Many big changes have happened in the digital world in the past ten years. A decentralized, user-controlled internet is the goal of the emerging Web3 technology, which is one of the most revolutionary trends. Within this context, Web3 payments are quickly changing our perceptions of ownership, digital connections, and transactions; they are essential to the emerging decentralized economy.

It is necessary to have a solid grasp of Web3 before attempting to comprehend Web3 payments. The third version of the World Wide Web is Web3.0 or simply Web3. Web3 seeks to decentralize control and ownership back to people, in contrast to Web 2.0’s emphasis on user-generated content and centralized platforms and Web 1.0’s focus on static, read-only websites. The main technology behind this shift is blockchain, which provides trustworthy, immutable ways to record information and conduct transactions.

Dismantling the authority exercised by centralized companies like Google, Facebook, and Amazon and returning control to consumers is the primary promise of Web3. Web3 apps, often called decentralized apps (dApps), are more secure and resistant to censorship because they run on blockchain networks.

Web3 Payments: A New Paradigm

One of its essential features, Web3 payments, has the potential to completely alter how we interact with the internet and the digital economy. Web3 payments eliminate the need for middlemen like banks and centralized payment processors, enabling users to conduct P2P transactions directly with one another. These systems use blockchain technology. Incorporating these modifications into the existing financial ecosystem brings about numerous significant transformations.

Financial institutions, payment processors, and regulatory agencies are all seen as middlemen in the conventional system, which can increase expenses, complexity, and failure points. However, Web3 payments provide a faster, more secure, and cheaper alternative by avoiding middlemen.

By leveraging decentralized blockchain networks, Web3 payments offer unique benefits, including:

- Decentralization: There is no need for central authorities to reduce the risk of censorship and interference.

- Borderless Transactions: Web3 payments allow users to transact globally without the constraints of traditional banking systems or currency conversions.

- Lower Fees: Since Web3 payments bypass intermediaries, users can enjoy significantly lower transaction fees, which is particularly beneficial for microtransactions and cross-border remittances.

- Security and Privacy: Blockchain’s cryptographic features ensure that transactions are secure and that users’ financial data is not exposed to centralized entities that may misuse it.

- Transparency: Every transaction on a blockchain is recorded in a public ledger, increasing transparency and reducing the risk of fraud.

How Web3 Payments Work

Web3 payments rely on blockchain technology as its central mechanism. A blockchain is a decentralized database that keeps track of financial transactions made through interconnected computers. We compile them into “blocks” and add them to a “chain” in the correct sequence to keep track of them. The network’s participants (called nodes) can independently verify and process transactions because of the blockchain’s decentralized structure, which means no single entity controls the data.

Web3 relies on smart contracts, agreements whose conditions are encoded into code and automatically executed for financial transactions. By automating the process and eliminating the need for trusted third parties, smart contracts guarantee that payments only go through when certain conditions are satisfied. For example, a smart contract in a P2P transaction can release funds automatically whenever both sides meet their requirements.

Cryptocurrencies like Bitcoin, Ethereum, and stablecoins are used to support transactions in Web3 payments, in addition to smart contracts. Users can transact easily across borders with cryptocurrencies since they function as a medium of exchange, unlike traditional currencies.

Key Players in Web3 Payments

Several platforms and protocols are pioneering the development of Web3 payment solutions. Some of the leading projects in this space include:

- Ethereum (ETH): Ethereum is the leading blockchain for decentralized applications and Web3 development. It offers a robust platform for smart contracts and decentralized finance (DeFi) protocols that enable Web3 payments.

- Polkadot (DOT): Polkadot is a multi-chain blockchain platform that enables different blockchains to interoperate, making it easier for Web3 projects to scale and offer payment solutions.

- Solana (SOL): Solana is known for its high throughput and low transaction fees, making it an attractive option for Web3 payments, especially for microtransactions and high-frequency trading.

- Chainlink (LINK): Chainlink is a decentralized oracle network that connects smart contracts with real-world data. It is crucial to enable Web3 payments by providing the necessary data to trigger smart contract conditions.

- Lightning Network: Built on top of Bitcoin, the Lightning Network is a layer 2 payment protocol designed to enable fast and low-cost transactions, making it ideal for Web3 payment use cases.

Advantages of Web3 Payments

Web3 payments offer several advantages over traditional payment systems, making them an appealing option for many use cases.

Decentralization and Control

Web3 payments operate without intermediaries, giving users complete control over their assets. This decentralized nature removes the need to trust a central authority like a bank or payment processor, which can impose fees, limits, or block transactions. Users control their financial data and assets, creating a more autonomous and censorship-resistant financial system.

Lower Fees

Traditional payment systems often come with high fees, particularly for international transactions. Web3 payments can significantly reduce these fees, especially when using Layer 2 solutions. Transaction costs can be minimized by eliminating intermediaries and relying on blockchain technology, making micropayments and international transactions more feasible.

Global Accessibility

One of the most revolutionary aspects of Web3 payments is their ability to provide financial services to unbanked or underbanked people. Over 1.7 billion people worldwide lack access to traditional banking services, but many have access to the Internet and mobile devices. Web3 payments can reach these individuals, allowing them to send, receive, and store funds without needing a bank account.

Transparency and Security

All Web3 transactions are recorded on a blockchain, providing a transparent and immutable ledger of activities. This level of transparency increases accountability and can help prevent fraud. Moreover, because transactions are secured using cryptographic algorithms, the risk of fraud, hacking, or unauthorized access is significantly reduced compared to centralized payment systems.

Programmable Payments

Smart contracts enable programmable payments, which can be triggered automatically when specific conditions are met. This functionality is especially useful for industries like supply chain management, insurance, and real estate, where conditional payments can streamline processes and reduce disputes.

Challenges Facing Web3 Payments

While Web3 payments have tremendous potential, they also face several challenges that must be addressed before they can achieve mainstream adoption.

Scalability

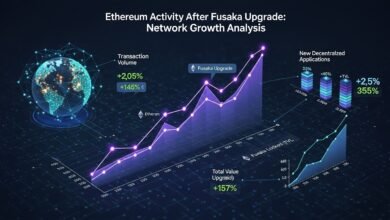

Although Web3 payments can be faster and cheaper than traditional systems, scalability remains challenging. Blockchains like Ethereum can only process a limited number of transactions per second (TPS), leading to congestion and high fees during peak times. Solutions like Ethereum 2.0, sharding, and Layer 2 protocols are being developed to address these scalability concerns, but they are not fully realized.

User Experience

The current user experience in Web3 can be complicated for those unfamiliar with blockchain technology. Setting up a digital wallet, securing private keys, and navigating dApps can be daunting for non-technical users. For Web3 payments to achieve mass adoption, the user experience needs to be simplified, with more intuitive interfaces and easier onboarding processes.

Regulation and Compliance

The regulatory environment surrounding Web3 payments is still evolving. Governments and financial regulators are grappling with how to classify and regulate cryptocurrencies and decentralized financial systems. Compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations remains challenging for many Web3 payment platforms. Without clear regulatory frameworks, businesses and users may face uncertainty when engaging in Web3 transactions.

Price Volatility

Price volatility is one of the biggest hurdles for Web3 payments, particularly those using cryptocurrencies like Bitcoin or Ethereum. The value of cryptocurrencies can fluctuate significantly, making them less reliable as a medium of exchange. Stablecoins, pegged to fiat currencies like the US dollar, offer a potential solution. Still, they also come with their own set of regulatory and technical challenges.

Adoption by Merchants

For Web3 payments to become mainstream, merchants must accept cryptocurrencies and integrate blockchain-based payment systems into their businesses. While some companies have started accepting crypto, most merchants still rely on traditional payment methods. Widespread merchant adoption will require infrastructure improvements, education, and incentives.

Real-World Use Cases for Web3 Payments

Despite the challenges, Web3 payments are already used in various real-world scenarios, demonstrating their potential to disrupt traditional financial systems. Some notable use cases include:

- Decentralized Finance (DeFi): DeFi platforms are perhaps the most significant example of Web3 payments in action. These platforms allow users to lend, trade, and earn cryptocurrency interest without intermediaries. Projects like Aave, Compound, and Uniswap have created decentralized marketplaces where users can engage in financial activities without relying on traditional banks.

- Remittances: Cross-border remittances are a prime area where Web3 payments can make a difference. Traditional remittance services often charge high fees and take days to process. Web3 payments, using cryptocurrencies or stablecoins, can facilitate near-instantaneous and cost-effective transfers across borders, providing a lifeline for individuals in developing countries.

- Micropayments and Content Monetization: Web3 payments enable new monetization models for creators and content providers. Platforms like Audius and Mirror use blockchain technology to allow creators to receive payments directly from their audience without intermediaries, creating more equitable revenue-sharing models.

- Gaming and NFTs: The gaming industry embraces Web3 payments through play-to-earn models and non-fungible tokens (NFTs). Players can earn cryptocurrency rewards, buy and sell in-game assets, and participate in decentralized gaming economies. NFTs also enable digital ownership of unique items, creating new opportunities for artists and creators to monetize their work.

- Tokenization of Assets: Web3 payments facilitate tokenizing real-world assets, such as real estate, art, and stocks. By representing these assets as tokens on a blockchain, users can buy, sell, and trade fractional ownership in a more liquid and accessible marketplace.

The Future of Web3 Payments

The future of Web3 payments is quite bright as blockchain technology keeps developing and improving. Web3 payments will be increasingly accessible and feasible for everyday use as scalability, security, and user experience advance. New opportunities for automation, personalization, and innovation in financial services will arise due to integrating Web3 payments with emerging technologies such as artificial intelligence (AI), the Internet of Things (IoT), and decentralized identity systems.

The development of Web3 payments will also be heavily influenced by governments and regulatory agencies. To encourage confidence and facilitate the broad use of these new payment systems, transparent regulatory frameworks and standards are essential. To build a Web3 payment ecosystem that is both secure and compliant, governments, corporations, and blockchain developers must work together.

Conclusion

Web3 payments are a huge change from the old, heavily controlled banking systems. Web3 payments provide an alternative to traditional P2P payment methods that are more efficient, safer, and cheaper by utilizing blockchain technology, digital currencies, and smart contracts. Despite this, widespread use of Web3 payments is contingent upon resolving important issues, including scalability, regulation, and security.

Decentralized payment systems and financial innovation have a bright future ahead of them thanks to developers constantly improving and expanding upon Web3. As more people and companies use this new paradigm, our views on money and transactions could drastically alter. Web3 can revolutionize global financial systems.

[sp_easyaccordion id=”3049″]