Bitcoin price recovery has shifted toward an upside direction, allowing it to reclaim the pivotal $90,000 mark after facing heightened bearish and selling pressure over the past few days, driven by macroeconomic uncertainty.

Bitcoin price recovery. The flagship asset recently rose to the $94,000 threshold following US President Donald Trump’s latest announcement of a crypto strategic reserve before dropping again to $82,000. With BTC surging again, renewed optimism has entered the market as investors anticipate a more significant rebound.

Bitcoin Enters Critical Zone

Given the robust volatility in the market presently, Bitcoin has failed to maintain an upward movement for an ideal period. During the price fluctuations, Alphractal, an advanced on-chain data and investment platform, has outlined a crucial moment for Bitcoin price that could impact its market dynamics. According to the on-chain platform, Bitcoin is approaching a critical juncture as it moves closer to entering a price discovery zone. This move comes as bullish sentiment rises about Bitcoin’s prospects despite the ongoing volatility in the broader crypto market.

Specifically, this price recovery zone is between the $70,000 and the $90,000 range, indicating a $20,000 price gap. Furthermore, within this zone, key derivatives metrics such as open interest (OI), trade count, and buying volume show a lack of historical consolidation. As BTC aims to enter the price recovery zone, Alphractal highlighted that the $100,000 level will likely become the next key resistance area. Meanwhile, the $70,000 mark is expected to be a support range once BTC enters the price recovery zone.

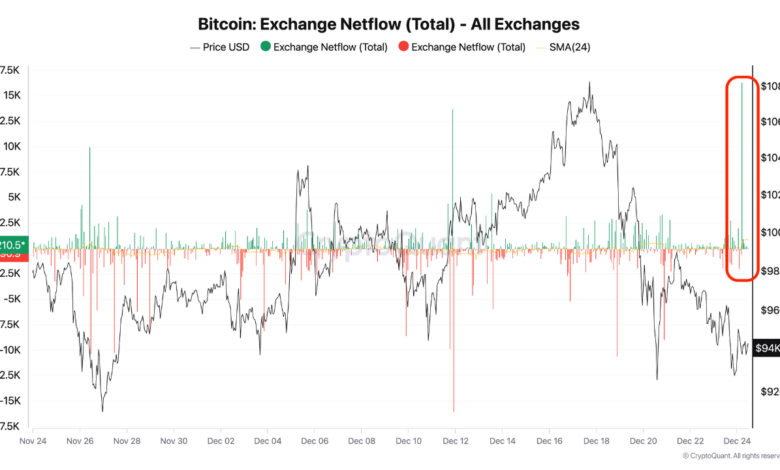

When this happens, the platform points to the frequent liquidations of longs and shorts’ BTC positions due to poor price stability. With bullish momentum growing again and key levels being tested, this move may extend, propelling the asset toward higher price levels. Data from CoinMarketCap shows that Bitcoin has rebounded by nearly 3% in the last 24 hours, bringing its price slightly above the $90,000 mark. Despite the brief rebound, selling pressure continues to increase as BTC‘s trading volume has plummeted by more than 26% in the past day.

Declining Bitcoin Investor Sentiment

While Bitcoin’s price performance wanes, investors’ sentiment appears to have weakened, as evidenced by a decline in large investor or whale transaction volume over the past two years. Alphractal reported that the volume of transactions above $100,000 from large investors has remained neutral since November 2022 compared to 2021, when BTC witnessed significant movements.

There has also been a decrease in on-chain volume over time. Compared to earlier times, the volume of BTC transactions on the blockchain is still lower. On-chain volumes have occasionally fallen to levels not seen since 2014, which suggests that network activity is declining.

Final thoughts

The article presents an insightful analysis of Bitcoin’s recent price movements and outlook in light of ongoing market volatility and macroeconomic factors. The $90,000 mark has become a crucial pivot for Bitcoin, indicating a potential price discovery phase between the $70,000 and $90,000 range. This zone presents both an opportunity and a challenge, as Bitcoin may experience increased volatility and liquidations during this period, making it a key moment to watch for investors.

The mention of Bitcoin potentially approaching a price discovery zone is significant, as it suggests that the asset might soon face a phase of price exploration where historical data may not be as helpful in predicting future price trends. The $100,000 level is a potential resistance point, with the $70,000 level as support.

However, the article also raises concerns about decreased investor sentiment and declining whale transaction volume, which may signal weakening confidence among large investors and less market activity overall. This could mean lower momentum in Bitcoin’s price recovery or a more gradual upward movement.