Best cryptocurrencies to invest in 2026 that offer substantial growth potential while managing risk effectively. The digital asset market has matured significantly, with institutional adoption reaching unprecedented levels and regulatory frameworks providing greater clarity for investors. Understanding which cryptocurrencies deserve a place in your portfolio requires careful analysis of technology fundamentals, market positioning, real-world utility, and long-term viability. This comprehensive guide examines the most promising digital assets that expert analysts believe will deliver strong performance throughout the year.

Cryptocurrency Investment Landscape in 2026

The cryptocurrency market has undergone a remarkable transformation since its inception. What began as an experimental digital currency has blossomed into a diverse ecosystem encompassing thousands of projects with varying purposes and technological innovations. The current environment for cryptocurrency investments differs substantially from previous cycles, characterized by increased institutional participation, clearer regulatory guidelines, and broader mainstream acceptance.

Traditional financial institutions now offer cryptocurrency services to their clients, and major corporations have integrated blockchain technology into their operations. This institutional embrace has brought legitimacy to the sector while simultaneously introducing new dynamics that investors must understand. The volatility that once defined cryptocurrency markets has moderated somewhat, though significant price movements remain characteristic of the asset class.

Regulatory developments have played a crucial role in shaping the investment landscape. Governments worldwide have established frameworks that provide greater protection for investors while fostering innovation. These regulations have eliminated many fraudulent projects and created an environment where legitimate cryptocurrencies can thrive. Understanding this regulatory backdrop is essential when identifying the best cryptocurrencies to invest in 2026.

How to Evaluate Cryptocurrencies Before Investing

Successful cryptocurrency investment requires a rigorous evaluation methodology rather than speculation based on hype or social media trends. Several fundamental factors distinguish promising projects from those likely to fail. Technology infrastructure forms the foundation of any cryptocurrency’s value proposition. Projects built on robust, scalable blockchain architectures with proven security records demonstrate greater potential for long-term success.

Development team credentials and track records provide insight into a project’s execution capability. Teams with experienced developers, transparent communication practices, and consistent delivery of roadmap milestones inspire greater confidence. The opposite scenario features anonymous teams, missed deadlines, and vague technical documentation, all significant red flags for potential investors.

Real-world adoption and utility separate speculative assets from those providing genuine value. Cryptocurrencies solving actual problems or facilitating meaningful transactions demonstrate staying power that purely speculative assets lack. Network effects become increasingly important as projects mature, with larger user bases creating self-reinforcing cycles of value creation.

Tokenomics, or the economic model governing a cryptocurrency’s supply and distribution, significantly impacts long-term value. Projects with deflationary mechanisms, reasonable token distribution, and alignment between stakeholder incentives tend to perform better than those with inflationary models or heavily concentrated ownership. Market capitalization and liquidity also warrant consideration, as these factors affect price stability and ease of entry or exit from positions.

Bitcoin: The Digital Gold Standard Remains Strong

Bitcoin continues occupying the preeminent position among digital assets in 2026, maintaining its status as the most recognized and widely adopted cryptocurrency. The original cryptocurrency has evolved from a peer-to-peer payment system into a store of value comparable to gold, earning the moniker “digital gold” through its scarcity and decentralized nature.

The Bitcoin network has demonstrated remarkable resilience over its existence, surviving numerous challenges including regulatory crackdowns, exchange failures, and competitive threats from newer projects. This proven track record provides confidence that Bitcoin will continue playing a central role in the cryptocurrency ecosystem. The halving event that occurred in 2024 reduced Bitcoin’s inflation rate further, reinforcing its scarcity characteristics that underpin its value proposition.

Institutional adoption of Bitcoin has reached critical mass, with major corporations holding significant quantities on their balance sheets and investment funds offering Bitcoin exposure to traditional investors. This institutional embrace provides price stability and legitimacy that were absent in earlier cycles. The development of Bitcoin’s Lightning Network has addressed scalability concerns, enabling faster and cheaper transactions while maintaining the security of the main blockchain.

Bitcoin’s simplicity represents both strength and limitation. While it lacks the smart contract functionality of newer platforms, this focused design has proven secure and reliable. For investors seeking exposure to cryptocurrency with minimal complexity, Bitcoin remains the foundational holding. Its position as the gateway cryptocurrency means that Bitcoin’s performance often influences the broader market, making it an essential component of any crypto portfolio strategy.

Ethereum: The Smart Contract Platform Powering Web3

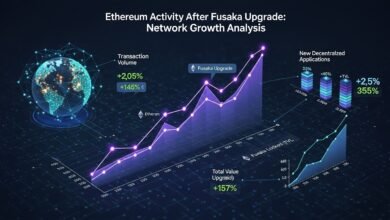

Ethereum has solidified its position as the leading smart contract platform, serving as the infrastructure layer for decentralized applications, non-fungible tokens, and decentralized finance protocols. The network’s successful transition to proof-of-stake consensus through “The Merge” dramatically reduced energy consumption while improving scalability and security. This technological evolution demonstrates Ethereum’s capacity for adaptation and positions it favorably among the best cryptocurrencies to invest in 2026.

The Ethereum ecosystem hosts the vast majority of decentralized finance activity, with hundreds of billions of dollars locked in various protocols built on the platform. This network effect creates substantial value for Ethereum as the native token required for transaction fees and smart contract execution. Developers continue choosing Ethereum for new projects due to its established infrastructure, extensive documentation, and large community of builders.

Layer-two scaling solutions have addressed Ethereum’s historical congestion issues, enabling dramatically higher transaction throughput at reduced costs. These solutions maintain Ethereum’s security guarantees while providing performance characteristics competitive with centralized systems. The combination of layer-one security and layer-two scalability positions Ethereum as the foundation for Web3 applications.

Ethereum’s roadmap includes continued improvements to scalability, security, and user experience. The upcoming proto-danksharding upgrade will further reduce transaction costs and increase throughput. Ethereum’s deflationary tokenomics, implemented through transaction fee burning, create interesting supply dynamics that could support price appreciation. For investors believing in the decentralized internet vision, Ethereum represents core infrastructure exposure.

Solana: High-Performance Blockchain for Mass Adoption

Solana has emerged as a compelling alternative to Ethereum, offering dramatically higher transaction speeds and lower costs through its innovative proof-of-history consensus mechanism. The network can theoretically process thousands of transactions per second, positioning it ideally for applications requiring high throughput. This performance advantage has attracted developers building consumer-facing applications where user experience depends on fast, inexpensive transactions.

The Solana ecosystem has recovered impressively from challenges faced during previous market downturns, demonstrating resilience and community commitment. Developer activity has surged, with numerous projects choosing Solana for decentralized applications spanning gaming, social media, and financial services. The network’s mobile strategy, including hardware wallets designed for mainstream consumers, differentiates its approach from competitors.

Solana’s focus on composability allows different applications to interact seamlessly, creating network effects that benefit the entire ecosystem. This architectural decision facilitates innovation by enabling developers to build upon existing protocols rather than starting from scratch. The growing number of validators securing the network enhances decentralization, addressing early criticisms about concentration.

Transaction costs on Solana remain negligible compared to competing platforms, making it economically viable for applications that would be prohibitively expensive elsewhere. This cost advantage has particular relevance for gaming and social applications where users generate numerous transactions. For investors seeking exposure to a high-performance blockchain investment, Solana offers compelling risk-reward characteristics.

Cardano: Research-Driven Approach to Blockchain Development

Cardano distinguishes itself through rigorous academic research and peer-reviewed development methodology. The project prioritizes correctness and security over speed to market, resulting in a platform built on formal verification and scientific principles. This methodical approach appeals to investors valuing thoroughness and long-term sustainability over rapid iteration.

The Cardano blockchain utilizes a unique proof-of-stake consensus mechanism called Ouroboros, which has been mathematically proven secure. This academic foundation provides confidence in the network’s security properties and energy efficiency. Cardano’s layered architecture separates settlement and computation, enabling flexibility and upgradability that monolithic designs lack.

Smart contract functionality on Cardano continues expanding, with an increasing number of decentralized applications launching on the platform. The ecosystem has developed its own identity, attracting developers who appreciate the emphasis on security and formal methods. Cardano’s strong presence in developing nations, particularly Africa, positions it uniquely for global adoption as these regions embrace digital financial services.

The Cardano treasury system enables sustainable funding for ecosystem development through community governance. This mechanism ensures ongoing resources for improvements and innovations without relying on centralized entities. Cardano’s measured approach may result in slower development compared to competitors, but the focus on correctness could prove advantageous as the industry matures and security becomes paramount.

Polkadot: Enabling Blockchain Interoperability

Polkadot addresses a fundamental challenge in the cryptocurrency space through its focus on interoperability between different blockchains. The project’s innovative architecture allows multiple specialized blockchains to communicate and share security through the central relay chain. This design enables developers to create purpose-built blockchains optimized for specific use cases while maintaining connectivity to the broader ecosystem.

The parachain auction mechanism creates interesting economic dynamics, with projects competing for slots on the Polkadot network by locking substantial token quantities. This system ensures only serious projects with community support secure positions, maintaining quality standards. Successful parachain projects often experience significant attention and adoption, benefiting from Polkadot’s shared security model.

Polkadot’s governance system empowers token holders to direct network evolution through on-chain voting. This democratic approach to upgrades and parameter changes enables the network to adapt to changing requirements without contentious hard forks. The treasury system funds development and ecosystem growth through inflation, ensuring sustainable long-term progress.

The vision of a multi-chain future where different blockchains specialize in specific functions rather than competing head-to-head aligns with Polkadot’s architecture. As the cryptocurrency ecosystem matures, interoperability will likely become increasingly important, positioning Polkadot strategically among the top crypto investments of 2026. The project’s technical sophistication and experienced team, led by Ethereum co-founder Gavin Wood, provides credibility and execution capability.

Avalanche: Scalable Platform for Decentralized Applications

Avalanche has established itself as a high-performance platform combining scalability with security through its innovative consensus protocol. The network achieves sub-second transaction finality while maintaining decentralization, addressing the traditional blockchain trilemma more effectively than many competitors. This performance enables applications requiring immediate confirmation, expanding cryptocurrency’s practical use cases.

The subnet architecture allows developers to create customized blockchains with specific rules and validator sets while maintaining connectivity to the main network. This flexibility enables compliance with regulatory requirements or implementation of specialized features without compromising the broader ecosystem. Financial institutions have shown particular interest in Avalanche’s subnet capability for creating permissioned networks that interact with public blockchains.

Avalanche’s Ethereum compatibility through the C-Chain has facilitated ecosystem growth by enabling developers to deploy existing Ethereum applications with minimal modifications. This compatibility reduces barriers to entry and has resulted in rapid expansion of the Avalanche ecosystem. Native projects have also flourished, creating a diverse application landscape spanning decentralized finance, gaming, and enterprise solutions.

The AVAX token serves multiple purposes within the ecosystem, including staking for network security, paying transaction fees, and participating in governance decisions. The token’s deflationary mechanism through fee burning creates supply dynamics that could support long-term value appreciation. For investors seeking exposure to a platform balancing performance with decentralization, Avalanche presents compelling characteristics among blockchain investments.

Chainlink: Connecting Smart Contracts to Real-World Data

Chainlink occupies a unique position in the cryptocurrency ecosystem by solving the oracle problem, enabling smart contracts to interact with external data sources reliably. This functionality is essential for numerous blockchain applications requiring real-world information, from decentralized finance protocols needing price feeds to insurance contracts requiring weather data. Chainlink’s dominance in the oracle market creates a defensible moat around its value proposition.

The network’s decentralized architecture ensures data reliability through multiple independent nodes providing information that gets aggregated to produce trustworthy results. This design prevents single points of failure and maintains the security properties that make blockchain technology valuable. Chainlink’s reputation system and staking mechanisms incentivize honest behavior from node operators, aligning economic incentives with network security.

Chainlink has expanded beyond basic price feeds to enable more sophisticated functionality including verifiable randomness, automation services, and cross-chain communication. These additional capabilities position Chainlink as infrastructure for increasingly complex blockchain applications. The Cross-Chain Interoperability Protocol represents Chainlink’s vision for connecting different blockchain networks, potentially capturing significant value as the multi-chain ecosystem develops.

Major enterprises and blockchain projects have integrated Chainlink’s services, demonstrating real-world adoption and utility. This widespread implementation creates network effects where new projects default to Chainlink due to its established presence and reliability. The LINK token’s role in incentivizing node operators and securing the network creates sustainable demand dynamics that support long-term value.

Polygon: Scaling Ethereum for Mainstream Adoption

Polygon has positioned itself as the leading Ethereum scaling solution, providing faster and cheaper transactions while maintaining security through the main Ethereum network. The platform’s success in attracting major brands and applications demonstrates its practical utility for real-world use cases. Companies seeking blockchain integration often choose Polygon due to its combination of performance, security, and Ethereum compatibility.

The Polygon ecosystem encompasses multiple scaling solutions including sidechains, rollups, and validiums, giving developers flexibility in choosing appropriate trade-offs between decentralization, security, and performance. This multi-pronged approach addresses different use cases more effectively than a single scaling solution. The zkEVM rollup represents Polygon’s most advanced scaling technology, combining zero-knowledge proofs with Ethereum virtual machine compatibility.

Polygon’s aggressive business development efforts have secured partnerships with major corporations spanning various industries. These enterprise relationships provide legitimacy and demonstrate blockchain’s practical applications beyond speculative trading. The network’s low transaction costs make it economically viable for consumer applications where users might generate numerous transactions.

The MATIC token serves multiple functions, including paying transaction fees, participating in network security through staking, and governance. Polygon’s recent rebranding and expanded vision encompassing multiple scaling technologies position it as infrastructure for Web3 rather than a single-purpose scaling solution. For investors believing in Ethereum’s long-term success, Polygon provides leveraged exposure to that thesis through its complementary role.

VeChain: Enterprise Blockchain for Supply Chain Management

VeChain focuses on solving real-world business problems through blockchain technology, particularly in supply chain management and product authentication. This practical orientation differentiates VeChain from primarily speculative projects, as the platform generates revenue from enterprise clients seeking improved operational efficiency and transparency. The track record of working with major corporations demonstrates VeChain’s ability to deliver tangible business value.

The dual-token system separates value storage from transaction costs, creating stability for businesses planning long-term blockchain implementations. This design addresses a significant concern for enterprises hesitant to adopt cryptocurrency due to price volatility. VeChain’s focus on sustainability and environmental tracking aligns with growing corporate emphasis on environmental, social, and governance factors.

VeChain’s partnerships span multiple industries including luxury goods, food safety, logistics, and automotive manufacturing. These diverse implementations demonstrate the technology’s versatility and practical applicability across sectors. The network’s proof-of-authority consensus mechanism prioritizes transaction speed and energy efficiency over maximal decentralization, reflecting its enterprise focus.

The VeChain ecosystem includes tools and services specifically designed for business users, lowering barriers to blockchain adoption. This enterprise-friendly approach positions VeChain advantageously as corporations increasingly explore blockchain solutions. For investors seeking exposure to practical blockchain applications with clear business models, VeChain presents interesting characteristics among cryptocurrency market trends.

Cosmos: The Internet of Blockchains

Cosmos enables blockchain interoperability through its Inter-Blockchain Communication protocol, allowing different networks to exchange information and value seamlessly. This vision of connected blockchains working together rather than competing in isolation addresses fundamental ecosystem fragmentation. The Cosmos SDK provides developers with tools to create customized blockchains quickly, reducing development time and costs significantly.

The hub-and-zone architecture allows independent blockchains to maintain sovereignty while benefiting from connection to the broader Cosmos network. This design balances autonomy with interoperability more effectively than systems requiring all activity on a single chain. Major projects have built on Cosmos technology, validating the approach and creating network effects that benefit the ecosystem.

Cosmos’s focus on user sovereignty and blockchain independence appeals to projects wanting control over their networks while maintaining connectivity. The modular design philosophy enables customization and optimization for specific use cases rather than forcing compromise through one-size-fits-all architecture. This flexibility has attracted diverse projects ranging from decentralized finance platforms to application-specific blockchains.

The ATOM token’s role in the Cosmos ecosystem continues evolving through governance decisions. Recent proposals have enhanced ATOM’s utility through interchain security and liquid staking features. As the multi-chain vision becomes reality, Cosmos’s infrastructure position could capture substantial value from facilitating communication and transactions across blockchains.

Building a Balanced Cryptocurrency Portfolio

Constructing a resilient cryptocurrency portfolio requires balancing various factors including risk tolerance, investment timeline, and market exposure preferences. Diversification across different cryptocurrency categories reduces risk while maintaining upside potential. A typical balanced approach includes allocation to established assets like Bitcoin and Ethereum as foundational holdings, complemented by smaller positions in promising alternative cryptocurrencies.

Risk management becomes crucial when investing in cryptocurrency due to the asset class’s inherent volatility. Position sizing should reflect individual risk tolerance, with highly speculative investments limited to amounts that won’t materially impact financial wellbeing if lost entirely. Dollar-cost averaging, where investors purchase fixed amounts at regular intervals regardless of price, helps mitigate timing risk and removes emotion from investment decisions.

Regular portfolio rebalancing maintains desired allocation percentages as different assets appreciate or decline at varying rates. This disciplined approach forces selling winners and buying losers, which often feels counterintuitive but maintains risk parameters and can improve returns over time. Tax considerations should inform rebalancing decisions, particularly regarding short-term versus long-term capital gains treatment.

Security practices must prioritize protecting cryptocurrency holdings from theft or loss. Hardware wallets provide superior security compared to exchange custody, though they require users to manage private keys responsibly. Diversifying storage solutions and maintaining backups of recovery phrases prevents catastrophic loss. Understanding the specific security model of each cryptocurrency helps inform appropriate storage decisions.

How to Buy Cryptocurrencies Safely in 2026

Purchasing cryptocurrency has become significantly more accessible through regulated exchanges offering user-friendly interfaces and various payment methods. Selecting reputable exchanges with strong security records and regulatory compliance reduces counterparty risk substantially. Major exchanges provide insurance protection for customer deposits, adding another layer of security against platform failures.

The verification process required by regulated exchanges, while sometimes cumbersome, protects both users and platforms from fraud and illegal activity. Completing identity verification enables higher transaction limits and access to additional features. Understanding fee structures across different exchanges helps minimize transaction costs that can erode returns over time.

Payment methods vary in speed, cost, and convenience, with bank transfers typically offering lower fees but slower settlement compared to credit cards or cryptocurrency deposits. Some exchanges offer rewards or reduced fees for using specific payment methods or holding platform tokens. Comparing options across multiple exchanges ensures optimal pricing and service quality.

Security practices extend beyond exchange selection to account protection. Enabling two-factor authentication using authenticator applications rather than SMS messages provides stronger security against account takeovers. Unique, complex passwords stored in password managers prevent credential reuse vulnerabilities. Regularly reviewing account activity and immediately reporting suspicious transactions helps identify problems quickly.

Conclusion

The cryptocurrency market in 2026 offers unprecedented opportunities for investors willing to conduct thorough research and maintain disciplined investment practices. The best cryptocurrencies to invest in 2026 combine strong fundamentals, real-world utility, experienced development teams, and favorable market positioning. While no investment carries guaranteed returns, the projects highlighted in this guide represent thoroughly vetted options with compelling value propositions.

Success in cryptocurrency investment requires ongoing education as the technology and regulatory environment continue evolving rapidly. Staying informed about developments affecting your holdings enables timely adjustments to investment theses when circumstances change. Community engagement through forums, social media, and project-specific channels provides valuable insights into ecosystem health and development progress.

The long-term potential of blockchain technology extends far beyond speculation, with cryptocurrency representing ownership stakes in networks reshaping how humanity coordinates economic activity. Approaching cryptocurrency as a long-term investment rather than a get-rich-quick scheme aligns expectations with realistic outcomes and reduces stress from short-term volatility. Patient investors who maintain conviction through market cycles often achieve the most favorable results.

Now is an excellent time to begin building your cryptocurrency portfolio using the insights and strategies outlined in this comprehensive crypto buying guide. Start with small positions in established cryptocurrencies while continuing your education, gradually expanding exposure as confidence and knowledge grow. The future of finance is being built on blockchain technology, and strategic investors positioning themselves today will likely benefit as mainstream adoption continues accelerating throughout 2026 and beyond.

See more: JPMorgan Bitcoin Price Bottom—$28.3 Trillion Gold Challenge 2026