What is Web3 Staking in the cryptocurrency landscape has evolved dramatically since Bitcoin’s inception, introducing innovative mechanisms that allow investors to generate passive income from their digital assets. Among these groundbreaking developments, Web3 staking has emerged as one of the most compelling opportunities for cryptocurrency holders to earn daily returns while supporting blockchain networks’ security and functionality.

Web3 staking represents a fundamental shift from traditional “hodling” strategies, transforming idle cryptocurrency holdings into productive assets that generate consistent rewards. This revolutionary approach combines the decentralized principles of blockchain technology with sophisticated consensus mechanisms that reward participants for their contributions to network security and validation.

Unlike traditional banking systems, where your money sits dormant in savings accounts earning minimal interest, cryptocurrency staking enables you to actively participate in blockchain governance while earning substantial returns. The beauty of this system lies in its democratic nature – anyone with supports cryptocurrencies can become a validator or delegator, contributing to network security while earning staking rewards.

The Web3 ecosystem has matured significantly, offering numerous platforms and protocols that facilitate staking across various blockchain networks. From established networks like Ethereum 2.0 to emerging DeFi protocols, the staking landscape provides diverse opportunities for both novice and experienced crypto investors to maximize their returns.

This comprehensive guide will explore every aspect of Web3 staking, from fundamental concepts to advanced strategies, helping you understand how to transform your cryptocurrency holdings into a reliable source of daily income.

Understanding Web3 Staking Fundamentals

What is Web3 Staking?

Web3 staking is a process where cryptocurrency holders lock up their tokens in a blockchain network to support its operations and security. In return for this commitment, participants receive staking rewards in the form of additional tokens. This mechanism is integral to Proof-of-Stake (PoS) consensus algorithms, which have become increasingly popular due to their energy efficiency compared to Proof-of-Work systems.

The concept of staking originated from the need to create more sustainable and scalable blockchain networks. While Bitcoin relies on energy-intensive mining, PoS networks select validators based on their stake in the network, creating a more environmentally friendly approach to achieving consensus and maintaining security.

How Staking Mechanisms Work

Blockchain staking operates through sophisticated algorithms that randomly select validators to propose and validate new blocks. The probability of selection typically correlates with the validator’s stake size, though most networks implement measures to prevent centralization. Validators must maintain their nodes online and follow protocol rules, or risk having their staked tokens slashed as punishment for malicious behavior.

Smart contracts play a crucial role in automating the staking process, ensuring transparent and trustless operations. These contracts handle reward distribution, slashing conditions, and unbonding periods, eliminating the need for intermediaries and reducing counterparty risk.

Types of Web3 Staking Options

Direct Network Staking

Direct staking involves running a validator node on supported blockchain networks. This approach requires technical expertise, substantial initial investment, and continuous monitoring. Popular networks for direct staking include Ethereum 2.0, Cardano, Polkadot, and Solana, each offering different staking rewards and requirements.

Validators in direct staking earn the highest rewards but also bear the greatest responsibility. They must maintain 24/7 uptime, keep their software updated, and ensure their nodes operate according to network protocols. Any downtime or malicious behavior can result in penalties or slashing.

Delegated Staking

Delegated staking allows token holders to participate in staking without running their own validator nodes. Participants delegate their tokens to established validators who handle the technical aspects while sharing rewards with delegators. This approach significantly lowers the barrier to entry for cryptocurrency staking.

Staking pools have emerged as popular platforms for delegated staking, offering user-friendly interfaces and professional management. These pools aggregate multiple users’ stakes, increasing the chances of being selected as validators while distributing rewards proportionally among participants.

Liquid Staking Solutions

Liquid staking represents an innovative evolution in staking technology, allowing users to stake their tokens while maintaining liquidity through derivative tokens. Platforms like Lido, Rocket Pool, and Marinade Finance issue liquid staking tokens that represent staked positions, enabling users to trade or use these tokens in DeFi protocols while still earning staking rewards.

This approach addresses one of staking’s primary drawbacks – the lock-up period that traditionally prevents access to staked funds. Liquid staking derivatives have opened new possibilities for yield farming and composable DeFi strategies.

Benefits of Web3 Staking

Passive Income Generation

The most compelling benefit of Web3 staking is its ability to generate passive income from cryptocurrency holdings. Staking rewards typically range from 4% to 20% annually, depending on the network and staking method chosen. These rewards compound over time, creating a snowball effect that can significantly increase portfolio value.

Unlike traditional investments that require active management, cryptocurrency staking operates automatically once set up. Rewards are distributed regularly, often daily or weekly, providing a steady stream of income that can be reinvested or withdrawn as needed.

Network Participation and Governance

Staking provides token holders with governance rights in many blockchain networks. Stakers can vote on protocol upgrades, parameter changes, and future developments, giving them a voice in the network’s evolution. This democratic approach ensures that those with the most at stake have the greatest influence on network decisions.

Governance tokens earned through staking often appreciate as networks grow and mature, providing additional upside potential beyond regular staking rewards. Active participation in governance can also lead to special rewards or airdrops from network development teams.

Portfolio Diversification

Web3 staking offers excellent diversification opportunities across different blockchain ecosystems. By staking various cryptocurrencies across multiple networks, investors can spread risk while capitalizing on different growth opportunities. This multi-chain approach provides exposure to various sectors within the crypto ecosystem, from smart contract platforms to specialized DeFi protocols.

Popular Web3 Staking Platforms

Ethereum 2.0 Staking

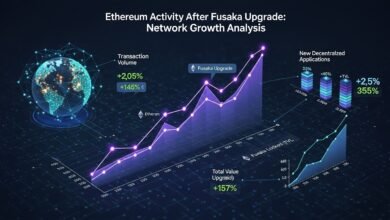

Ethereum staking represents one of the largest and most significant staking opportunities in the Web3 space. With the transition to Ethereum 2.0, ETH holders can stake their tokens to secure the network while earning approximately 4-6% annual rewards. The minimum requirement of 32 ETH for direct validation has led to the proliferation of staking pools and liquid staking solutions.

Cardano (ADA) Staking

Cardano staking offers one of the most user-friendly staking experiences, with no minimum requirements and no lock-up periods. ADA holders can delegate their tokens to stake pools while retaining full control over their funds. The network’s unique Ouroboros consensus mechanism ensures fair reward distribution while maintaining high security standards.

Polkadot (DOT) Staking

Polkadot staking utilizes a sophisticated Nominated Proof-of-Stake system where nominators support validators with their stakes. The network offers attractive rewards of 10-12% annually, though it requires a minimum stake and involves bonding periods. Polkadot’s parachain auctions also provide additional staking opportunities through crowd loans.

Solana (SOL) Staking

Solana staking combines high performance with attractive yields, offering approximately 6-8% annual rewards. The network’s rapid transaction processing and low fees make it attractive for both validators and delegators. Solana’s growing DeFi ecosystem provides additional opportunities for leveraging staked SOL in various protocols.

Risks and Considerations in Web3 Staking

Market Volatility Risks

While staking rewards provide additional tokens, the underlying value depends on market conditions. Cryptocurrency prices can be highly volatile, potentially offsetting staking gains during market downturns. Investors must consider both reward rates and potential price appreciation or depreciation when evaluating staking opportunities.

Impermanent loss can occur in liquid staking scenarios where derivative tokens may trade at premiums or discounts to underlying assets. Understanding these market dynamics is crucial for making informed staking decisions.

Technical and Operational Risks

Validator risks include potential slashing for malicious behavior or extended downtime. While delegated staking reduces technical requirements, choosing reliable validators becomes crucial for maintaining consistent rewards and avoiding penalties. Smart contract risks in DeFi staking platforms also require careful consideration and due diligence.

Regulatory Uncertainty

The evolving regulatory landscape surrounding cryptocurrency staking presents ongoing challenges. Different jurisdictions may classify staking rewards differently for tax purposes, and future regulations could impact staking operations. Staying informed about regulatory developments is essential for long-term staking strategies.

Getting Started with Web3 Staking

Choosing the Right Platform

Selecting appropriate staking platforms requires evaluating multiple factors, including reward rates, security measures, user interface, and supported cryptocurrencies. Established platforms with strong track records and transparent operations typically offer better security and reliability.

Centralized exchanges like Coinbase, Binance, and Kraken offer simplified staking services, while decentralized platforms provide greater control and often higher rewards. The choice depends on individual risk tolerance and technical expertise.

Setting Up Your Staking Strategy

Developing a comprehensive staking strategy involves diversifying across multiple networks and platforms to optimize risk-adjusted returns. Consider factors such as lock-up periods, minimum requirements, and withdrawal flexibility when designing your approach.

Dollar-cost averaging into staking positions can help mitigate timing risks while building substantial stakes over time. Regular monitoring and rebalancing ensure optimal performance as market conditions evolve.

Security Best Practices

Wallet security remains paramount in Web3 staking. Use hardware wallets for storing private keys and never share sensitive information. Enable two-factor authentication on all platforms and regularly update software to prevent security vulnerabilities.

Cold storage for long-term stakes and hot wallets for active management provide balanced security and convenience. Regular backup procedures ensure access to funds even if primary devices fail.

Maximizing Your Staking Returns

Compound Interest Strategies

Compounding rewards through automatic reinvestment can significantly amplify long-term returns. Many platforms offer automatic compounding features that reinvest earned rewards, eliminating manual intervention while maximizing growth potential.

Understanding compounding frequency helps optimize returns – daily compounding typically outperforms weekly or monthly compounding, especially over extended periods.

Advanced Staking Techniques

Yield farming with liquid staking derivatives opens additional earning opportunities. Platforms like Curve Finance and Uniswap offer liquidity mining rewards for providing staking derivative pairs, creating multiple income streams from single assets.

Cross-chain staking strategies leverage different networks’ unique advantages while maintaining diversified exposure. Bridge technologies enable moving assets between chains to capture optimal staking opportunities.

Future of Web3 Staking

Emerging Trends and Technologies

Liquid staking evolution continues with new protocols offering improved capital efficiency and enhanced yields. Multi-chain staking platforms are developing to simplify cross-network staking management, while AI-powered optimization tools help maximize returns automatically.

Institutional adoption of staking services indicates growing mainstream acceptance, potentially leading to improved infrastructure and regulatory clarity. Enterprise staking solutions are emerging to serve large-scale investors and institutions.

Potential Developments

Ethereum scaling solutions may introduce new staking mechanisms and reward structures. Layer 2 staking protocols could offer enhanced yields while reducing gas costs for smaller stakers. Regulatory frameworks are likely to mature, providing clearer guidelines for staking operations and tax treatment. This clarity could accelerate institutional adoption and mainstream integration.

For More: Web3 Security AGII& AI-Powered Detection Enhances Blockchain

Conclusion

Web3 staking represents a paradigm shift in how cryptocurrency holders can generate passive income while contributing to blockchain network security and governance. With daily returns possible through various staking mechanisms, from direct validation to liquid staking solutions, the opportunities for building wealth through cryptocurrency staking continue to expand.

The key to successful staking lies in understanding the various options available, carefully evaluating risks and rewards, and implementing diversified strategies across multiple networks and platforms. As the Web3 ecosystem matures, staking will likely become an increasingly important component of comprehensive cryptocurrency investment strategies.