SEC crypto regulation, the U.S. Securities and Exchange Commission (SEC) has given up on its earlier attempt to bring Bitcoin companies under its jurisdiction. This change in strategy signals a turning point in the continuous argument on how the United States digital assets ought to be managed. Arguing that many digital assets fit under current securities laws. The SEC has worked for years to control the crypto sector under those rules.

But political pressure, legal disputes, and opposition from business leaders have caused this posture to change. The future of Crypto control is unknown as the SEC distances itself from its first tough stance. The reasons the SEC is reevaluating its regulatory goals, the effects on the bitcoin sector.

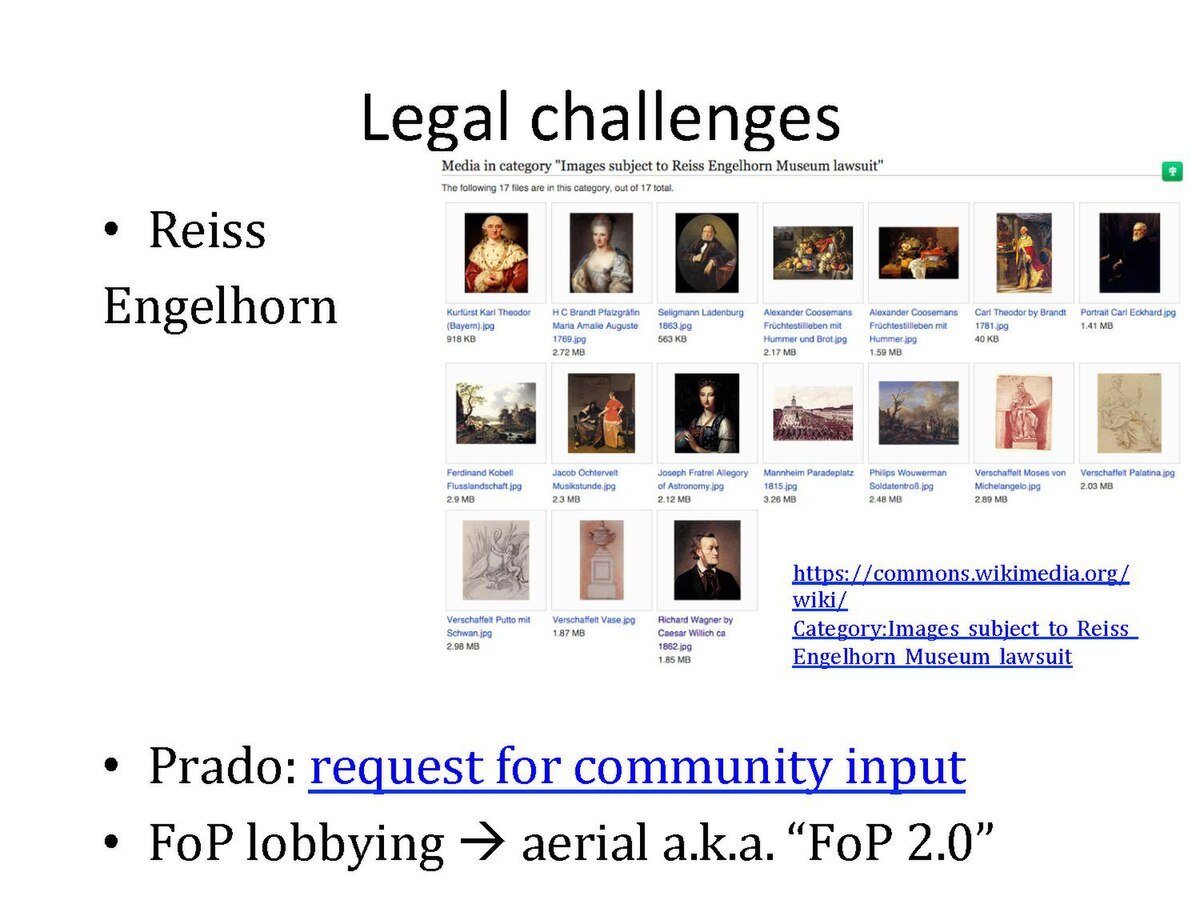

Legal Challenges

Numerous well-publicized court cases have convoluted the SEC’s regulatory drive. The Ripple (XRP) litigation, whereby a U.S. court decided XRP is not a security sold on secondary markets. Among the most well-known examples. This decision made it more difficult for the SEC to enforce rules on digital assets. Since it refuted their claim that most cryptocurrencies should be classified as securities. Further compromising the commission’s power over the sector. Other cryptocurrency companies including Coinbase and Binance have also battled hard against SEC lawsuits.

Clear Legislation

Congress has not yet passed thorough laws defining the position of cryptocurrencies and setting unambiguous rules of regulation. Lack of legal clarity has caused resistance to the SEC’s attempts to control cryptocurrency. The companies from legislators claiming that new laws—not existing securities rules—should control digital assets.

Certain Congressmen have proposed laws to establish a new regulatory system. The differentiating cryptocurrency from conventional financial assets. The SEC’s withdrawal could indicate a greater willingness to let legislators set industry norms.

Resistance and Political Pressure

Crypto industry executives and lobbyists strongly oppose the SEC’s attempts to control the market. Businesses contend that the SEC’s stance inhibits innovation and pushes crypto companies abroad, where legal frameworks might be more friendly.

Political pressure also has a part. Certain U.S. legislators think the SEC’s tactics have been overly forceful and could compromise the nation’s leadership in blockchain technologies. The SEC’s choice might also have been affected by forthcoming elections since legislators are starting to discuss crypto control.

The SEC’s Resource Allocation

Through continuous investigations, lawsuits, and enforcement actions, the SEC might have concluded that its resources would be better used elsewhere. Compared to conventional banking, crypto is still a quite tiny business, hence the commission might prioritize enforcement in areas where its jurisdiction is unambiguous and legal conflicts are less divisive.

Greater Regulatory Uncertainty

Although the SEC’s retreat seems beneficial for the crypto sector, it also generates greater uncertainty. Clear rules help crypto companies negotiate compliance criteria, reducing legal risks and perhaps market instability.

Power to Congress

The SEC’s ruling might assign other U.S. authorities, notably the Commodity Futures Trading Commission (CFTC), which has adopted a more crypto-friendly attitude by designating Bitcoin and Ethereum as commodities rather than securities, responsibility for crypto regulation. Congress might also actively shape new rules, which would either help or hurt the crypto sector depending on how new laws are worded.

Potential Market Growth

Should the SEC’s retreat result in a more favorable regulatory climate, it could inspire institutional investors to enter the crypto market more boldly. Regulatory uncertainty has many financial institutions reluctant to interact with digital assets. The easing of SEC enforcement could result in more acceptance and expansion of the market.

Legal Battles

Despite this strategy shift, the SEC is unlikely to entirely stop its enforcement proceedings against specific crypto companies. Companies the SEC has already sued—like Binance, Coinbase, and Ripple—may still find legal conflict over earlier regulatory disagreements. The general trend, meanwhile, points to the SEC perhaps seeking fewer fresh crypto cases.

Conclusion

The regulatory scene for digital assets will change significantly with the SEC’s decision to relinquish its past initiatives to control crypto companies. Although this action might offer temporary comfort for the sector, it also begs fresh questions regarding future governance of cryptocurrencies. Congress will probably be more involved, so the crypto sector might see new laws that either encourage innovation or impose tougher restrictions develop.

Businesses and institutional investors will closely track changes since the crypto industry’s long-term stability and growth depend on regulatory clarity. Investors and businesses must be educated, flexible, and ready for more changes in the legal environment around digital assets as the argument on crypto control develops.