Trump cryptocurrency policy Adds Crypto to U.S. Strategic Reserve, legally included cryptocurrencies in the country. An unprecedented step that has rocked the banking and bitcoin markets. As investors and analysts expect a new era of universal use and official approval of digital assets. This historic choice has resulted in a noteworthy gain in Crypto Price. Trump’s cryptocurrency policy recent position on cryptocurrencies underscored the significance of blockchain. The technologies and distributed finance (DeFi), profoundly changing American economic policy. With the quick price rises in Bitcoin, Ethereum, and other big cryptocurrencies. This legislative move could greatly affect the world financial system.

A Game-Changer for Crypto

Trump’s cryptocurrency policy declaration occurred during a well-publicized speech on economic strategy. Trump underlined the need for the United States to embrace technology innovation and financial sovereignty. The officially acknowledged alongside conventional assets like gold and foreign currencies as part of a larger goal to increase the country’s reserves. According to Trump, future economic stability will depend much on digital assets—especially Bitcoin and several altcoins.

Trump’s cryptocurrency policy to the U.S. strategic reserve enables the government to acknowledge their value as a contrast to inflation and geopolitical uncertainty. This measure is expected to speed up the institutional acceptance of cryptocurrencies, and big investors and financial institutions remain cautious about regulatory uncertainty.

Crypto Is Joining the Strategic Reserve

Trump cryptocurrency policy choice to include in the strategic reserve fits his pro-business and innovative ideas. Many essential elements helped to produce this historic ruling; Concerned about inflation, Bitcoin and other cryptocurrencies have been increasingly seen as digital gold since their distributed character and resistance to government manipulation provide a barrier against devaluation of money. Trump has also long promoted less reliance on foreign financial systems.

By keeping digital assets, the United States may diversify its reserves and lessen reliance on conventional Crypto vs. Fiat like the Chinese yuan and euro. As witnessed in countries like El Salvador and the Central African Republic, the increasing worldwide acceptance of cryptocurrencies supports this shift and helps the United States to establish leadership in the changing financial scene. Finally, blockchain technology is at the leading edge in financial innovation; acknowledging crypto assets in the strategic reserve shows the nation’s dedication to helping the following generation of digital finance.

Crypto Prices Skyrocket

Right after following Trump’s cryptocurrency policy skyrocketed. Bitcoin was trading about $50,000 before the news; after a few hours, it jumped to about $65,000, among one of its most significant single-day rises. It too saw a considerable rise, surpassing $4,000 as speculators speculated on Ethereum’s future participation in government-backed blockchain initiatives. Other top cryptocurrencies include Solana (SOL), XRP, and Cardano (ADA) recorded double-digit percentage rises.

Institutional Investors Flock to Crypto

Once reluctant because of regulatory issues, institutional investors are now confidently joining the market. Viewed as valid assets in a diverse portfolio, hedge funds, asset managers, and pension funds are raising their crypto holdings. Retail traders also enthusiastically answered, driving a purchasing frenzy on leading cryptocurrency exchanges. As FOMO (fear of missing out) brought fresh players into the market, trading volumes exploded.

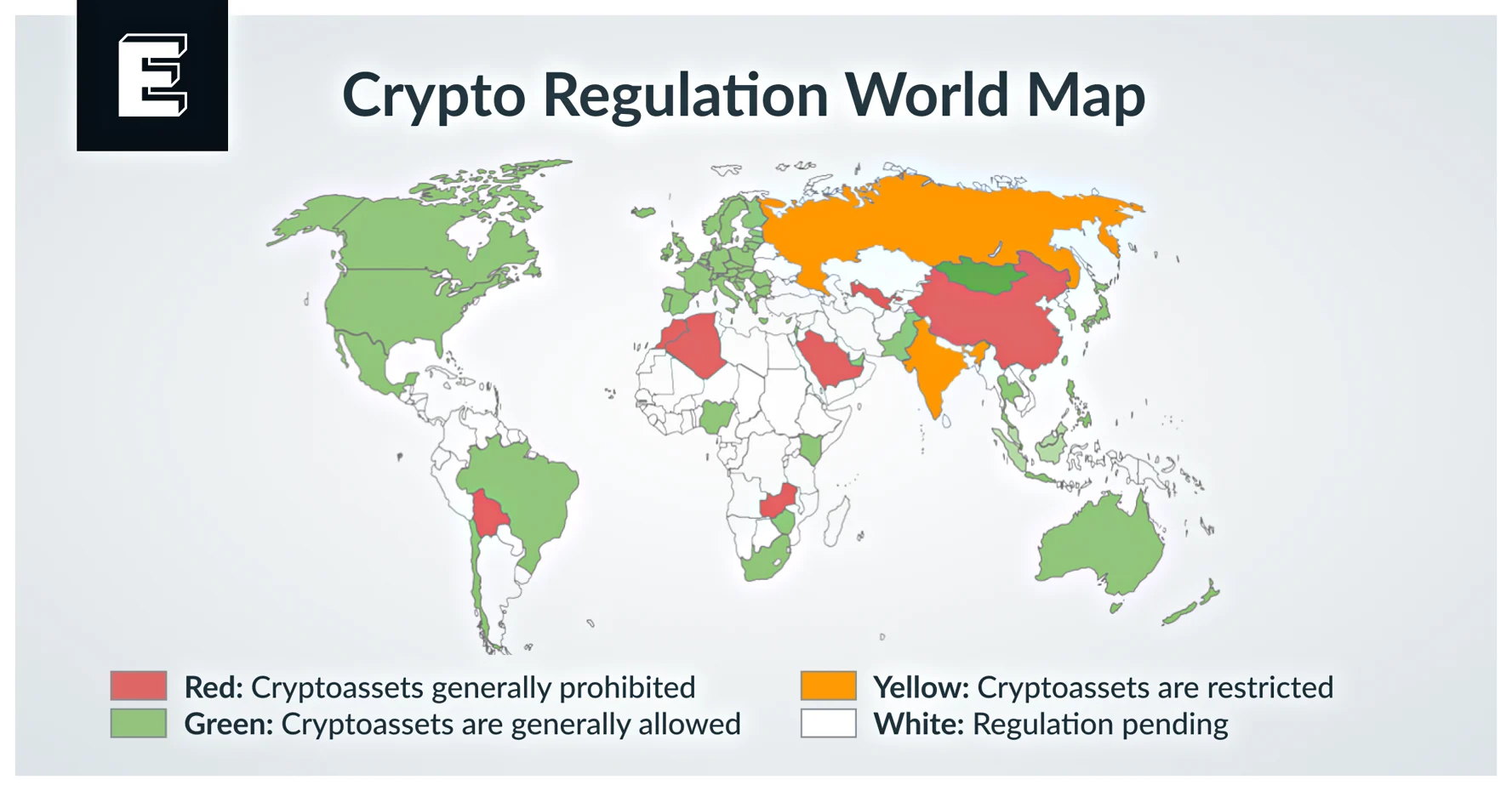

Crypto Regulations and Policy Changes

Trump’s pro-crypto posture will probably shape the American future legislative rules. Although other financial authorities, including the Securities and Exchange Commission (SEC), have maintained a wary attitude, this recent move might result in more positive rules for digital assets. Accepting cryptocurrencies on the strategic reserve could lead to better institutional adoption, trading, and crypto taxes policies.

Furthermore, as crypto is already included in national reserves, there is increasing conjecture about the possible arrival of a U.S. central bank digital currency (CBDC) incorporating blockchain technology. This action could inspire big companies to show Bitcoin and other digital assets on their balance sheets, therefore hastening widespread acceptance.

Future of Cryptocurrencies

Trump’s inclusion of cryptocurrencies in the strategic reserve might have long-lasting consequences for the sector. More government organizations, businesses, and financial institutions could start gathering Bitcoin and other digital currencies as crypto is now an acknowledged reserve asset. This action may also propel the quick growth of tokenized assets and distributed finance (DeFi) based on blockchain technologies.

Trump cryptocurrency policy makers might also advocate more exact crypto rules to guarantee consumer protection and boost mainstream adoption. Globally, other countries could follow the U.S. in including cryptocurrencies into their reserves, validating digital assets and changing the financial scene worldwide.

Conclusion

Trump’s cryptocurrency policy inclusion of cryptocurrencies in the U.S. strategic reserve is a turning point for the digital asset market. The United States is embracing the future of decentralized banking and blockchain technology by making cryptocurrency a national financial reserve asset. Investor optimism is evident in the market’s initial bounce, but the decision’s long-term effects won’t be seen for several months. The crypto sector is entering a new era in which digital assets are crucial to the global financial system due to growing acceptance, changes in regulations, and possible geopolitical repercussions.