Bitcoin falls to its lowest level since Trump took office in January 2025. This dramatic downturn has sent shockwaves through the digital currency ecosystem, leaving investors scrambling to understand the forces behind this unprecedented decline. The leading cryptocurrency, which once promised to revolutionize global finance, has now retraced to price levels not seen since the early days of the Trump presidency. This Bitcoin price drop in 2026 represents more than just a market correction—it signals a fundamental shift in how institutional investors, regulatory bodies, and everyday traders perceive the future of decentralized finance. As we analyze this critical moment in cryptocurrency market history, understanding the confluence of factors that brought Bitcoin to this juncture becomes essential for anyone with skin in the digital asset game.

Current Bitcoin Price Collapse

The magnitude of this decline cannot be understated. When Bitcoin falls to lowest level Trump presidency, we’re talking about a retracement that has erased months of gains and shattered the confidence of many cryptocurrency enthusiasts who believed the asset class had finally achieved mainstream legitimacy. The current price action represents a stunning reversal from the optimism that characterized the early months of 2025, when many analysts predicted Bitcoin would reach new all-time highs under what was perceived as a crypto-friendly administration.

The cryptocurrency market decline in 2026 has been characterized by persistent selling pressure, evaporating liquidity, and a complete absence of the institutional buying that had previously provided a floor for prices. Technical analysts point to a breakdown of critical support levels that had held firm for over a year, suggesting that the current downturn may have further to run before finding a sustainable bottom. The psychological impact of seeing Bitcoin price drop 2026 to these levels has been profound, with social media sentiment turning decidedly bearish and fear indexes reaching levels comparable to previous bear market bottoms.

Market participants who entered positions during the euphoric rally of late 2024 and early 2025 now find themselves underwater, facing difficult decisions about whether to hold through the turbulence or cut losses. The velocity of this decline has caught many off guard, with some institutional funds reporting significant redemptions as investors seek to protect capital. This digital currency crash has reignited debates about Bitcoin’s true value proposition and whether the asset deserves a place in diversified investment portfolios.

Trump Administration Crypto Policy Impact

The relationship between Trump administration crypto policy and current market conditions is complex and multifaceted. When President Trump returned to office in January 2025, the cryptocurrency industry held high expectations for regulatory clarity and supportive policies that would enable digital assets to flourish. Campaign promises about making America the “crypto capital of the world” created immense optimism among investors and entrepreneurs alike. However, the reality of governance has proven far more nuanced than campaign rhetoric suggested.

While the administration initially took steps to replace key regulatory figures perceived as hostile to cryptocurrency innovation, the actual policy framework that emerged has been more measured than enthusiasts hoped. The Treasury Department’s approach to stablecoin regulation, while providing some clarity, also introduced compliance requirements that many smaller projects found difficult to meet. The Securities and Exchange Commission, despite new leadership, has maintained scrutiny of digital asset offerings, leading to continued uncertainty about which tokens might face enforcement action.

Additionally, geopolitical considerations have played a significant role in shaping Trump era crypto policy. Concerns about national security implications of decentralized finance, particularly regarding sanctions evasion and illicit finance, have led to regulatory approaches that some in the industry view as overly restrictive. The administration’s focus on preventing adversarial nations from using cryptocurrencies to circumvent economic sanctions has resulted in enhanced surveillance requirements and reporting obligations that have increased operational costs for exchanges and other service providers.

The disconnect between campaign promises and policy implementation has contributed to market disappointment. When Bitcoin falls lowest level Trump administration comparison becomes a headline, it highlights the gap between expectations and reality. Investors who anticipated a regulatory environment that would dramatically accelerate institutional adoption have instead encountered a landscape where progress is incremental and uncertainty remains elevated.

Macroeconomic Factors Driving the Decline

Beyond cryptocurrency-specific dynamics, broader macroeconomic conditions have created a hostile environment for risk assets across the board. The Federal Reserve’s monetary policy stance throughout 2025 and into 2026 has remained more restrictive than many anticipated, with interest rates staying elevated to combat persistent inflation. This high-rate environment has made yield-bearing traditional assets more attractive relative to non-yielding speculative investments like Bitcoin, fundamentally altering the calculus for institutional allocators.

The strengthening of the US dollar throughout this period has also created headwinds for cryptocurrency market performance. Historically, Bitcoin has exhibited an inverse correlation with dollar strength, as international investors often view digital currencies as an alternative store of value when fiat currencies weaken. However, the dollar’s resilience in the face of global economic uncertainty has diminished this appeal, redirecting capital flows toward traditional safe-haven assets.

Global economic growth concerns have further dampened appetite for speculative investments. Slowing growth in major economies, particularly in Asia and Europe, has reduced the pool of capital available for cryptocurrency investment. Corporate earnings pressures and stock market volatility have created a risk-off environment where investors prioritize capital preservation over growth, leading to broad-based selling across cryptocurrency markets.

The liquidity conditions that enabled the Bitcoin rally in previous years have also deteriorated. Central bank balance sheet reduction, tighter lending standards, and reduced risk appetite among financial institutions have all contributed to a less liquid market environment. This liquidity withdrawal has been particularly painful for cryptocurrencies, which rely heavily on consistent capital inflows to maintain upward price momentum.

Technical Analysis of Bitcoin’s Decline

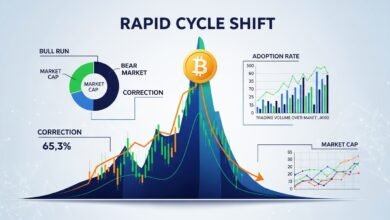

From a technical perspective, the breakdown that led Bitcoin to current levels represents a textbook example of failed support and cascading liquidations. The cryptocurrency initially violated key moving averages that had provided support throughout 2025, triggering automated selling from quantitative trading systems and momentum-following algorithms. This initial breach created a self-reinforcing cycle where technical deterioration prompted further selling, which in turn worsened the technical picture.

Chart patterns that had previously indicated consolidation and potential accumulation were invalidated as prices broke decisively lower. The head and shoulders pattern that developed over several months resolved to the downside, providing a bearish roadmap that technical traders followed with increasing conviction. Volume analysis revealed that selling pressure was accompanied by above-average transaction volumes, suggesting genuine conviction behind the bearish move rather than illiquid price manipulation.

The Bitcoin market analysis from a technical standpoint reveals multiple layers of support that have failed to hold. Price levels that would have been considered strong buying opportunities based on historical patterns have been swept aside with minimal resistance. This suggests that the underlying bid structure that previously supported the market has fundamentally changed, with fewer willing buyers at prices that would have attracted significant interest in previous cycles.

Momentum indicators have remained deeply oversold for extended periods, a condition that in healthier markets would typically attract dip buyers. However, the persistence of negative momentum without meaningful relief rallies indicates exhaustion among the bullish contingent and a shift in market character. The relative strength index and other oscillators continue painting a picture of a market searching for a bottom but not yet finding the capitulation event that typically marks cyclical lows.

Institutional Investment Sentiment Shift

Perhaps the most concerning aspect of the current Bitcoin price drop 2026 scenario is the documented shift in institutional sentiment. Major investment firms that had previously allocated portions of their portfolios to digital assets have begun reducing or eliminating these positions entirely. Public filings and earnings calls from prominent asset managers reveal a marked decrease in enthusiasm for cryptocurrency as an asset class, with many citing regulatory uncertainty, volatility concerns, and macroeconomic headwinds as justification for reduced exposure.

The institutional narrative that drove previous bull markets emphasized Bitcoin’s potential as “digital gold” and an inflation hedge. However, the cryptocurrency’s failure to perform this function during recent inflationary periods has undermined this thesis in the eyes of many professional investors. When Bitcoin declined alongside traditional risk assets rather than serving as a portfolio diversifier, it called into question the fundamental investment case that had attracted institutional capital.

Corporate treasury adoption, which had been touted as a major driver of future demand, has also stalled. Companies that purchased Bitcoin for their balance sheets during the 2020-2021 period have largely maintained their holdings but few new corporate buyers have emerged. The opportunity cost of holding a volatile, non-yielding asset when interest rates on cash are attractive has led corporate financial officers to reconsider the wisdom of significant cryptocurrency allocations.

Pension funds and endowments, which move markets through their sheer size, have shown minimal inclination to increase cryptocurrency exposure at current levels. Despite depressed prices that might theoretically represent attractive entry points, these large institutional investors appear content to wait for greater regulatory clarity and demonstrated stability before committing significant capital. This absence of institutional buying interest helps explain why Bitcoin falls lowest level Trump era comparisons have become possible.

Regulatory Developments and Market Impact

Regulatory evolution continues to shape cryptocurrency market dynamics in profound ways. While the Trump administration has made efforts to provide clearer guidelines for digital asset businesses, the regulatory landscape remains fragmented and complex. Different agencies maintain varying interpretations of how existing laws apply to cryptocurrencies, creating compliance challenges that have proven costly and time-consuming for market participants.

The Securities and Exchange Commission’s approach to cryptocurrency classification remains a source of ongoing uncertainty. Despite leadership changes, the agency continues to evaluate digital assets on a case-by-case basis to determine whether they constitute securities subject to registration requirements. This unpredictable regulatory environment has chilled innovation and made it difficult for projects to launch with confidence, reducing the pipeline of new opportunities that might attract investor interest.

International regulatory coordination has also impacted market sentiment. Efforts by global standard-setting bodies to establish common frameworks for cryptocurrency oversight have generally trended toward stricter controls and enhanced reporting requirements. While standardization may eventually benefit the industry by providing clarity, the near-term impact has been to increase compliance costs and reduce the privacy characteristics that many early adopters valued.

Enforcement actions against exchanges and other service providers have created additional market friction. High-profile cases involving alleged violations of anti-money laundering rules or unregistered securities offerings have resulted in significant fines and operational restrictions. These enforcement actions remind market participants that regulatory risk remains elevated, contributing to the cautious sentiment that has allowed Bitcoin to fall to current levels without significant buying support materializing.

Comparison to Previous Bitcoin Bear Markets

Historical context provides valuable perspective on the current cryptocurrency market decline. Bitcoin has experienced multiple severe bear markets throughout its existence, with drawdowns of seventy percent or more occurring on several occasions. Each previous cycle followed a similar pattern of euphoric rally, extended consolidation, and eventual collapse that shook out speculative excess and weak-handed investors.

The 2018 bear market, which followed the late 2017 bubble, saw Bitcoin decline roughly eighty-five percent from peak to trough. That downturn was characterized by the implosion of initial coin offering mania, regulatory crackdowns, and the realization that many cryptocurrency projects lacked viable business models. The recovery from those lows took over two years and required fundamental improvements in infrastructure, regulatory clarity, and institutional participation.

The 2022 bear market, triggered by Federal Reserve tightening and the collapse of major industry participants like FTX, demonstrated that cryptocurrency markets remained vulnerable to both macroeconomic conditions and internal dysfunction. That cycle’s bottom formation took months and was accompanied by significant industry consolidation, with weaker companies failing while stronger survivors gained market share.

The current decline shares characteristics with both previous bear markets while also exhibiting unique features. Like 2018, there appears to be a reckoning with unrealistic expectations about rapid mainstream adoption. Similar to 2022, macroeconomic conditions are playing a significant role in determining price action. However, the current cycle is unfolding against a backdrop of greater institutional awareness and more developed regulatory frameworks, suggesting that the eventual recovery path may differ from previous patterns.

Global Economic Implications

When Bitcoin falls to lowest level in years, the implications extend beyond cryptocurrency markets to broader economic and financial systems. The wealth effect from declining digital asset values impacts consumer spending among cryptocurrency holders, particularly in regions where adoption rates are high. Countries that had embraced Bitcoin as legal tender or developed significant cryptocurrency-related industries face economic headwinds as the sector contracts.

The employment impact within the cryptocurrency industry has been substantial. Exchanges, blockchain development companies, and related service providers have announced layoffs and hiring freezes as revenues decline and venture capital funding becomes scarce. The talent that flowed into the sector during boom times is now seeking opportunities in other industries, representing a potential brain drain that could slow future innovation.

Traditional financial institutions that had invested in cryptocurrency infrastructure or partnerships are reassessing these initiatives. Banks that developed digital asset custody services or trading desks are evaluating whether to maintain these operations at current business volumes. Payment processors that integrated cryptocurrency functionality are questioning the return on investment as transaction volumes decline alongside prices.

The geopolitical dimension of Bitcoin’s decline also merits consideration. Countries that had viewed digital currencies as potential tools for circumventing economic sanctions or reducing dependence on dollar-dominated payment systems may reconsider these strategies as market capitalization shrinks and volatility persists. The reduced market depth at lower prices makes Bitcoin less practical for large-scale international transactions, potentially limiting its utility for state-level actors.

Mining Industry Stress and Network Security

The Bitcoin mining industry faces existential pressures as prices fall to levels that challenge the economic viability of many operations. Mining profitability depends on the relationship between Bitcoin price, mining difficulty, energy costs, and hardware efficiency. When prices decline sharply while difficulty remains elevated, many miners find themselves operating at or below breakeven, forcing difficult decisions about whether to continue operations.

Smaller mining operations with higher energy costs or older equipment are particularly vulnerable. Some have already ceased operations, reducing the network hash rate and raising questions about long-term security implications. While Bitcoin’s network has demonstrated remarkable resilience through previous bear markets, a sustained period of miner capitulation could theoretically increase vulnerability to potential attacks, though the scale required for such attacks remains prohibitively large.

The geographic distribution of mining activity has shifted in response to regulatory changes and energy availability. Some regions that previously hosted significant mining operations have implemented restrictions or increased oversight, prompting miners to relocate to more hospitable jurisdictions. This migration has operational and capital costs that further stress already tight margins.

Public mining companies face additional pressures from shareholders and debt holders as their primary asset depreciates. Many of these firms expanded aggressively during the bull market, taking on debt to finance equipment purchases and facility expansion. Servicing this debt becomes increasingly challenging when revenues decline, and some companies may face restructuring or bankruptcy if conditions do not improve.

Investor Psychology and Market Sentiment

The psychological dimension of cryptocurrency investment during this downturn cannot be overlooked. Retail investors who entered the market during periods of enthusiasm now confront significant paper losses and must decide whether their original investment thesis remains valid. The emotional toll of watching portfolio values decline day after day tests the conviction of even committed believers in cryptocurrency’s long-term potential.

Social media sentiment analysis reveals a marked shift from the euphoria that characterized earlier periods. Online communities that previously reinforced bullish narratives and dismissed concerns now feature more balanced discussions that acknowledge genuine challenges facing the industry. This evolution suggests a potential maturation of the investor base, though it also reflects the disappointment and frustration that accompanies significant wealth destruction.

Fear and greed indicators designed to measure market sentiment have remained in extreme fear territory for extended periods. While contrarian investors sometimes interpret such readings as potential buying opportunities, the persistence of negative sentiment without catalysts for reversal has worn down this conviction. Many who might have viewed previous dips as chances to accumulate have become increasingly reluctant to deploy capital.

The generational aspect of cryptocurrency investment adds another layer to psychological considerations. Younger investors who viewed Bitcoin as their generation’s unique opportunity to build wealth through a new asset class must now reckon with the possibility that timing and risk management matter as much in cryptocurrency as in traditional markets. This learning experience may ultimately create a more sophisticated investor base but is painful in the near term.

Future Outlook and Recovery Scenarios

Regulatory clarity could serve as a significant catalyst if and when it materializes. Comprehensive legislation that provides clear rules for digital asset classification, custody requirements, and permissible business activities might restore confidence and encourage institutional participation. The Trump administration’s stated intentions regarding cryptocurrency policy could eventually translate into the supportive framework that investors anticipated, though timing remains uncertain.

Macroeconomic conditions will likely play a decisive role in determining recovery timing. A shift in Federal Reserve policy toward rate cuts in response to economic weakness could reignite interest in risk assets including cryptocurrency. Alternatively, persistent inflation that undermines confidence in fiat currencies might revive Bitcoin’s narrative as an alternative store of value, though this thesis has been tested and found wanting in recent inflationary periods.

Technological developments within the cryptocurrency ecosystem could also influence recovery prospects. Improvements in scalability, user experience, and practical applications might broaden the user base and create genuine utility that supports valuation beyond pure speculation. The maturation of decentralized finance applications, if they can demonstrate sustainable business models, might provide fundamental support for digital asset prices.

The pessimistic scenario involves an extended period of price stagnation or further decline as the structural challenges facing cryptocurrencies prove more durable than optimists expect. Continued regulatory headwinds, persistent macroeconomic challenges, and the absence of compelling new use cases could keep Bitcoin range-bound at depressed levels for an extended period. Previous bear markets have lasted years, and there is no guarantee that recovery will be swift or dramatic.

Lessons for Cryptocurrency Investors

The current digital currency crash offers valuable lessons for anyone involved in cryptocurrency markets. Risk management emerges as perhaps the most critical takeaway, as even assets that appeared to have achieved mainstream legitimacy can experience severe drawdowns. Position sizing appropriate to individual risk tolerance becomes essential when volatility can destroy substantial portions of portfolio value in short order.

Diversification within and beyond cryptocurrency markets deserves renewed emphasis. Investors who maintained balanced portfolios with traditional assets alongside digital currencies have weathered the current storm more successfully than those who concentrated holdings exclusively in cryptocurrency. The correlation between Bitcoin and other risk assets during stressed market conditions highlights that digital currencies may not provide the portfolio diversification benefits that some had assumed.

Understanding market cycles and avoiding the temptation to extrapolate current trends indefinitely represents another crucial lesson. The euphoria that accompanies bull markets can cloud judgment and lead to poor decision-making, just as despair during bear markets can cause investors to abandon sound long-term strategies. Maintaining emotional discipline and adhering to predetermined investment plans helps navigate both extremes.

The importance of distinguishing between investment and speculation becomes clear during periods like this. Cryptocurrency investment based on fundamental conviction in the technology’s long-term potential differs meaningfully from speculation driven by price momentum or fear of missing out. Understanding one’s own motivations and investment horizon helps maintain appropriate expectations and avoid disappointment when markets inevitably turn.

Conclusion

The reality that Bitcoin falls to lowest level since Trump took office represents more than just a price milestone—it symbolizes a critical juncture for the entire cryptocurrency ecosystem. This 2026 market decline has exposed vulnerabilities in the investment thesis that drove prices higher and forced a wholesale reevaluation of digital assets’ place in modern portfolios. While the pain experienced by investors who entered at higher levels is genuine and significant, bear markets have historically served as necessary corrections that remove excess speculation and create foundations for more sustainable growth.

The path forward remains uncertain, with legitimate arguments supporting both optimistic and pessimistic scenarios. What seems clear is that cryptocurrency markets in 2026 and beyond will likely look different from those of previous cycles, with greater regulatory oversight, more sophisticated participants, and higher standards for projects seeking investor capital. Whether the current Bitcoin price represents a generational buying opportunity or a warning signal about structural challenges will only become clear with time and perspective.

For investors navigating this challenging environment, maintaining realistic expectations while staying informed about evolving Trump administration crypto policy and broader market conditions remains essential. The cryptocurrency market has demonstrated remarkable resilience through previous downturns, but past performance offers no guarantees about future results. Those who choose to remain engaged with this asset class should do so with appropriate risk management, diversification, and a clear understanding of their investment horizon and objectives.

As we continue monitoring how Bitcoin and other digital assets perform throughout 2026, staying informed about regulatory developments, macroeconomic trends, and technological innovations will help investors make educated decisions. Whether this proves to be a temporary setback or a more fundamental shift in cryptocurrency’s trajectory, understanding the forces at play remains crucial for anyone with exposure to this dynamic and evolving market.