100 Trading Secrets Exposed for Positive Profits. The world of trading can be both exhilarating and intimidating, especially for those seeking positive profits in today’s volatile markets. Whether you’re a beginner trader stepping into the financial markets for the first time or an experienced investor looking to refine your trading strategies, understanding the core trading secrets that separate successful traders from the rest is crucial for long-term success.

Professional traders don’t rely on luck or gut feelings—they follow time-tested trading techniques and methodologies that have been proven to generate consistent returns. These profitable trading methods aren’t necessarily complex, but they require discipline, patience, and a deep understanding of market dynamics. The difference between winning and losing traders often comes down to knowing these insider secrets and applying them consistently.

In this comprehensive guide, we’ll unveil the top trading secrets that professional traders use to achieve positive profits year after year. From advanced risk management principles to sophisticated market analysis techniques, these insights will transform your approach to trading and help you build a sustainable, profitable trading career. Each secret we reveal has been battle-tested in real market conditions and represents years of collective trading wisdom from industry experts.

The journey to becoming a successful trader isn’t just about learning chart patterns or memorizing technical indicators—it’s about developing a complete trading framework that encompasses psychology, strategy, and execution. These trading secrets will provide you with the foundation needed to navigate any market condition and consistently extract profits from your trading activities.

1. Foundation Trading Secrets for Consistent Profits

Master Your Trading Psychology

The first and most crucial trading secret revolves around mastering your psychological approach to the markets. Emotional trading is the fastest way to destroy your trading account, yet most traders underestimate the psychological challenges they’ll face. Successful traders understand that fear and greed are their biggest enemies, and they develop specific strategies to manage these emotions.

Professional traders implement strict rules to maintain psychological discipline. They never risk more than they can afford to lose, they stick to their predetermined trading plans, and they accept losses as part of the business. This psychological foundation is what separates profitable traders from those who consistently lose money in the markets.

Develop an Unshakeable Trading Plan

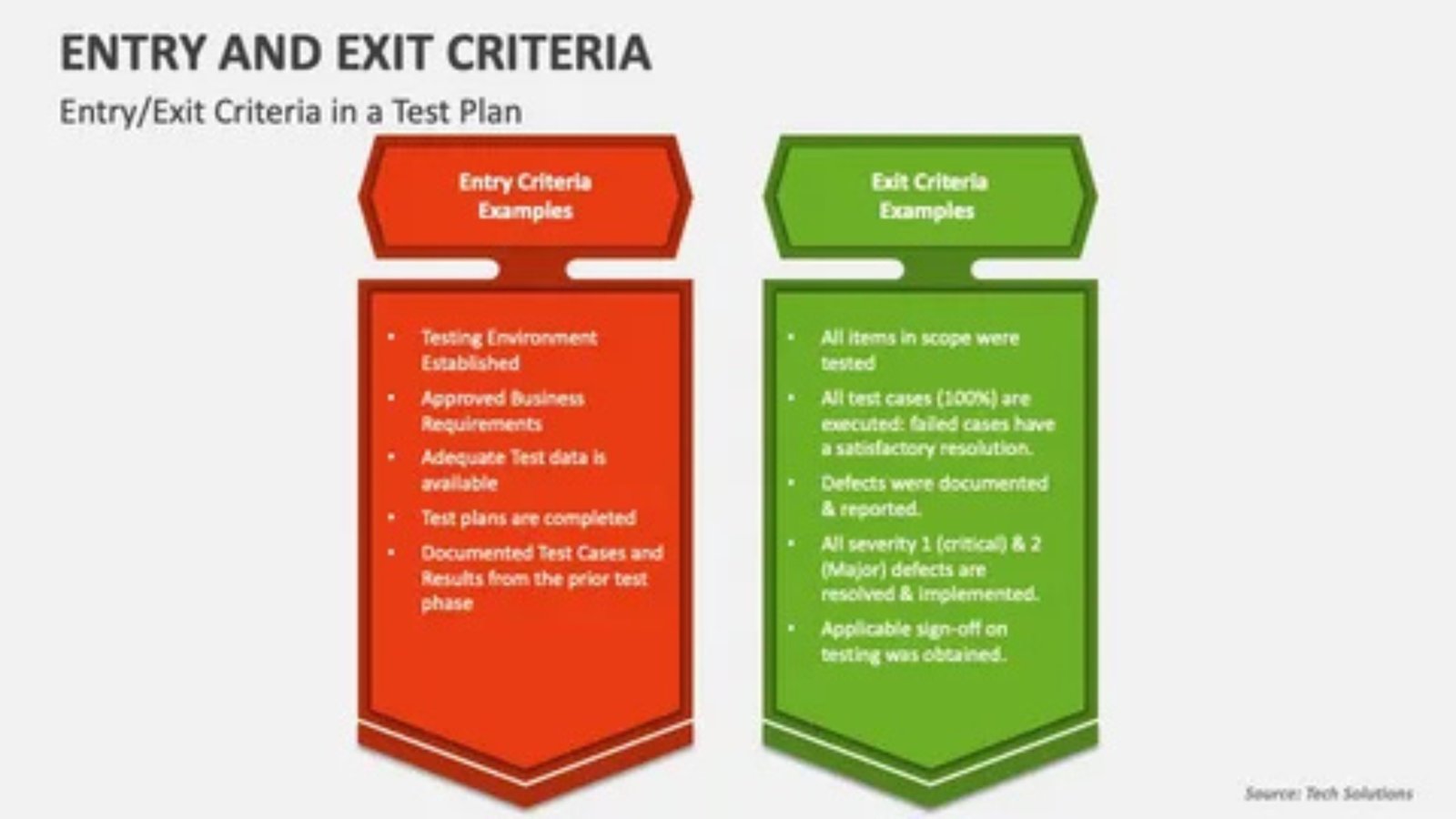

Every profitable trading strategy begins with a comprehensive trading plan. This isn’t just a simple set of rules—it’s a detailed blueprint that covers every aspect of your trading business. Your trading plan should include your risk tolerance, preferred markets, trading strategies, entry and exit criteria, and position sizing rules.

Professional traders spend more time planning their trades than executing them. They analyze market conditions, identify potential opportunities, and prepare for multiple scenarios before placing a single trade. This methodical approach to trade planning is one of the most important trading secrets for achieving positive profits.

2. Advanced Risk Management Trading Secrets

The 2% Rule and Position Sizing Mastery

One of the most fundamental trading secrets involves proper position sizing and risk management. The legendary 2% rule states that you should never risk more than 2% of your trading capital on any single trade. This simple rule has saved countless traders from devastating losses and is a cornerstone of profitable trading.

Risk management goes beyond just limiting losses—it’s about optimizing your risk-to-reward ratios and ensuring that your winning trades significantly outweigh your losing ones. Successful traders typically aim for risk-to-reward ratios of at least 1:2, meaning they risk $1 to potentially make $2 or more.

Stop-Loss Strategies That Actually Work

Implementing effective stop-loss strategies is another critical trading secret that separates professionals from amateurs. Many traders place stop-losses based on arbitrary percentages or round numbers, but profitable traders use more sophisticated methods. They consider market volatility, support and resistance levels, and average true range when setting their stop-losses.

Professional traders also understand the importance of trailing stops and how to adjust them as trades move in their favor. This dynamic approach to risk management allows them to protect profits while still giving their trades room to develop.

3. Technical Analysis Trading Secrets

Price Action Trading Mastery

Price action trading is one of the purest forms of market analysis and represents a collection of powerful trading secrets used by the most successful traders. Unlike indicators that lag behind price movement, price action gives you real-time insight into market sentiment and future price direction.

Professional traders focus on key price action patterns such as pin bars, inside bars, and engulfing patterns. These formations provide high-probability trading opportunities when they occur at significant support and resistance levels. Understanding price action allows traders to make informed decisions without relying heavily on lagging indicators.

Support and Resistance Level Identification

Identifying genuine support and resistance levels is a crucial trading secret that forms the foundation of most profitable trading strategies. These levels represent areas where buying and selling pressure historically converge, creating predictable price reactions that successful traders exploit for profit.

Professional traders use multiple timeframes to identify the most significant support and resistance levels. They understand that levels that have been tested multiple times become stronger, and they know how to trade both bounces from these levels and breakouts through them.

4. Market Analysis and Timing Secrets

Multi-Timeframe Analysis Techniques

One of the most powerful trading secrets involves conducting thorough multi-timeframe analysis before entering any trade. Professional traders never rely on a single timeframe—they analyze the broader trend on higher timeframes and look for precise entry points on lower timeframes.

This market analysis technique helps traders align their trades with the dominant trend while timing their entries for maximum profitability. Successful traders typically use a top-down approach, starting with monthly and weekly charts to identify the overall trend, then moving to daily and hourly charts for trade execution.

Volume Analysis and Market Sentiment

Understanding volume analysis is another critical trading secret that many retail traders overlook. Volume provides crucial insights into the strength of price movements and helps professional traders identify potential reversals and continuations before they become obvious to the general trading public.

Successful traders pay close attention to volume patterns, particularly during breakouts and at key support and resistance levels. High volume confirms the validity of price movements, while low volume often signals weak or unsustainable moves.

5. Entry and Exit Strategy Secrets

Perfect Timing for Trade Entries

Mastering trade entry techniques is one of the most valuable trading secrets for maximizing profitability. Professional traders don’t just identify good trading opportunities—they wait for the perfect moment to enter their positions. This patience and precision in timing can mean the difference between a profitable trade and a losing one.

Successful traders use various entry strategies, including breakout entries, pullback entries, and reversal entries. Each method requires different confirmation signals and risk management approaches, but all share the common goal of entering trades at the most favorable price points possible.

Exit Strategies for Maximum Profits

Knowing when and how to exit trades is arguably more important than knowing when to enter them. Professional traders develop sophisticated exit strategies that allow them to capture maximum profits while protecting their capital. These strategies include profit targets, trailing stops, and partial profit-taking techniques.

The most successful traders understand that exiting trades is both an art and a science. They use technical analysis, market conditions, and risk-reward considerations to determine the optimal exit points for their positions.

6. Advanced Trading Psychology and Discipline

Building Unwavering Trading Discipline

Trading discipline is perhaps the most important trading secret of all, yet it’s also the most difficult to master. Professional traders develop ironclad discipline through years of experience and consistent practice. They create detailed trading rules and follow them religiously, regardless of market conditions or emotional pressures.

Successful traders understand that discipline isn’t just about following rules—it’s about developing the mental fortitude to stick to their trading plans even when facing consecutive losses or missing apparent opportunities. This unwavering commitment to their process is what allows them to achieve positive profits over the long term.

Managing Trading Stress and Emotions

Learning to manage stress and emotions is a crucial trading secret that directly impacts profitability. Professional traders develop specific techniques for handling the psychological pressure that comes with risking money in volatile markets. These techniques include meditation, regular exercise, proper sleep, and maintaining work-life balance.

Successful traders also understand the importance of taking breaks from trading when emotional or stressed. They recognize that trading while in a poor mental state leads to poor decision-making and unnecessary losses.

For More: Crypto Trading Hours: Navigating the Market in 2024

Conclusion

The trading secrets revealed in this comprehensive guide represent decades of collective wisdom from professional traders who have consistently achieved positive profits in various market conditions. These strategies, techniques, and psychological insights form the foundation of successful trading and can transform your approach to the financial markets.

Remember that becoming a profitable trader requires more than just knowledge—it demands consistent practice, disciplined execution, and continuous learning. The trading secrets we’ve discussed aren’t magic formulas, but rather proven methodologies that require dedication and proper implementation to be effective.