The continuously shifting cryptocurrency market has created new possibilities for investors while impacting traditional financial markets. An in-depth familiarity with market dynamics, risk management concepts, and forthcoming trends is essential for developing a sound crypto investment plan in light of the proliferation of digital assets. Focusing on both long-term investing goals and short-term trading opportunities, this essay lays out essential tactics for navigating the cryptocurrency sector in 2024.

Understanding the Crypto Market Landscape

Cryptocurrencies have moved beyond the hype stage, becoming integral to global finance. In 2024, the market features thousands of digital assets, ranging from dominant players like Bitcoin (BTC) and Ethereum (ETH) to emerging projects in decentralized finance (DeFi), gaming (GameFi), and non-fungible tokens (NFTs).

- Bitcoin as a Store of Value: Bitcoin remains the flagship cryptocurrency and is often seen as digital gold. Despite its volatility, Bitcoin’s finite supply and growing adoption by institutions make it a reliable hedge against inflation and currency devaluation.

- Ethereum and Smart Contract Platforms: Ethereum has established itself as the leading smart contract platform, powering decentralized applications (dApps). The rise of Ethereum Layer-2 solutions and ETH 2.0’s transition to proof-of-stake have improved scalability and reduced transaction fees, strengthening its position in the DeFi ecosystem.

- Altcoins and the Rise of Ecosystems: Beyond Bitcoin and Ethereum, other ecosystems like Solana, Polkadot, and Avalanche have gained traction. These altcoins offer unique features, such as improved scalability, interoperability, and lower transaction costs, making them attractive for specific use cases.

Emerging Sectors to Watch

- Decentralized Finance (DeFi): DeFi has disrupted traditional finance by offering decentralized borrowing, lending, and trading. Projects like Uniswap, Aave, and Compound continue to innovate, but the sector remains risky due to smart contract vulnerabilities and regulatory uncertainties.

- NFTs and the Metaverse: The NFT market has matured, shifting focus from digital art to real-world applications like tokenized real estate and virtual assets in the metaverse. Platforms like Decentraland and The Sandbox are leading the way.

- GameFi and Play-to-Earn: Play-to-earn (P2E) games allow players to earn cryptocurrencies or NFTs as rewards. Axie Infinity pioneered this trend, but new games with improved mechanics and economies are emerging.

- Regulatory Environment: As governments continue to assess the role of digital assets, increased regulations are anticipated. Keeping an eye on regulatory changes, especially regarding stablecoins and privacy coins, is essential for long-term planning.

Setting Investment Goals: Long-Term vs. Short-Term Strategies

Before diving into crypto investments, defining your financial goals and risk tolerance is crucial. Your strategies will vary significantly based on whether you seek long-term capital appreciation or short-term profits.

Long-Term Hold (HODL) Crypto Investment Strategy

The HODL strategy is about buying and holding cryptocurrencies over a long period, banking on their future appreciation. This strategy minimizes constant market monitoring and allows investors to reverse short-term volatility.

- Why It Works: Bitcoin and Ethereum have consistently delivered substantial long-term gains over the past decade despite short-term dips. Investors who have held their positions since the early days have seen outsized returns.

- How to Implement: Focus on fundamentally strong assets with long-term potential. Bitcoin, Ethereum, and large-cap altcoins (like Solana or Chainlink) are generally safer for long-term holding. Diversification across different types of assets, including a mix of stablecoins and growth-oriented tokens, can balance your portfolio’s risk.

- Risk Management: Even for long-term investors, it’s important to understand market cycles. Bull markets may drive prices to unsustainable levels, followed by corrections. Using dollar-cost averaging (DCA) — periodically investing a fixed amount — helps smooth out volatility and reduce the impact of market timing.

Short-Term Trading

Short-term trading can yield significant returns if you prefer a more hands-on approach. This involves taking advantage of the price volatility that defines crypto markets.

- Day Trading: Day traders execute multiple trades within the same day, capitalizing on intraday price movements. This strategy requires a thorough understanding of technical analysis, candlestick patterns, and market psychology.

- Swing Trading: Swing trading involves holding a position for a few days or weeks to capture gains during price swings. Traders use a combination of technical indicators (such as moving averages, RSI, and Fibonacci retracement levels) to identify potential entry and exit points.

- Trend Following: This strategy involves identifying the broader trend in the market (bullish or bearish) and trading in the direction of that trend. Trend-following strategies are effective during sustained market movements but can lead to losses if the market moves sideways.

Risk Management in Crypto Investments

One of the most important aspects of investing in cryptocurrencies is risk management. Crypto markets are notorious for their volatility, and while this volatility offers profit opportunities, it also poses significant risks.

Diversification

Diversifying your portfolio across different cryptocurrencies and asset types (e.g., stablecoins, altcoins, NFTs) is essential to managing risk. A well-diversified portfolio reduces the impact of a single asset’s poor performance. However, over-diversification can dilute returns, so striking a balance is important.

Position Sizing

Position sizing refers to the capital allocated to a particular trade or investment. In volatile markets like crypto, managing position sizes carefully is crucial to avoid significant losses on any single trade.

- How to Implement: As a rule of thumb, never invest more than 5-10% of your total portfolio in one trade, especially for smaller, less-established altcoins.

- Stop-Loss Orders: Stop-loss orders automatically sell an asset when it falls to a certain price, protecting your portfolio from severe losses. Placing a stop-loss order for volatile assets can help preserve capital during sharp downturns.

Hedging Strategies

Hedging involves taking positions in assets that protect against potential losses in your main portfolio. For instance, you can hedge a portfolio of altcoins with a short position in Bitcoin or use stablecoins like USDC or DAI during market corrections.

Stablecoins and Yield Generation

Stablecoins have become a key component of risk management in crypto portfolios. Pegged to the value of traditional currencies (like the U.S. dollar), stablecoins help minimize volatility while offering a way to participate in DeFi protocols for yield generation.

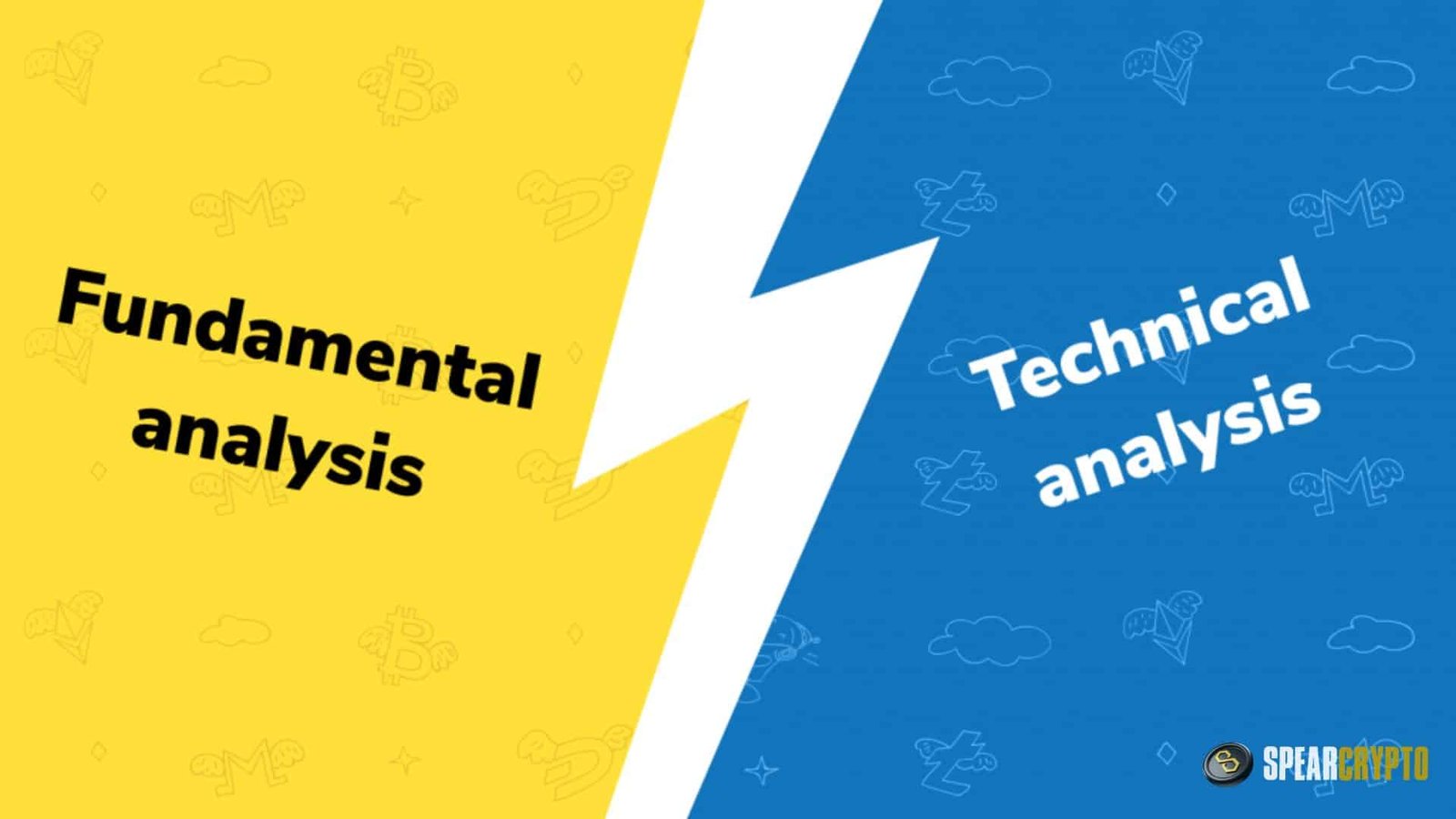

Fundamental vs. Technical Analysis

Investment strategies often rely on two key types of analysis: fundamental and technical. Understanding both is crucial for success in crypto investments.

Fundamental Analysis

Fundamental analysis evaluates the intrinsic value of a cryptocurrency based on its technology, use case, team, and community support. Metrics like the project’s whitepaper, development activity, and partnerships can provide insight into the long-term potential of a token.

- Network Growth: Look for projects with active developer communities and growing user bases. The network effect is a critical value driver, as more users lead to greater utility.

- Tokenomics: Assess the token’s economic model. Scarcity (limited supply) and demand (use cases) are essential to long-term value. Inflationary tokens or tokens with weak utility are likely to underperform.

- Adoption: Real-world adoption is a strong indicator of future success. Cryptocurrencies gaining traction in industries like finance, gaming, or supply chain management have a better chance of long-term survival.

Technical Analysis

Technical analysis uses historical price and volume data to predict future price movements. Common indicators used in technical analysis include moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence).

- Price Patterns: Patterns such as head and shoulders, triangles, and double tops/bottoms are used to forecast potential reversals or continuations of price trends.

- Volume: Monitoring volume can help confirm the strength of a price movement. Higher volume during price increases suggests strong buyer interest, while low volume during a price rise may indicate a weak rally.

Staying Informed and Adapting

The cryptocurrency market is dynamic, and strategies that work well in one market cycle may not be effective in another. Staying informed and being able to adapt is crucial for long-term success.

- Follow News and Developments: Crypto news can significantly impact market sentiment and prices. Regulatory changes, technological advancements, and macroeconomic factors all play a role.

- Join Communities: Being part of online communities (e.g., Twitter, Reddit, Discord) can help you stay updated on trends and gain insights from experienced investors.

- Continuous Learning: The crypto space is evolving, with new technologies and innovations emerging regularly. Continuous learning, whether through reading, taking online courses, or attending conferences, will help you stay ahead of the curve.

Conclusion

Investing in cryptocurrencies offers unparalleled opportunities for wealth creation, but it comes with significant risks. Whether you’re a long-term investor focusing on major assets like Bitcoin and Ethereum or a short-term trader exploiting the volatility of altcoins, having a solid strategy is crucial. By combining technical and fundamental analysis, practicing disciplined risk management, and staying informed, you can navigate the complex crypto landscape and capitalize on the opportunities it presents in 2024 and beyond.

[sp_easyaccordion id=”3002″]