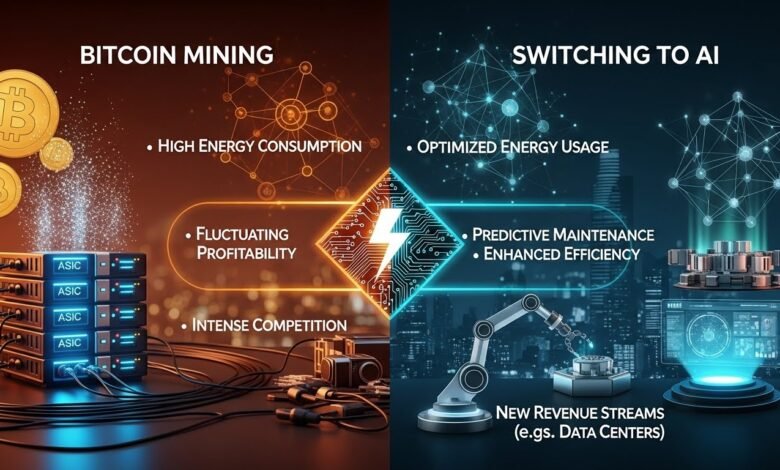

Bitcoin mining companies switching to AI operations becomes an increasingly common trend. Over the past two years, numerous mining enterprises have begun pivoting away from traditional cryptocurrency mining toward artificial intelligence computing infrastructure. This strategic shift isn’t just a minor adjustment—it represents a fundamental restructuring of how these companies utilize their computational resources, driven by economic pressures, technological opportunities, and the explosive growth in AI demand. As Bitcoin mining companies face mounting challenges from rising energy costs, declining block rewards, and increased competition, the lucrative AI sector offers a compelling alternative that leverages existing infrastructure while promising better profit margins.

The Economic Pressures Forcing Bitcoin Miners to Pivot

The financial landscape for Bitcoin mining companies has become increasingly challenging, creating the perfect storm that’s pushing many operators toward alternative revenue streams. Understanding these economic pressures is crucial to comprehending why this industry-wide shift is occurring.

Declining Mining Profitability and Block Reward Halvings

Bitcoin mining profitability has experienced significant downward pressure following the most recent halving event in April 2024. The halving mechanism, built into Bitcoin’s protocol, cuts the block reward in half approximately every four years. This latest halving reduced rewards from 6.25 BTC to 3.125 BTC per block, effectively slashing mining revenue by 50% overnight for operations that maintained the same hash rate.

For many cryptocurrency mining companies, this dramatic reduction in rewards created an immediate profitability crisis. Smaller operations with higher electricity costs found themselves operating at break-even or even at a loss. Even well-capitalized mining companies saw their margins compress substantially, forcing management teams to explore alternative uses for their expensive computational infrastructure.

The mathematics are straightforward but unforgiving. When Bitcoin prices don’t double following a halving event, miners earn significantly less for the same amount of computational work and energy expenditure. Historical data shows that while Bitcoin prices eventually trend upward after halvings, the immediate period often creates severe financial stress for mining operations.

Soaring Energy Costs and Environmental Concerns

Energy expenses represent the largest operational cost for Bitcoin mining operations, typically accounting for 60-80% of total operating expenses. As global energy prices have fluctuated and in many regions increased substantially, the cost-benefit equation for cryptocurrency mining has deteriorated.

Bitcoin mining companies operating in regions without access to cheap, renewable energy sources have been particularly affected. The average industrial electricity rate in many jurisdictions has risen significantly, compressing profit margins to unsustainable levels. Meanwhile, mining difficulty continues to increase as more hash power joins the network, requiring more energy to mine the same amount of Bitcoin.

Environmental concerns have also intensified regulatory pressure on cryptocurrency mining. Several jurisdictions have implemented restrictions or outright bans on energy-intensive mining operations. This regulatory uncertainty adds another layer of risk that makes the mining business less attractive compared to alternative uses of computing infrastructure.

Increased Network Difficulty and Competition

As more miners join the Bitcoin network and deploy increasingly efficient ASIC hardware, the network difficulty adjusts upward to maintain the approximate 10-minute block time. This self-regulating mechanism means that Bitcoin mining companies must continually invest in newer, more efficient equipment just to maintain their competitive position.

The result is a technological arms race that requires substantial ongoing capital investment. Companies that can’t keep pace find their older equipment becoming obsolete, generating less revenue while consuming the same amount of energy. This creates a profitability death spiral that forces difficult decisions about whether to invest more capital into mining or explore alternative business models.

The AI Boom: A Lucrative Alternative for Mining Infrastructure

While Bitcoin mining faces headwinds, artificial intelligence computing has emerged as one of the fastest-growing sectors in technology. The infrastructure requirements for AI workloads share surprising similarities with cryptocurrency mining, making the pivot strategically attractive for mining companies.

Growing Demand for AI Computing Resources

The explosion in generative AI applications, large language models, and machine learning workloads has created unprecedented demand for computational resources. Companies developing AI models require massive amounts of GPU computing power for training and inference operations. This demand far exceeds current supply, creating a seller’s market for anyone who can provide reliable, scalable computing infrastructure.

Bitcoin mining companies switching to AI are positioning themselves to capture this demand. The same facilities that once housed rows of cryptocurrency mining equipment can be repurposed to host GPU servers for AI workloads. Major technology companies, AI startups, and research institutions are actively seeking partnerships with entities that can provide the computing infrastructure needed for their AI ambitions.

The financial incentives are compelling. AI computing contracts often provide more stable and predictable revenue streams compared to the volatility inherent in cryptocurrency mining. Rather than depending on Bitcoin price fluctuations and mining difficulty adjustments, companies can negotiate fixed-price contracts with AI customers that guarantee revenue for extended periods.

Infrastructure Compatibility and Conversion Advantages

One of the key factors making Bitcoin mining companies switching to AI feasible is the surprising overlap in infrastructure requirements. Both operations require:

Robust electrical infrastructure capable of handling massive power loads consistently. Mining facilities already have industrial-grade electrical systems, backup power, and relationships with utility providers that can support AI computing operations.

Advanced cooling systems to dissipate the enormous heat generated by computational equipment. The cooling infrastructure designed for mining operations translates almost directly to AI data center requirements.

Network connectivity with high bandwidth and low latency. Mining operations typically have excellent internet connectivity that serves AI workloads equally well.

Physical security and environmental controls to protect expensive computing equipment. The same security measures that protected cryptocurrency mining equipment work for GPU servers.

This infrastructure compatibility means Bitcoin mining companies can pivot to AI without starting from scratch. The conversion process, while still requiring significant investment, is far less capital-intensive than building AI computing facilities from the ground up.

Higher Profit Margins in AI Computing Services

Perhaps the most compelling reason for Bitcoin mining companies switching to AI is the superior profit margins available in the AI computing sector. Industry analysis suggests that GPU computing for AI workloads can generate 2-3 times the revenue per kilowatt-hour compared to Bitcoin mining, particularly at current Bitcoin prices and network difficulty levels.

Cryptocurrency mining companies that have made the transition report EBITDA margins that exceed their previous mining operations by substantial percentages. The more stable revenue, combined with the ability to charge premium rates for scarce GPU computing resources, creates a business model that’s more attractive to investors and lenders.

Additionally, AI computing contracts often include provisions for capacity expansion, allowing mining companies to grow their operations with committed revenue backing those investments. This stands in stark contrast to cryptocurrency mining, where expanding capacity means competing against an ever-growing global hash rate with no guarantee of proportional revenue increases.

Real-World Examples: Mining Companies Making the Switch

The transition of Bitcoin mining companies switching to AI isn’t theoretical—numerous high-profile examples demonstrate how this strategy is being implemented across the industry.

Core Scientific’s Strategic Transformation

Core Scientific, once one of the largest Bitcoin mining companies in North America, has become a poster child for the mining-to-AI pivot. After emerging from bankruptcy restructuring, the company announced major partnerships with AI companies to repurpose significant portions of its infrastructure.

The company committed approximately 70 megawatts of its power capacity to AI cloud computing contracts, representing a substantial portion of its total infrastructure. This strategic move allowed Core Scientific to diversify revenue streams while maintaining its core mining operations at reduced scale.

Financial results following this transition showed the wisdom of the strategy. The AI computing contracts provided stable, predictable revenue that helped the company rebuild investor confidence after its bankruptcy. Core Scientific’s stock price responded positively to announcements of AI partnerships, demonstrating how the market values this diversification strategy.

Hut 8’s Hybrid Approach to Mining and AI

Hut 8, a prominent cryptocurrency mining company, adopted a hybrid strategy that balances traditional Bitcoin mining with AI computing services. Rather than completely abandoning mining, the company positioned itself to capitalize on both opportunities depending on market conditions.

This flexible approach allows Hut 8 to shift resources between Bitcoin mining and AI computing based on which activity offers superior returns at any given time. During periods of favorable mining economics, the company can prioritize cryptocurrency production. When AI computing offers better margins, resources flow in that direction.

The company has specifically emphasized “high-performance computing” services that serve both AI and other computational needs. This positioning appeals to a broader customer base while leveraging the same infrastructure investments. Hut 8’s management has publicly stated that this diversification strategy reduces business risk and creates multiple paths to profitability.

Hive Digital Technologies’ Data Center Evolution

Hive Digital Technologies represents another case study in how Bitcoin mining companies can evolve their business models. The company rebranded elements of its operations to emphasize data center services alongside cryptocurrency mining.

Hive invested significantly in GPU infrastructure that can serve AI workloads, machine learning applications, and rendering services. This diversification allows the company to market its computing capacity to customers beyond the cryptocurrency sector, opening new revenue opportunities.

The strategic vision articulated by Hive Digital Technologies focuses on becoming a diversified computing infrastructure provider rather than purely a mining company. This positioning helps attract investment capital and customer interest from the rapidly growing AI sector while maintaining optionality to pursue mining when conditions are favorable.

Technical Considerations: From ASIC to GPU Computing

The transition of Bitcoin mining companies switching to AI involves significant technical considerations, particularly around the types of computing hardware required for different workloads.

ASIC Mining Hardware Limitations

Bitcoin mining predominantly uses Application-Specific Integrated Circuits (ASICs), which are chips designed exclusively for calculating SHA-256 hashes as quickly and efficiently as possible. These devices excel at cryptocurrency mining but cannot be repurposed for AI computing or general-purpose applications.

This hardware specificity creates a challenge for mining companies looking to pivot. ASIC equipment represents substantial capital investment that becomes stranded assets if the company exits mining entirely. The secondary market for used mining equipment exists but typically recovers only a fraction of the original purchase price, especially for older generation equipment.

Some cryptocurrency mining companies have addressed this by maintaining ASIC operations at reduced scale while investing new capital into GPU infrastructure for AI workloads. This approach preserves the option value of mining equipment while building new revenue streams.

GPU Infrastructure for AI Workloads

Artificial intelligence computing, particularly for training large models, relies heavily on Graphics Processing Units (GPUs). Unlike ASICs, GPUs are versatile processors capable of handling the parallel computing tasks required for machine learning, neural network training, and inference operations.

Bitcoin mining companies switching to AI must invest in GPU infrastructure to serve this market. High-end GPUs from manufacturers like NVIDIA, particularly the H100 and A100 series designed for AI applications, command premium prices due to strong demand and limited supply.

The capital requirement for GPU deployment is substantial, but mining companies benefit from having the supporting infrastructure already in place. The electrical systems, cooling capacity, facility space, and operational expertise required to run GPU clusters overlap significantly with mining operations.

Power and Cooling Requirements Comparison

Both Bitcoin mining and AI computing are power-intensive operations, but the specific requirements differ in important ways. ASIC miners typically operate at constant full power, generating consistent heat output that facilities can design around.

GPU clusters for AI workloads may have more variable power consumption depending on the specific computational tasks being performed. However, peak power requirements for high-end AI GPUs can be substantial, often matching or exceeding the power density of mining operations.

Mining companies with robust power and cooling infrastructure find these systems readily adaptable to GPU computing. The main technical challenge involves reconfiguring power distribution and cooling systems to match the specific requirements of GPU racks, which may have different form factors and heat dissipation patterns than mining hardware.

Challenges and Risks in the Mining-to-AI Transition

While Bitcoin mining companies switching to AI pursue attractive opportunities, the transition involves significant challenges and risks that must be carefully managed.

Capital Investment Requirements

Converting mining facilities to AI computing infrastructure requires substantial capital investment. High-performance GPUs suitable for AI workloads cost tens of thousands of dollars per unit, and building meaningful computing capacity requires hundreds or thousands of GPUs.

For Bitcoin mining companies that may have limited capital after years of challenging mining economics, securing funding for this transition can be difficult. Traditional lenders may be hesitant to finance cryptocurrency-adjacent businesses, even when those businesses are pivoting toward more conventional computing services.

Some mining companies have addressed this through partnerships with AI companies or technology investors who provide capital in exchange for long-term computing capacity commitments. Others have pursued equipment financing or sale-leaseback arrangements to fund GPU purchases while preserving working capital.

Competition from Traditional Data Center Operators

Bitcoin mining companies entering the AI computing market face competition from established data center operators with decades of experience serving enterprise customers. These traditional competitors often have advantages in geographic reach, customer relationships, regulatory compliance, and operational track records.

The cryptocurrency mining industry’s reputation, which includes past bankruptcies and volatility, can be a liability when courting risk-averse AI customers. Mining companies must work to establish credibility and demonstrate that their infrastructure and operational capabilities meet enterprise standards.

Some mining operations have addressed this by partnering with established data center operators or white-labeling their services through established brands. Others focus on differentiating through price, location advantages, or rapid deployment capabilities that traditional providers may struggle to match.

Market Timing and AI Demand Sustainability

The current surge in AI computing demand is undeniable, but questions remain about long-term sustainability. Bitcoin mining companies switching to AI must consider whether current high prices and strong demand will persist or if market saturation and technology advances could reduce profitability.

Advances in AI hardware efficiency, new entrants bringing additional GPU capacity online, and potential slowdowns in AI development could all impact the economics of AI computing services. Mining companies making this transition must ensure they’re not simply jumping from one boom-bust cycle to another.

Diversification and flexible infrastructure that can potentially serve multiple computing workloads may provide the best risk mitigation. Cryptocurrency mining companies with the ability to pivot between different revenue opportunities based on market conditions will likely have the best long-term survival prospects.

The Future Landscape: What This Means for Cryptocurrency Mining

The trend of Bitcoin mining companies switching to AI has significant implications for the broader cryptocurrency mining industry and the Bitcoin network itself.

Consolidation in the Mining Industry

As smaller and mid-sized mining companies struggle with profitability challenges, industry consolidation appears inevitable. Well-capitalized operations with access to the cheapest energy sources will continue mining profitably, while marginal operators exit or pivot to alternative business models.

This consolidation could result in greater centralization of Bitcoin’s hash rate among fewer, larger operators. While this doesn’t necessarily threaten Bitcoin’s security model, it does represent a shift from the originally envisioned decentralization. Geographic concentration in regions with favorable energy costs and regulatory environments may also increase.

The mining companies that survive and thrive will likely be those that either achieved the lowest possible operating costs or successfully diversified into AI computing and other high-performance computing services.

Impact on Bitcoin Network Hash Rate and Security

When significant mining operations redirect resources to AI computing, the Bitcoin network’s total hash rate could potentially decline. However, Bitcoin’s difficulty adjustment mechanism ensures the network continues functioning regardless of hash rate changes, adjusting difficulty every 2,016 blocks to maintain approximately 10-minute block times.

A declining hash rate would reduce the total computational power securing the Bitcoin network, theoretically making it less costly to attempt a 51% attack. However, the economic incentives against such attacks remain strong, and the Bitcoin network would need to see dramatic hash rate declines before security became a serious concern.

More likely, the exit of marginal miners improves profitability for remaining operators, potentially attracting new entrants or encouraging existing mining companies to expand operations when conditions become favorable again.

Potential for Hybrid Business Models

The most successful Bitcoin mining companies going forward may be those that adopt flexible, hybrid approaches rather than completely abandoning cryptocurrency mining. The ability to dynamically allocate computing resources between mining and AI workloads based on relative profitability could provide competitive advantages.

Such hybrid models allow mining operations to capitalize on favorable periods in either market while maintaining expertise and infrastructure for both. When Bitcoin prices surge or network difficulty drops, resources can flow toward mining. When AI computing offers superior returns, GPU capacity serves that demand.

This flexibility requires investment in diverse computing infrastructure and operational expertise across both domains, but it also provides insurance against volatility in either market individually.

Strategic Recommendations for Mining Companies Considering the Pivot

For Bitcoin mining companies evaluating whether to pursue AI computing opportunities, several strategic considerations should guide decision-making.

Assess Your Infrastructure Compatibility

Not all mining facilities are equally suited for conversion to AI data centers. Mining companies should conduct thorough assessments of their existing infrastructure focusing on power capacity, cooling systems, network connectivity, and facility certifications.

Locations with stranded or curtailed energy capacity that made sense for Bitcoin mining may not be suitable for AI customers who require guaranteed uptime and connectivity to major internet exchange points. Geographic isolation that was acceptable for mining operations may be a liability when serving latency-sensitive AI workloads.

Facilities located in regions with strong data protection laws, reliable power grids, and good connectivity to major population centers will have the easiest path to serving AI customers.

Evaluate Market Timing and Capital Availability

Bitcoin mining companies considering the transition must carefully evaluate market timing. While AI computing demand is currently strong, the capital required for conversion is substantial. Companies should assess their ability to secure financing, the expected return on investment, and the timeline to profitability.

Rushing into AI computing without adequate capital or during a potential market peak could prove as disastrous as continuing unprofitable mining operations. Conversely, waiting too long could mean missing the opportunity as more competitors enter the market and margins compress.

Consider Partnership Opportunities

Rather than going it alone, mining companies might explore partnerships with established AI firms, data center operators, or technology investors. Such partnerships can provide capital, customer relationships, technical expertise, and operational credibility that mining companies may lack.

Strategic partnerships can take various forms, including capacity purchase agreements, joint ventures, white-label arrangements, or equity investments. The right partnership structure depends on the mining company’s specific circumstances, goals, and negotiating position.

Conclusion

The phenomenon of Bitcoin mining companies switching to AI represents more than just a business pivot—it signals a fundamental evolution in how computing infrastructure is deployed and monetized. As the economics of cryptocurrency mining become increasingly challenging, forward-thinking operators are recognizing that their most valuable assets may not be their mining expertise but rather their power infrastructure, cooling systems, and facility operations.

The transition from Bitcoin mining to AI computing isn’t without risks, but for many companies, it offers the most viable path to profitability and long-term sustainability. The synergies between mining infrastructure and AI data center requirements create unique opportunities for repurposing existing assets while capturing the value in one of technology’s fastest-growing sectors.

For investors, industry observers, and mining companies themselves, this trend deserves careful attention. The companies that successfully navigate this transition may emerge as significant players in the AI infrastructure landscape, while those that resist adaptation risk becoming obsolete as mining economics continue to deteriorate.

See more;Crypto Mining Guide 2025 Beginner’s Manual for Cryptocurrency Mining Success