The Trump Media and Technology Group has declared that it has filed trademark applications for various brand names associated with its planned exchange-traded funds (ETFs) and structured mutual funds (SMAs), which are scheduled to debut this year. Trademarks about the company’s planned Bitcoin ETFs and SMAs are among those submitted.

Trump Media Trademarks Truth-Fi Bitcoin Plus ETF

Trump Media has said in a news release that it has sought to trademark the Truth. Fi Bitcoin Plus ETF. As of this year, the firm has received six brand name applications associated with its separately managed accounts and customized exchange-traded funds. This is one of them. The business also trademarked the Fi Bitcoin Plus SMA Fund along with the Truth. Truth is also included in the list of trademarks—Truth with Fi Made in America ETF. Truth, Fi Made in America SMA.U.S. Energy Independence Trust (TETF) and Straight Talk This is the U.S. Energy Independence SMA. This news arrived after TMTG announced its intention to invest in Bitcoin and related cryptocurrencies. In particular, the business would put $250 million into Bitcoin, exchange-traded funds, and SMAs via Charles Schwab.

According to Trump Adds Bitcoin , investment vehicles will be part of the new Truth—Fi brand, encompassing financial technology and services. TMTG has announced the launch of Truth—Fix as part of its financial services and FinTech strategy. The company also revealed that Charles Schwab will be the custodian of an investment of up to $250 million.

Trump’s World Liberty Financial Invests $34.8M in Crypto

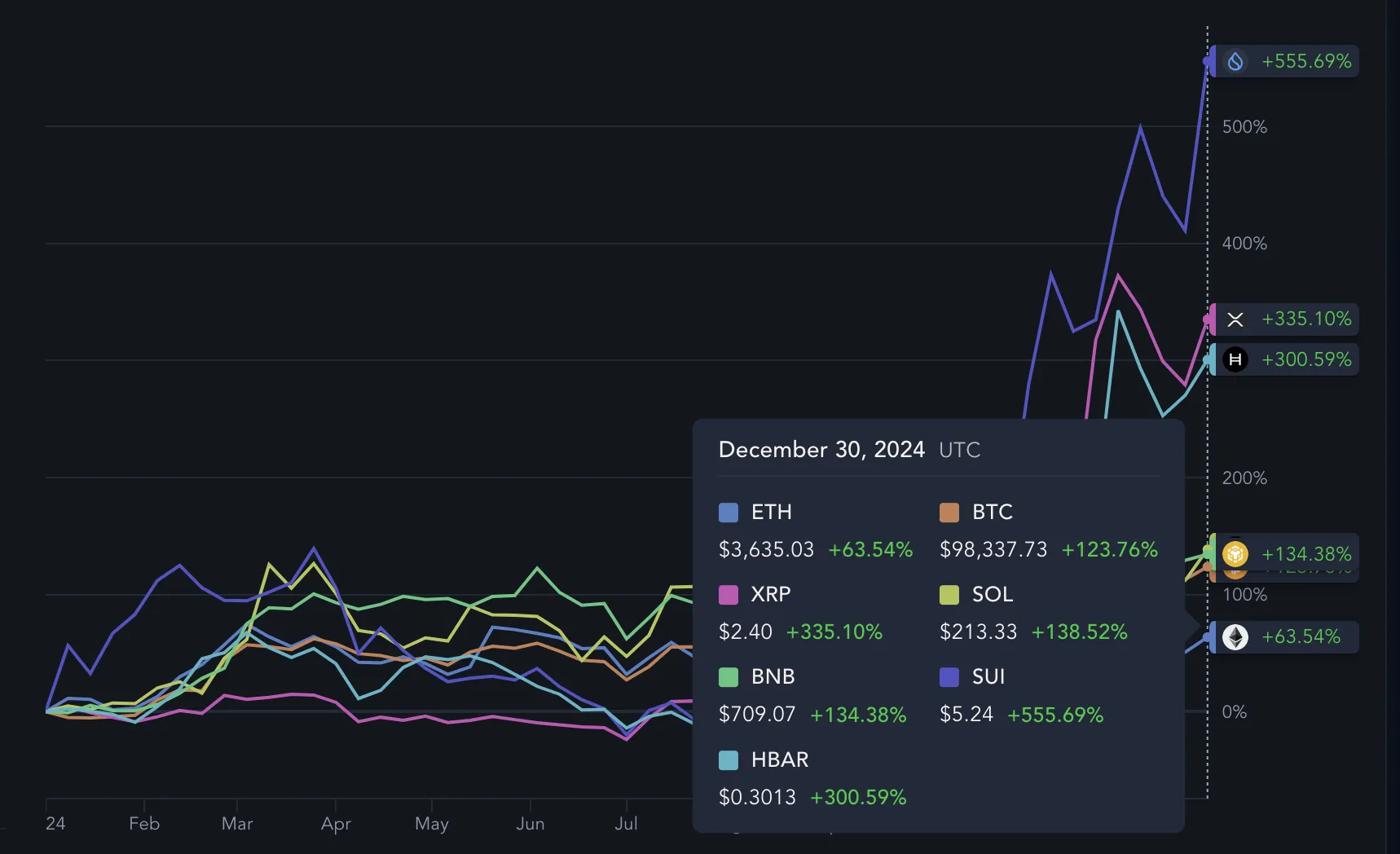

Donald Trump’s World Liberty Financial has also been activerypto space, accumulating several crypto tokens. Arkham Intelligence data shows that the decentralized finance (DeFi) project currently holds $34.8 million worth of crypto. In addition to USDC, Tron (TRX) is the company’s largest crypto holding, with $9.34 million worth of TRX held. The company also has $5 million worth of staked Ethereum and $1.16 million in ETH. A few days ago, Donald Trump’s son, Eric Trump, stated in an X post that he believes now is a great time to buy ETH. In a recent X post, he also opined that now is a great time to buy Bitcoin. World Liberty FFinancial’saccumulation of ETH is one of the significant reasons why crypto analysts predict that the Ehterum could rally to $4,000 soon enough.

The $250 Million Bitcoin Investment

Trump Media has announced its plan to invest heavily in Bitcoin and similar cryptocurrencies alongside its trademark filings. The business intends to use its cooperation with Charles Schwab to invest up to $250 million in Bitcoin, ETFs, and SMAs. This massive investment reflects the firm’s increasing optimism about blockchain and digital assets.

As the investment’s custodian, Charles Schwab will keep them safe and comply with all applicable regulations. This is a massive step for Trump Meme Coin , which shows they are serious about diversifying their holdings and looking into the cryptocurrency market. The participation of Schwab is significant because the company is a reputable financial institution that has been providing investing services for a long time. Its decision to pour a lot of money into Bitcoin and other cryptocurrencies shows its confidence in its future as a mainstream financial instrument. It also lays the groundwork for future growth as TMTG establishes itself as a major player in the economic and cryptocurrency industries.

Final Thoughts

Trump Media and Technology Group’s strategic move into cryptocurrency signals a significant shift in the company’s financial approach. By filing for trademarks for Bitcoin-related ETFs and separately managed accounts (SMAs), as well as committing up to $250 million in Bitcoin investments, TMTG is positioning itself at the forefront of the emerging crypto and fintech markets. The partnership with Charles Schwab as a custodian underscores the credibility and security of this ambitious venture.

Simultaneously, World Liberty Financial, under the Trump brand, continues its push into decentralized finance, holding millions in crypto assets, including significant amounts in Ethereum. As crypto markets grow, such investments signal a long-term belief in the sector’s potential. These efforts reflect TMTG’s commitment to innovation, diversification, and seizing new opportunities in the evolving digital asset world. With the support of a trusted financial partner like Schwab and growing confidence in blockchain technologies, Trump Media’s bold financial strategy could pave the way for future success, further blending traditional finance with emerging cryptocurrencies.