The Bitcoin price today continues to demonstrate remarkable resilience as BTC holds firm near the $89,000 mark despite a confluence of challenging market conditions on December 26, 2025. As global markets operate with reduced liquidity during the extended holiday season, Bitcoin faces multiple headwinds including significant exchange-traded fund outflows and the largest quarterly options expiration in cryptocurrency history. Understanding the current Bitcoin price today requires analyzing these interconnected factors that are shaping market dynamics and influencing trader sentiment across digital asset platforms worldwide. The world’s leading cryptocurrency is navigating a complex landscape where institutional activity, retail participation, and macro-economic pressures converge to create an environment of heightened uncertainty yet surprising price stability.

Current Bitcoin Price Analysis and Market Position

The Bitcoin price today reflects a mature asset class responding to both traditional financial market pressures and crypto-native catalysts. Trading at approximately $89,000, BTC has established a relatively narrow trading range over the past forty-eight hours, demonstrating what many analysts interpret as a consolidation phase following the volatile movements experienced throughout December. This price level represents a critical psychological and technical threshold for the cryptocurrency market, as it sits significantly above the key support zone identified by technical analysts at $85,000 while remaining below the recent local high of $94,500 recorded in mid-December.

Market participants closely monitoring the Bitcoin price today have observed that trading volumes have contracted by approximately thirty-five percent compared to the weekly average, a phenomenon directly attributable to the holiday season when institutional desks reduce staffing and retail traders step away from active market monitoring. This reduction in liquidity amplifies price volatility potential, meaning that relatively smaller order flows can generate disproportionately large price movements in either direction. Despite these conditions, Bitcoin has maintained its position within a defined range, suggesting that both buyers and sellers have established an equilibrium around current price levels.

The BTC price stability comes amid broader cryptocurrency market dynamics that show mixed signals across different digital assets. While Bitcoin holds near $89,000, alternative cryptocurrencies have experienced more pronounced volatility, with several major tokens recording double-digit percentage declines over the same period. This divergence reinforces Bitcoin’s position as a relatively haven within the digital asset ecosystem, attracting capital flows from investors seeking to preserve value during periods of heightened uncertainty in smaller-cap cryptocurrencies.

Holiday Liquidity Crunch Impact on Bitcoin Trading

Holiday liquidity conditions are exerting a substantial influence on the Bitcoin price today, creating a trading environment characterized by thinner order books and increased susceptibility to sharp price movements. The period between Christmas and New Year traditionally represents one of the lowest liquidity windows in both traditional finance and cryptocurrency markets, as institutional traders take vacation time and trading desks operate with skeleton crews. For Bitcoin, this translates into reduced market depth, where large orders can more easily move prices compared to periods of normal trading activity.

The liquidity crunch affecting the Bitcoin price today manifests in several observable market characteristics. Bid-ask spreads across major cryptocurrency exchanges have widened noticeably, increasing transaction costs for traders and reducing the efficiency of price discovery mechanisms. Order book depth analysis reveals that the volume of standing buy and sell orders at prices within two percent of the current market price has declined by nearly forty percent compared to pre-holiday levels. This thinning of market depth means that significant buy or sell orders can create rapid price dislocations that might not occur under normal market conditions.

Experienced cryptocurrency traders recognize that holiday liquidity conditions create both risks and opportunities for Bitcoin price movements. The reduced trading volumes and market participation can lead to exaggerated price swings in response to news events or large transactions, creating conditions where technical support and resistance levels may be tested or broken with less selling or buying pressure than would typically be required. Several market makers and high-frequency trading firms have also reduced their Bitcoin market-making activities during this period, further contributing to the liquidity constraints that characterize the current trading environment.

Bitcoin ETF Outflows Creating Downward Pressure

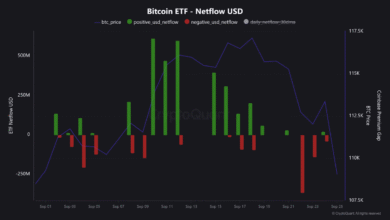

Exchange-traded fund activity represents a significant factor influencing the Bitcoin price today, with recent data showing substantial outflows from spot Bitcoin ETFs that have accumulated over the past week. These investment vehicles, which launched throughout 2024 and experienced tremendous initial success in attracting institutional and retail capital, have recorded net outflows exceeding $1.2 billion during the final weeks of December. This represents a notable shift from the strong inflow patterns that characterized much of the year and signals potential changes in investor sentiment toward cryptocurrency exposure through regulated investment products.

The Bitcoin ETF outflows impacting market dynamics today stem from multiple sources and motivations. Year-end portfolio rebalancing by institutional investors accounts for a significant portion of the selling pressure, as fund managers adjust positions to lock in gains, manage tax liabilities, and reset allocations ahead of the new calendar year. Additionally, some profit-taking has occurred following Bitcoin’s substantial price appreciation earlier in 2025, with certain investors choosing to reduce exposure after achieving their return targets. The outflows have been concentrated in several of the largest spot Bitcoin ETFs, suggesting that institutional rather than retail flows are driving this trend.

The relationship between ETF flows and the Bitcoin price today operates through direct and indirect mechanisms. When ETF shares are redeemed, authorized participants must sell the underlying Bitcoin holdings to return cash to departing investors, creating genuine selling pressure in spot markets. Beyond this direct impact, the flow data itself influences market sentiment, as traders and analysts interpret sustained outflows as a bearish signal that may prompt additional selling from other market participants. However, it’s important to note that the BTC price has demonstrated resilience despite these outflows, suggesting that buying interest from other sources has been sufficient to absorb the ETF-related selling pressure.

Record Bitcoin Options Expiry Event and Market Implications

A historic Bitcoin options expiration event is occurring today, with approximately $14 billion in notional value of BTC options contracts reaching their expiration date. This represents the largest quarterly options expiry in cryptocurrency history, surpassing previous records and creating significant potential for price volatility as market makers adjust their hedging positions and traders close or roll their options strategies. The Bitcoin price today is being influenced by the complex dynamics surrounding this massive options expiry, which involves thousands of individual contracts across multiple strike prices and expiration strategies.

Options market analysis reveals important insights into how this expiry event may influence the Bitcoin price today and in coming sessions. The largest concentration of open interest exists at the $90,000 strike price, with substantial positions also clustered at $85,000 and $95,000 strikes. These levels represent what options traders call “max pain” zones, where the greatest number of options contracts would expire worthless, representing optimal outcomes for options sellers. The current BTC price near $89,000 positions the market close to the high-volume strike at $90,000, suggesting that gravitational forces may pull prices toward this level as market makers adjust their delta hedges through the expiration process.

The mechanics of options expiry create specific trading patterns that experienced cryptocurrency traders monitor closely. As contracts approach expiration, options sellers who maintain delta-neutral positions must adjust their underlying Bitcoin holdings to manage risk. If BTC prices move higher, these market makers typically must sell Bitcoin to maintain their hedges, creating selling pressure that can cap upward price movements. Conversely, declining prices may force covering of short positions, potentially providing support. These dynamics become amplified during record-large expiry events like today’s, where the sheer magnitude of contracts reaching expiration can generate substantial hedging flows that influence the Bitcoin price today.

Technical Analysis of Bitcoin’s Current Price Structure

From a technical perspective, the Bitcoin price today occupies an interesting position within the broader chart structure that has developed over recent months. The current level near $89,000 represents the midpoint of a trading range that has defined BTC price action since early December, with upper resistance identified around $94,500 and lower support establishing around $84,000. This consolidation pattern follows the substantial rally that carried Bitcoin from the $70,000 area in November to peaks above $95,000 earlier this month, representing a natural period of digestion after such a significant upward movement.

Key technical indicators provide mixed signals regarding the Bitcoin price today and near-term directional prospects. The relative strength index currently reads at 52, indicating neither overbought nor oversold conditions and suggesting that BTC maintains room for movement in either direction without hitting extremes. Moving average analysis shows that Bitcoin continues trading above its fifty-day moving average, which currently resides near $86,000, a technical development that many chartists interpret as maintaining the intermediate-term bullish trend. However, the price has failed to break above the twenty-day moving average resistance near $91,000, indicating that shorter-term momentum has stalled.

Volume profile analysis of the Bitcoin price today reveals important information about support and resistance levels based on historical trading activity. The highest volume node, representing the price level where the most BTC has changed hands recently, sits at approximately $88,500, very close to current market prices. This high-volume area typically provides support during downward price tests and resistance during upward movements, as many market participants have established positions near these levels and show willingness to defend them. Additionally, the volume-weighted average price for the past thirty days calculates to $89,200, suggesting that current prices represent relatively fair value based on recent trading history.

Institutional Activity and Bitcoin Market Dynamics

Institutional participation continues shaping the Bitcoin price today through various channels beyond ETF flows, with corporate treasuries, hedge funds, and traditional finance players maintaining active involvement in cryptocurrency markets. Recent blockchain analysis indicates that wallet addresses associated with institutional holders have shown minimal movement during the holiday period, suggesting that large players are largely maintaining their positions rather than actively trading through current market volatility. This behavior pattern differs from retail trader activity, which shows increased transaction frequency despite overall lower volume conditions.

Corporate Bitcoin holdings remain a significant component of institutional exposure, with numerous publicly traded companies maintaining substantial BTC positions on their balance sheets. These treasury holdings, which collectively exceed several billion dollars in value, create underlying demand dynamics that support the Bitcoin price today by removing supply from active circulation. Companies that adopted Bitcoin treasury strategies earlier in the cycle have generally maintained conviction in their positions despite price volatility, viewing their cryptocurrency holdings as long-term strategic assets rather than trading positions subject to short-term market timing decisions.

The institutional infrastructure supporting Bitcoin trading has continued expanding throughout 2025, providing deeper liquidity and more sophisticated trading tools that influence the BTC price formation process. Prime brokerage services, custody solutions, and derivatives platforms designed specifically for institutional clients have proliferated, reducing friction for large players seeking cryptocurrency exposure. This maturing infrastructure contributes to more efficient markets and tighter bid-ask spreads under normal conditions, though the benefits become less pronounced during holiday liquidity crunches like the one affecting the Bitcoin price today.

Regulatory Landscape and Bitcoin Price Implications

The regulatory environment surrounding Bitcoin and cryptocurrency markets continues evolving, with developments at both domestic and international levels influencing investor sentiment and the BTC price. Recent clarity from regulatory agencies regarding digital asset classification and treatment has generally been interpreted as constructive for the industry, providing institutional participants with greater confidence in compliance frameworks and reducing regulatory uncertainty that previously hindered mainstream adoption. These regulatory advances contribute to the legitimacy and accessibility of Bitcoin as an investment asset class, supporting long-term price appreciation potential.

Specific regulatory developments impacting the Bitcoin price today include ongoing implementation of cryptocurrency market structure legislation that establishes clearer rules for digital asset trading platforms, custody providers, and market intermediaries. These regulatory frameworks, while imposing compliance obligations on industry participants, simultaneously create more predictable operating environments that encourage institutional participation and capital allocation to cryptocurrency markets. The net effect of regulatory maturation has been positive for Bitcoin price stability and mainstream acceptance, as evidenced by the successful launch and operation of spot Bitcoin ETFs that operate under established securities regulations.

International regulatory coordination regarding cryptocurrency oversight has also progressed throughout 2025, with major financial jurisdictions working toward compatible approaches to digital asset regulation. This global coordination reduces the risk of regulatory arbitrage and fragmentation while providing multinational corporations and financial institutions with clearer frameworks for Bitcoin engagement across different markets. The BTC price benefits from this regulatory clarity through reduced uncertainty premiums and increased institutional participation from players who require robust compliance frameworks before making significant capital allocations to emerging asset classes.

Macroeconomic Factors Influencing Bitcoin Valuation

Broader macroeconomic conditions play an increasingly significant role in determining the Bitcoin price today, as the cryptocurrency has evolved from a niche speculative asset to a recognized component of diversified investment portfolios. Current monetary policy stance from major central banks, including the Federal Reserve’s position on interest rates and quantitative measures, directly influences risk asset valuations across equities, bonds, and digital assets. The BTC price has shown growing correlation with traditional risk assets during certain market regimes, particularly during periods of macroeconomic stress or major policy shifts that affect liquidity conditions across financial markets.

Inflation dynamics and currency devaluation concerns continue supporting the investment thesis for Bitcoin as a store of value and hedge against monetary expansion. Despite central bank efforts to manage inflation through interest rate adjustments and other policy tools, concerns about long-term currency purchasing power persist among certain investor cohorts who view cryptocurrency as protection against fiat currency depreciation. This macroeconomic backdrop contributes to sustained institutional and high-net-worth individual interest in Bitcoin allocation, providing underlying support for the BTC price even during periods of short-term volatility or technical weakness.

Global economic growth prospects and financial market stability also factor into Bitcoin valuation models and price projections. Economic uncertainty or stress in traditional financial systems historically correlates with increased interest in alternative assets, including cryptocurrency, as investors seek diversification and protection from systemic risks. Conversely, periods of strong economic growth and market stability may reduce some of the alternative asset appeal while potentially directing capital flows toward traditional equities and growth-oriented investments. The Bitcoin price today reflects this complex interplay of macroeconomic factors, risk sentiment, and asset allocation decisions across the global investment landscape.

Blockchain Metrics and On-Chain Bitcoin Analysis

On-chain metrics provide valuable insights into the fundamentals supporting the Bitcoin price today beyond what traditional price and volume analysis reveals. Hash rate, which measures the total computational power securing the Bitcoin network, recently reached new all-time highs exceeding 500 exahashes per second. This milestone demonstrates continued investment in Bitcoin mining infrastructure and reinforces network security, factors that support long-term value proposition and price stability. The expanding hash rate indicates miner confidence in future BTC price appreciation, as these operations make substantial capital investments based on revenue projections from block rewards and transaction fees.

Active address metrics for the Bitcoin network show healthy user engagement despite holiday season trading lulls, with daily active addresses maintaining levels consistent with recent months. This sustained network activity indicates ongoing organic usage and adoption rather than purely speculative trading interest, strengthening the fundamental case for Bitcoin valuation. Additionally, the number of addresses holding at least 0.1 BTC continues growing steadily, suggesting broadening ownership distribution and increased retail participation in the cryptocurrency ecosystem that supports long-term price stability.

Exchange reserve data reveals that the amount of Bitcoin held on centralized trading platforms has declined substantially over recent months, with approximately 2.4 million BTC currently sitting in exchange wallets compared to over 3 million earlier in the year. This withdrawal of coins from exchanges into self-custody solutions indicates that holders are taking longer-term positions rather than maintaining assets in readily tradeable form, effectively reducing available supply and creating supportive conditions for the Bitcoin price today. The declining exchange reserves also suggest conviction among existing holders who are less likely to sell their positions in response to short-term price fluctuations.

Bitcoin Price Predictions and Analyst Perspectives

Market analysts and cryptocurrency experts have offered varied perspectives on near-term and longer-term Bitcoin price trajectories, with projections ranging from consolidation around current levels to significant moves in either direction. Bullish analysts point to the upcoming Bitcoin halving in 2028 as a catalyst that historically precedes major price appreciation cycles, combined with growing institutional adoption and improving regulatory clarity as factors supporting higher valuations. These optimistic projections see BTC potentially reaching six-figure price levels within the next twelve to eighteen months, driven by supply constraints and increasing demand from both institutional and retail sources.

More conservative analysts emphasize the near-term headwinds facing the Bitcoin price today, including ETF outflows, regulatory uncertainties in certain jurisdictions, and potential macroeconomic challenges that could reduce risk appetite across financial markets. These perspectives suggest that cryptocurrency markets may experience extended consolidation or even downward pressure before establishing a foundation for the next major upward move. Technical analysts in this camp identify key support levels that would need to hold to maintain the overall bullish market structure, with breaks below $85,000 potentially triggering more substantial selling pressure that could test lower support zones.

Quantitative models analyzing Bitcoin valuation through metrics like stock-to-flow ratios, network value to transactions relationships, and realized price calculations provide additional frameworks for assessing whether current prices represent fair value or deviations from fundamental levels. These models generally suggest that the Bitcoin price today trades within reasonable ranges relative to historical patterns and network fundamentals, neither significantly overvalued nor undervalued based on quantitative measures. However, model-based valuations carry inherent limitations and uncertainties, particularly during periods of rapid market evolution or structural changes in cryptocurrency adoption and usage patterns.

Global Bitcoin Adoption Trends and Market Expansion

Bitcoin adoption continues expanding globally through multiple channels including retail payment integration, corporate treasury allocation, and sovereign nation interest in cryptocurrency reserves. Several countries have advanced discussions regarding strategic Bitcoin reserve proposals, viewing the digital asset as a potential component of national treasury diversification strategies. This government-level interest, while still early stage, represents a potentially transformative development for Bitcoin legitimacy and long-term price support as nation-state actors enter the market with substantial purchasing power and extended time horizons.

Payment integration for Bitcoin has progressed throughout 2025, with major payment processors and financial technology platforms enabling cryptocurrency transactions for merchants and consumers. This expanding acceptance network increases Bitcoin’s utility as a medium of exchange beyond its primary function as a store of value and investment asset, potentially supporting the BTC price through increased transaction demand and reduced volatility as usage patterns diversify. Lightning Network adoption has accelerated particularly in regions with less developed banking infrastructure, demonstrating Bitcoin’s potential to provide financial services access to underserved populations globally.

Developing market interest in Bitcoin and cryptocurrency has grown substantially, driven by factors including currency instability, capital controls, and limited access to traditional investment opportunities. Countries experiencing high inflation or currency devaluation have seen significant grassroots Bitcoin adoption as citizens seek to preserve wealth and conduct transactions outside of unstable local financial systems. This adoption trend creates underlying global demand for BTC that supports price stability and growth potential regardless of shorter-term trading dynamics in developed market exchanges that generate most visible price action.

Risk Factors and Challenges for Bitcoin Markets

Despite the resilient Bitcoin price today, several risk factors and challenges face cryptocurrency markets that could influence future price trajectories. Cybersecurity threats remain a persistent concern, with exchange hacks, wallet compromises, and smart contract vulnerabilities periodically affecting market confidence and creating selling pressure. While security practices have improved substantially across the industry, the decentralized and digital nature of cryptocurrency creates unique attack surfaces that require ongoing vigilance and technological advancement to mitigate effectively.

Scalability challenges for the Bitcoin network continue generating debate within the technical community regarding optimal approaches to increasing transaction throughput while maintaining decentralization and security properties. Layer-two solutions like the Lightning Network address some of these limitations, but mainstream adoption requires continued development and user experience improvements that make these technologies accessible to non-technical users. The BTC price could face pressure if competing blockchain platforms demonstrate superior scalability characteristics that attract developer activity and user adoption away from the Bitcoin ecosystem.

Environmental concerns regarding Bitcoin mining energy consumption represent another risk factor that influences institutional investment decisions and regulatory approaches in certain jurisdictions. While the industry has made substantial progress in renewable energy adoption and mining efficiency improvements, public perception and policy responses to environmental considerations could affect cryptocurrency market dynamics. The Bitcoin price today exists within this broader context of ongoing debates about sustainability and environmental responsibility in digital asset operations that may influence long-term adoption trajectories.

Conclusion

The Bitcoin price today reflects a complex interplay of factors, including holiday liquidity constraints, institutional ETF outflows, and record options expiration events that create both challenges and opportunities for cryptocurrency traders and investors. Despite these headwinds, BTC maintains a position near $89,000, demonstrating remarkable resilience that speaks to the underlying strength and maturation of digital asset markets. As we look ahead to the remainder of the holiday period and into the new year, market participants should monitor key technical levels, on-chain metrics, and macroeconomic developments that will shape the next major directional move for Bitcoin prices.

The current market environment rewards patience and disciplined trading approaches, as reduced liquidity amplifies volatility potential while options expiry dynamics create gravitational forces around key strike prices. Long-term Bitcoin investors maintaining conviction in the fundamental value proposition may view current price levels as attractive accumulation opportunities, particularly given the strong network fundamentals and growing institutional adoption trends that support multi-year bullish scenarios. However, short-term traders should exercise appropriate risk management given the elevated uncertainty and technical challenges facing markets during this unique confluence of year-end factors.

For those monitoring the Bitcoin price today and considering position adjustments, staying informed about evolving market conditions, regulatory developments, and technological advancements remains essential for successful navigation of cryptocurrency markets. Whether you’re an experienced trader, long-term investor, or newcomer exploring digital asset opportunities, understanding the multifaceted factors influencing BTC valuations provides crucial context for making informed decisions aligned with your investment objectives and risk tolerance in this dynamic and rapidly evolving market landscape.

See more: Bitcoin Price Today: Rises to $89K Amid Thin Liquidity & ETF Outflows