during bearish phases.

Regulatory and Compliance Implications

The magnitude of BTC ETFs net outflows has not gone unnoticed by regulatory authorities who oversee cryptocurrency investment funds and their interactions with traditional financial systems. The Securities and Exchange Commission and other regulatory bodies monitor ETF flows as indicators of market health and potential systemic risks, particularly given the novelty of spot Bitcoin products in the mainstream investment landscape.

Compliance considerations for Bitcoin exchange-traded funds include ensuring orderly redemption processes that do not disrupt underlying Bitcoin markets or create liquidity crises. The ability of ETF sponsors to handle $1.1 billion in redemptions over six days without significant operational failures demonstrates the robustness of custody and trading infrastructure, though questions remain about scalability if outflows intensify further.

Future regulatory developments may be influenced by observations from this outflow period, potentially leading to enhanced disclosure requirements, stress testing protocols, or limitations on leverage and derivative usage within Bitcoin investment vehicles. Regulators balance the objective of protecting investors with the goal of fostering financial innovation, and episodes of significant Bitcoin ETF redemptions provide real-world data for calibrating appropriate regulatory frameworks.

The global nature of cryptocurrency markets creates jurisdictional complexities for regulating spot Bitcoin ETFs, as these products trade in specific markets while underlying assets operate on borderless networks. Coordination among international regulatory bodies becomes increasingly important as crypto market sentiment can quickly spread across regions, creating challenges for localized policy responses.

Comparing Bitcoin ETFs to Traditional ETF Products

Placing BTC ETFs net outflows in the context of traditional ETF market behavior reveals both similarities and distinctions that characterize cryptocurrency investment products. Established equity and bond ETFs regularly experience flow cycles correlated with economic conditions and market sentiment, suggesting that outflow periods are normal features of ETF investing rather than unique pathologies of cryptocurrency investment funds.

However, the velocity and magnitude of flows in Bitcoin exchange-traded funds significantly exceed patterns observed in most traditional products. The six-day, $1.1 billion outflow represents a substantial percentage of total assets under management for Bitcoin ETFs, a proportion that would be unusual for mature equity or bond products except during severe market dislocations.

Investor composition differences partially explain these flow pattern variations. Bitcoin investment vehicles attract participants with higher risk tolerances and shorter investment horizons compared to core index fund investors, leading to more pronounced reactions to adverse market conditions. This demographic reality suggests that flow volatility may remain an inherent characteristic of cryptocurrency ETFs regardless of market maturation.

ETF market trends across asset classes demonstrate that successful products eventually develop more stable flow patterns as investor bases diversify and mature. Whether spot Bitcoin ETFs will follow this trajectory or continue exhibiting cryptocurrency-like volatility in their flows remains an open question that will be answered only through additional market cycles and time.

Future Outlook and Potential Recovery Scenarios

Analyzing potential paths forward following the sustained BTC ETFs net outflows requires considering multiple scenarios that could unfold based on various catalysts and market conditions. The most optimistic outlook envisions a quick sentiment reversal driven by positive catalysts such as favorable regulatory developments, macroeconomic improvements, or renewed institutional interest that could trigger return flows into Bitcoin investment vehicles.

A more moderate scenario sees consolidation at current levels with gradual stabilization of Bitcoin ETF redemptions as the market finds equilibrium between sellers exhausting their positions and opportunistic buyers accumulating at perceived value levels. This path would likely involve extended periods of range-bound trading while crypto market sentiment slowly rebuilds from current depressed levels.

Bearish scenarios contemplate additional waves of institutional Bitcoin selling if macroeconomic conditions deteriorate further or if specific negative catalysts emerge, such as regulatory crackdowns, security breaches at major exchanges, or competitive threats from central bank digital currencies. Such developments could extend the Bitcoin price decline and create additional pressure on cryptocurrency investment funds.

Historical market cycles suggest that periods of significant digital asset outflows eventually reverse when valuations become compelling enough to attract value-oriented investors. The question remains whether Bitcoin has reached such levels or if further downside is necessary before sustainable recovery can commence. Time will reveal which scenario materializes as market conditions evolve.

Lessons for Investors and Market Participants

The episode of sustained BTC ETFs net outflows offers valuable lessons for investors navigating Bitcoin exchange-traded funds and cryptocurrency markets more broadly. Understanding that flows can be as volatile as underlying asset prices helps set appropriate expectations for these investment vehicles and encourages more thoughtful position sizing and risk management.

Diversification principles remain crucial even within cryptocurrency allocations, as relying exclusively on Bitcoin investment vehicles exposes investors to both Bitcoin-specific risks and ETF structure considerations. Balancing direct cryptocurrency holdings with ETF exposure, or diversifying across multiple digital assets, may provide more resilient portfolio construction during turbulent periods.

The importance of conviction and investment thesis clarity has been highlighted by differential investor behavior during the Bitcoin ETF redemptions period. Those with well-defined reasons for holding Bitcoin exposure, whether as an inflation hedge, portfolio diversifier, or long-term value store, have been better equipped to maintain positions through volatility compared to those following momentum or herd behavior.

Market timing challenges are amplified in cryptocurrency markets where crypto market sentiment can shift rapidly. The difficulty of consistently identifying optimal entry and exit points suggests that systematic approaches such as dollar-cost averaging may serve most investors better than attempting to trade around flow cycles and short-term price movements.

Conclusion

The $1.1 billion in BTC ETFs net outflows during the six-day streak represents a significant moment in the evolution of Bitcoin exchange-traded funds and cryptocurrency investment more broadly. While the immediate impact on Bitcoin’s price and market sentiment has been decidedly negative, the longer-term implications remain uncertain as markets digest these flows and adjust to new equilibrium levels.

Understanding the drivers behind Bitcoin ETF redemptions, from macroeconomic factors to technical market dynamics, equips investors with frameworks for evaluating future developments and making informed decisions about cryptocurrency investment funds. The transparency of ETF flow data, while potentially amplifying market reactions, ultimately serves investors by providing real-time insights into institutional positioning and sentiment.

As Bitcoin investment vehicles mature and evolve through multiple market cycles, the lessons learned during periods of sustained digital asset outflows will inform product development, regulatory frameworks, and investor education. Whether this episode marks a temporary setback or a more fundamental reassessment of Bitcoin’s role in investment portfolios will become clearer as subsequent market conditions unfold.

For investors considering exposure to spot Bitcoin ETFs, the current environment of BTC ETFs’ net outflows may present opportunities for those with conviction in Bitcoin’s long-term value proposition and the patience to weather short-term volatility. As always, thorough due diligence, appropriate risk management, and alignment with individual financial goals should guide investment decisions in this dynamic and evolving asset class.

See more; Bitcoin Price Today: BTC Holds $89K Amid Holiday Trading