The Bitcoin Cash USD price recently dipped to around $538.76, catching the attention of traders, long-term holders, and curious newcomers to the crypto market. Whenever a major cryptocurrency like Bitcoin Cash (BCH) experiences a notable move, it raises important questions. Is this just another routine pullback in a volatile market, or is it a signal of a deeper trend shift? Are whales taking profits, or is broader macro uncertainty weighing on all risk assets?

Unlike quick social media hot takes, understanding the Bitcoin Cash USD price move requires a closer look at several layers: overall crypto market sentiment, macroeconomic conditions, Bitcoin’s performance, network fundamentals, and trader psychology. While BCH is often overshadowed by Bitcoin (BTC), it remains a highly liquid altcoin with strong name recognition and an active community. That means its price swings can offer insights into how investors are positioning themselves across the wider crypto landscape.

In this article, we will explore why the Bitcoin Cash USD price has dipped to $538.76, what this means in the context of recent market fluctuations, and how traders and investors can navigate this period of volatility. We will also examine the role of market sentiment, technical levels, on-chain activity, and macro headlines in shaping BCH’s short-term and long-term trajectory. By the end, you should have a more grounded view of where Bitcoin Cash stands today and what to watch next.

What Is Bitcoin Cash (BCH)?

Bitcoin Cash is a peer-to-peer digital currency that emerged in 2017 as a hard fork of Bitcoin. The split occurred due to disagreements within the community about how to scale the network and handle increasing transaction volumes. Bitcoin Cash increased the block size limit, allowing more transactions to be processed in each block and aiming for faster, cheaper payments compared to Bitcoin.

Bitcoin Cash is a peer-to-peer digital currency that emerged in 2017 as a hard fork of Bitcoin. The split occurred due to disagreements within the community about how to scale the network and handle increasing transaction volumes. Bitcoin Cash increased the block size limit, allowing more transactions to be processed in each block and aiming for faster, cheaper payments compared to Bitcoin.

Although BCH shares the original Bitcoin whitepaper’s vision of electronic cash, it has charted a separate path in terms of development and community. This means the Bitcoin Cash USD price is influenced by both its shared history with Bitcoin and its own unique fundamentals. When Bitcoin rallies or corrects sharply, BCH often follows, but it can also diverge based on news specific to its ecosystem, such as upgrades, adoption milestones, or changes in mining activity.

Why Bitcoin Cash Still Matters

Despite the rise of many other altcoins and Layer 2 solutions, Bitcoin Cash remains relevant for several reasons. First, it offers relatively low fees and quick settlement times, making it attractive for cross-border transfers and everyday payments in regions where traditional banking is expensive or unreliable. Second, BCH is listed on major exchanges and widely integrated into wallets, payment processors, and merchant tools, keeping its liquidity and accessibility high.

As a result, the Bitcoin Cash USD price is more than just a speculative number on a chart; it reflects ongoing debates about scalability, decentralization, and real-world use. This gives BCH a distinct narrative within the broader cryptocurrency market, which can amplify price movements when sentiment flips from fear to greed or vice versa.

Recent Market Fluctuations and the Drop to $538.76

The Bigger Picture: Crypto Volatility Returns

Cryptocurrencies are notorious for their volatility, and the recent dip in the Bitcoin Cash USD price to $538.76 fits squarely into that pattern. The broader market has been navigating a mix of bullish narratives and lingering uncertainties. On one side, there is optimism around institutional adoption, regulatory clarity in some regions, and the long-term potential of blockchain technology. On the other, traders are still cautious due to macroeconomic pressures such as interest rate policies, inflation concerns, and shifting risk appetite.

In such an environment, even strong rallies are often followed by sharp pullbacks. When capital rotates out of riskier assets, altcoins like Bitcoin Cash can experience outsized declines compared to larger, more established coins. The BCH price dip is therefore partly a reflection of this natural risk-off behavior that periodically sweeps through the crypto space.

Local Pullback or Start of a Larger Correction?

When the Bitcoin Cash USD price slides to a level like $538.76 after previously trading higher, traders immediately wonder whether this is a healthy correction within an ongoing uptrend or the beginning of a more sustained downtrend. One way to think about this is to consider what preceded the drop. If BCH recently enjoyed a strong rally driven by speculative enthusiasm, then a retracement is not only common but arguably necessary to shake out weak hands.

On the other hand, if the price fall comes after a longer period of sideways movement or declining momentum, it can signal that buyers are losing strength and that sellers are starting to dominate. In either scenario, the $538.76 level becomes an interesting reference point: if buyers step in aggressively and defend that area, it may act as support; if the price slices through it with heavy volume, traders may look for lower levels to find a new equilibrium.

Key Factors Influencing the Bitcoin Cash USD Price

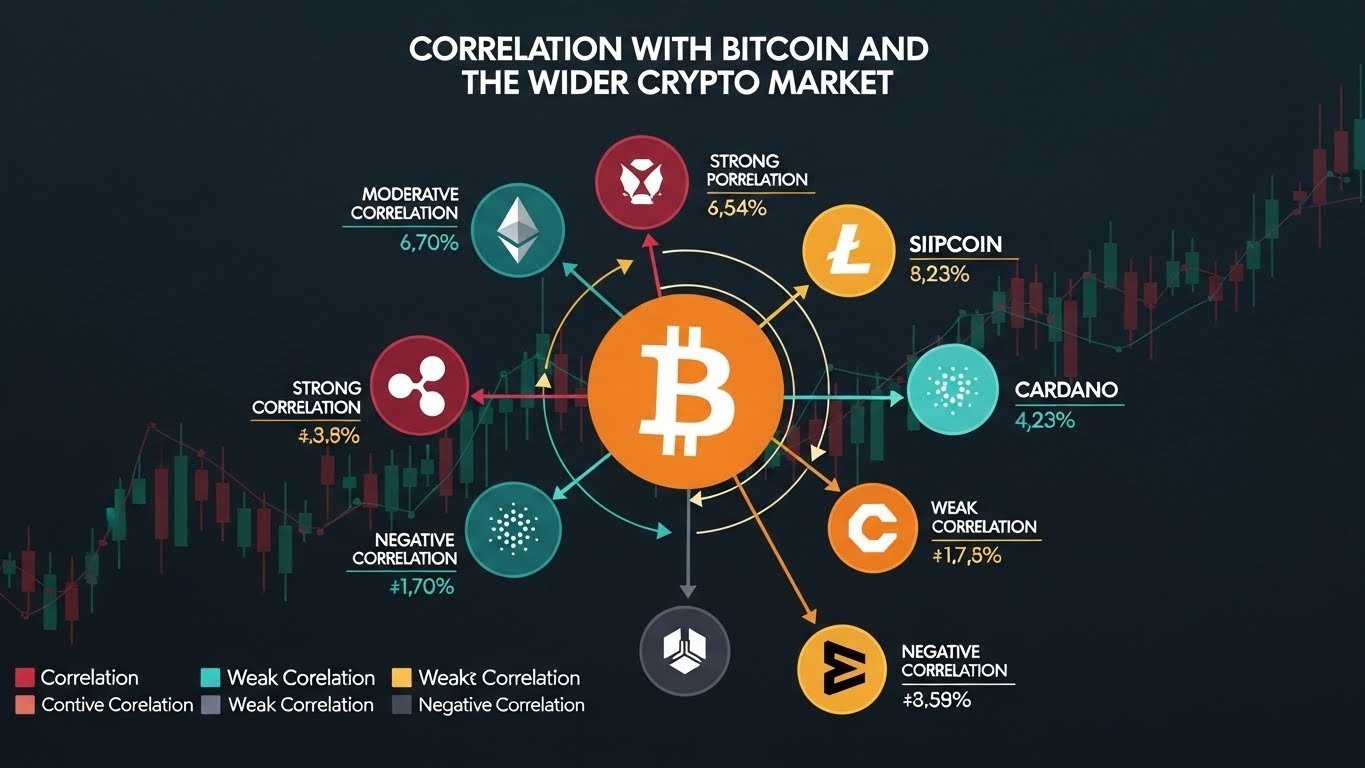

Correlation with Bitcoin and the Wider Crypto Market

No discussion of the Bitcoin Cash USD price is complete without referencing Bitcoin itself. Historically, BCH has shown a strong correlation with BTC, meaning that when Bitcoin moves up or down sharply, Bitcoin Cash often follows. This is partly due to shared investor bases and partly because many traders treat BCH as a high-beta play on broader crypto sentiment.

No discussion of the Bitcoin Cash USD price is complete without referencing Bitcoin itself. Historically, BCH has shown a strong correlation with BTC, meaning that when Bitcoin moves up or down sharply, Bitcoin Cash often follows. This is partly due to shared investor bases and partly because many traders treat BCH as a high-beta play on broader crypto sentiment.

During phases when Bitcoin experiences significant corrections or consolidations, capital often rotates into more stable assets or sits on the sidelines, leaving altcoins more vulnerable to declines. The move in Bitcoin Cash down to $538.76 can therefore be seen, at least in part, as a downstream effect of Bitcoin’s own ups and downs, as well as the mood across the entire digital asset market.

Macroeconomic Forces and Risk Sentiment

Beyond crypto-specific developments, global macro trends have a powerful impact on cryptocurrencies. When inflation expectations rise, some investors view assets like Bitcoin Cash as a hedge against fiat currency debasement, which can support prices. However, when central banks tighten monetary policy or when geopolitical tensions increase uncertainty, risk assets can suffer.

The recent dip in the Bitcoin Cash USD price suggests that broader risk sentiment may have cooled temporarily. If investors become more cautious, they may take profits from positions in volatile assets such as BCH, pushing prices down in the short term even if the long-term narrative remains intact.

Regulatory News and Market Confidence

Regulation is another crucial factor. Positive developments, like clearer guidelines around trading, custody, and taxation, can enhance investor confidence and support the Bitcoin Cash USD price. Conversely, negative headlines—such as crackdowns on exchanges or restrictive rules in major markets—can trigger sell-offs as traders anticipate reduced liquidity or increased compliance costs.

Even if a specific regulatory headline does not mention Bitcoin Cash by name, the spillover effect across the crypto ecosystem can be significant. When traders worry that stricter rules are coming, they often de-risk across multiple assets, including BCH.

Technical View: Support, Resistance, and Trading Levels

Why Traders Care About Levels Like $538.76

Technical analysis remains a popular tool for cryptocurrency traders. Numbers like $538.76 are not just random prices; they can line up with previous support and resistance zones, moving averages, or Fibonacci retracement levels that influence trader behavior. When the Bitcoin Cash USD price revisits such areas, it often sparks increased trading activity as bulls and bears battle for control.

If $538.76 corresponds with a region where BCH previously found buying interest, it might act as a support level where dip buyers re-enter the market. If it sits below recent support or within a zone where sellers historically dominated, traders may interpret the move as a sign of weakening strength, prompting them to wait for lower entries or tighter risk management.

Market Structure and Short-Term Volatility

Short-term market structure also matters. In highly leveraged environments, a burst of selling can trigger a cascade of liquidations on futures platforms, sending the Bitcoin Cash USD price sharply lower. Once that forced selling exhausts itself, prices can rebound quickly as natural buyers step back in and shorts take profits or close positions.

This dynamic is why BCH, like many other cryptocurrencies, often experiences sharp wicks on candlestick charts—brief plunges followed by rapid recoveries. For longer-term investors, this can be unnerving but also presents opportunities if they maintain a clear strategy and avoid reacting emotionally to every intraday swing.

Fundamental Drivers: Adoption, Network Health, and Utility

On-Chain Activity and Transaction Use

Fundamentals still matter, even in a market driven by sentiment and speculation. Over time, the Bitcoin Cash USD price is influenced by real usage of the network: how many transactions are happening, how active addresses are, and whether merchants and payment platforms are integrating BCH.

When on-chain activity grows, it signals increasing real-world utility, which can underpin higher valuations. If transaction counts, address growth, or merchant adoption stagnate, it becomes harder to justify sustained price appreciation, and investors may rotate into assets with stronger growth stories.

Mining, Security, and Network Upgrades

Bitcoin Cash relies on miners to secure the network, just like Bitcoin. Changes in hashrate, mining difficulty, or miner profitability can play into market sentiment. For example, if the BCH hashrate grows, it suggests a more secure network and potentially greater confidence among miners. If it falls sharply, some traders might worry about vulnerability to attacks or centralization.

Network upgrades and developer activity also play a role. Regular improvements, bug fixes, and protocol enhancements can signal a healthy, evolving ecosystem. Even if such developments are not immediately reflected in the Bitcoin Cash USD price, they can shape long-term investor confidence and set the stage for future growth phases.

Investor Psychology: Fear, Greed, and Narrative Shifts

The Emotional Side of Price Dips

Cryptocurrency markets are heavily influenced by investor psychology. When prices are rising, optimism and FOMO (fear of missing out) can push assets to valuations that exceed any reasonable fundamental metric. When the inevitable corrections arrive, the mood can flip to fear and panic just as quickly.

The dip of the Bitcoin Cash USD price to $538.76 may not fundamentally change the long-term story for BCH, but it can dramatically alter how traders feel in the moment. Some will view the drop as a signal to exit, fearing deeper losses. Others will see it as a buy-the-dip opportunity, convinced that BCH remains undervalued relative to its future potential.

Narrative Cycles and Market Stories

Crypto markets run on narratives: store of value, digital gold, cheap payments, smart contracts, DeFi, NFTs, and more. Bitcoin Cash has its own narrative centered on fast, low-cost transactions and the original vision of peer-to-peer electronic cash. When this narrative is actively promoted through news, partnerships, or community initiatives, it can boost demand and support the Bitcoin Cash USD price.

However, when attention shifts to other sectors—such as new Layer 1 chains, DeFi protocols, or AI-related tokens—BCH can temporarily fall out of the spotlight, leading to lower volumes and more pronounced reactions to negative events. Understanding these narrative cycles helps investors avoid overreacting to short-term fluctuations.

Strategies for Navigating Bitcoin Cash Price Volatility

For Short-Term Traders

Short-term traders focus on price action, volume, and technical indicators. For them, a move down to $538.76 presents both risk and opportunity. Some may look to enter long positions if they believe this level will hold as support, placing stop-loss orders just below to manage risk. Others may short rallies if they expect further downside, especially if broader market sentiment remains fragile.

In all cases, traders need a clear plan. Volatility can be both a friend and an enemy. Without disciplined risk management, even a correct thesis about the Bitcoin Cash USD price can lead to losses if positions are oversized or stops are not honored.

For Long-Term Investors

Long-term investors see volatility differently. Rather than focusing on every price tick, they consider whether the core thesis for Bitcoin Cash remains intact: a scalable, low-fee alternative for global payments with a recognizable brand and active community. If they believe in that thesis, dips such as the move to $538.76 may be viewed as accumulation opportunities.

These investors often use strategies like dollar-cost averaging (DCA), where they periodically add to their position regardless of short-term price swings. This can help smooth out volatility and avoid the stress of trying to perfectly time tops and bottoms.

Risk Management and Diversification

Regardless of time horizon, risk management is crucial. Crypto remains a high-risk asset class, and Bitcoin Cash is no exception. Allocating only a responsible portion of one’s portfolio to BCH and balancing it with other assets—whether other cryptocurrencies, stocks, or cash—can reduce the emotional pressure that comes with price dips.

The recent movement in the Bitcoin Cash USD price is a reminder that even established cryptocurrencies can experience sharp fluctuations. A well-thought-out investment plan, including clear entry and exit criteria and diversified holdings, can make these moves more manageable.

Outlook: What the Dip Means for Bitcoin Cash Going Forward

The decline of the Bitcoin Cash USD price to $538.76 should be seen as part of the ongoing story of a maturing yet still volatile market. BCH continues to operate as a functional payment-focused blockchain, with low fees and fast settlement. It remains interlinked with Bitcoin’s performance, sensitive to macroeconomic shifts, and influenced by regulatory news and narrative cycles.

In the near term, the key questions are whether buyers will step in around this level, whether broader crypto sentiment stabilizes, and whether any positive catalysts—such as increased merchant adoption, network upgrades, or improved regulatory clarity—emerge. Over the longer term, Bitcoin Cash’s success will depend on its ability to maintain relevance as a practical, usable form of digital cash in an increasingly crowded ecosystem.

For traders and investors, the most important takeaway is not to focus solely on a single price point, but to understand the context behind the move, the risks involved, and how BCH fits into their overall strategy.

Conclusion

The recent dip of the Bitcoin Cash USD price to $538.76 highlights once again how dynamic and emotionally charged the cryptocurrency market can be. Bitcoin Cash occupies a unique position as a high-profile fork of Bitcoin with a strong emphasis on real-world payments and scalability. Its price is shaped by a complex mix of factors: Bitcoin’s performance, macroeconomic conditions, regulatory developments, network health, and investor psychology.

While a single price level cannot define the long-term destiny of an asset, the move to $538.76 serves as a useful reminder that volatility is inherent to crypto investing. For some, it signals caution and the need for tighter risk controls. For others, it represents an opportunity to accumulate at a discount relative to recent highs.

Ultimately, successfully navigating the ups and downs of the Bitcoin Cash USD price requires a blend of informed analysis, disciplined strategy, and emotional resilience. By understanding the drivers behind price movements and aligning them with your own goals and risk tolerance, you can approach BCH and the broader crypto market with greater confidence, whether prices are surging or temporarily falling.

FAQs

Q. Why did the Bitcoin Cash USD price dip to $538.76?

The Bitcoin Cash USD price fell to around $538.76 due to a combination of factors, including broader market volatility, shifts in risk sentiment, and normal corrections following previous rallies. As with many cryptocurrencies, BCH is highly sensitive to changes in Bitcoin’s price, macroeconomic news, and trader positioning, which can all contribute to sharp short-term moves.

Q. Is the dip in Bitcoin Cash’s price a sign of a long-term downtrend?

A single dip does not automatically mean a long-term downtrend. It could be a healthy correction within an ongoing uptrend or a temporary reaction to negative news or macroeconomic uncertainty. To determine the bigger picture, investors typically look at longer-term charts, key support and resistance levels, and fundamental indicators such as on-chain activity and network development.

Q. How does Bitcoin’s performance affect the Bitcoin Cash USD price?

Bitcoin’s performance has a strong influence on the Bitcoin Cash USD price because market participants often view BCH as part of the broader Bitcoin ecosystem. When Bitcoin rallies, confidence and liquidity usually spill over into altcoins like BCH. When Bitcoin corrects sharply, risk appetite tends to decline across the board, and Bitcoin Cash often experiences similar or even larger percentage moves.

Q. Is Bitcoin Cash still useful for everyday payments?

Yes, Bitcoin Cash remains focused on being a fast, low-fee digital cash system. Its larger block size and relatively low transaction costs make it suitable for everyday payments and cross-border transfers, especially in regions where traditional banking systems are slow or expensive. Real-world adoption and merchant integration are important fundamental drivers that can support the Bitcoin Cash USD price over time.

Q. How should I manage risk when investing in Bitcoin Cash?

Risk management is essential when dealing with any cryptocurrency, including Bitcoin Cash. Common approaches include only investing money you can afford to lose, diversifying across different asset classes, using strategies like dollar-cost averaging, and setting clear entry, exit, and stop-loss levels. Understanding your own risk tolerance and staying informed about market conditions can help you navigate the volatility of the Bitcoin Cash USD price more effectively.

See more;Crypto 101 & $150K Bitcoin Essential Market Movers Guide