The token supply release altcoins event has investors on high alert, as historical patterns suggest substantial price volatility typically follows large-scale unlock events. Understanding how these cryptocurrency unlock events work and which projects are affected could mean the difference between protecting your portfolio and watching your investments decline in value.

Token unlocks represent one of the most critical yet often overlooked aspects of cryptocurrency investing. When projects release previously locked tokens into circulation, the sudden increase in available supply can create selling pressure that drives prices downward. For retail investors holding these altcoins, the upcoming token unlock schedule represents both a warning signal and a potential opportunity for those prepared to navigate the volatility.

Token Supply Release Mechanics in Cryptocurrency Markets

The concept of token supply release altcoins stems from the vesting schedules that blockchain projects implement during their initial development and fundraising phases. When projects conduct initial coin offerings, private sales, or allocate tokens to team members and early investors, they typically lock these assets for predetermined periods. This mechanism serves multiple purposes within the broader blockchain token economics framework.

Vesting schedules prevent early investors and team members from immediately dumping their holdings onto the market, which would create catastrophic price crashes and undermine long-term project viability. However, when these lockup periods expire, the market must absorb a significant influx of newly circulating tokens. The token vesting schedule becomes a critical factor that sophisticated investors monitor closely when evaluating potential investments.

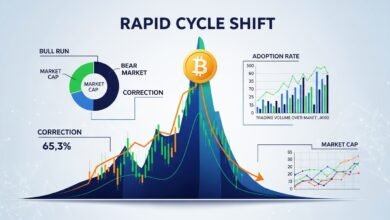

The mechanics behind these releases vary considerably across different projects. Some implement linear vesting, where tokens unlock gradually over time, while others use cliff vesting, releasing large quantities at specific intervals. The $321 million figure represents an aggregation of multiple projects reaching their unlock milestones simultaneously, creating a perfect storm of potential altcoin price volatility.

Which Altcoins Face Major Token Unlocks This Month

Several prominent blockchain projects are scheduled for significant token distribution events that contribute to the overall $321 million figure. These releases span various sectors within the cryptocurrency ecosystem, from decentralized finance protocols to layer-one blockchain networks and gaming tokens.

Aptos, the layer-one blockchain that has garnered significant attention for its technical innovations, faces one of the largest individual unlock events. Approximately 11.31 million APT tokens, valued at roughly $84 million at current market prices, are scheduled for release. This represents a substantial portion of the circulating supply and has already prompted discussions among holders about potential price impacts.

Optimism, the Ethereum layer-two scaling solution, also confronts a major unlock event with 24.16 million OP tokens entering circulation. Valued at approximately $31 million, this release comes at a crucial time for the network as it competes with other scaling solutions for market dominance. The crypto supply inflation from this unlock could test the resilience of OP’s price structure.

Arbitrum, another leading Ethereum scaling solution, faces its own cryptocurrency unlock events with 92.65 million ARB tokens scheduled for distribution. The sheer volume of tokens, worth around $56 million, represents one of the most significant single-project unlocks in this cycle. Historical precedent suggests ARB holders should prepare for increased volatility.

Several smaller but notable projects also contribute to the total figure. Immutable X, a layer-two solution focused on NFTs and gaming, will see 32.47 million IMX tokens unlocked, valued at approximately $24 million. Meanwhile, projects like Starknet, Ethena, and Sui each face unlock events ranging from $15 million to $30 million, collectively adding substantial selling pressure to the market.

Historical Patterns: How Token Unlocks Have Impacted Altcoin Prices

Examining historical token supply release altcoins events provides crucial insights into likely market behavior. Data from previous unlock cycles reveals consistent patterns that investors can use to inform their strategies. The relationship between unlock events and price action, while not perfectly predictable, demonstrates clear tendencies that warrant attention.

Research analyzing hundreds of unlock events across different market conditions shows that prices typically decline by an average of fifteen to thirty percent in the two weeks following major token releases. This crypto market dump phenomenon occurs regardless of broader market sentiment, though the magnitude varies based on factors like project fundamentals, holder composition, and overall cryptocurrency market conditions.

The selling pressure originates from multiple sources. Early investors who purchased tokens at substantial discounts often take profits immediately upon unlock, viewing the event as their exit opportunity. Team members and advisors receiving vested tokens may liquidate portions to cover expenses or diversify their holdings. Even investors who believe in the long-term project vision sometimes sell into strength if they anticipate short-term price weakness.

However, not all unlock events result in catastrophic price declines. Projects with strong fundamentals, active development communities, and genuine utility often weather unlock events with minimal lasting damage. The key differentiator typically relates to the ratio of unlocked tokens to existing circulating supply and the broader narrative surrounding the project at the unlock time.

Projects that communicate transparently about their token vesting schedule and maintain strong community engagement tend to perform better during unlock periods. Conversely, projects with weak fundamentals or those facing competitive pressures often experience exaggerated selloffs when unlock events coincide with broader market uncertainty.

The Psychological Impact of Supply Inflation on Crypto Investors

Beyond the mechanical aspects of increased token circulation, token supply release altcoins events carry significant psychological weight within cryptocurrency markets. The anticipation of unlocks creates self-fulfilling prophecies as investors adjust positions ahead of expected volatility, amplifying the very price movements they seek to avoid.

Many retail investors lack sophisticated understanding of blockchain token economics, leading to panic selling when they learn about upcoming unlocks. This information asymmetry benefits institutional investors and professional traders who monitor unlock schedules systematically and position accordingly. The psychological component transforms what might be a modest supply increase into a major market-moving event.

Fear of opportunity cost also drives behavior during unlock periods. Investors holding tokens scheduled for major releases face a difficult decision: sell before the unlock to avoid potential losses, or maintain positions betting on project fundamentals overcoming temporary selling pressure. This dilemma creates heightened emotional trading that increases volatility beyond what pure supply-demand mechanics would suggest.

Social media amplifies these psychological effects. When prominent crypto influencers highlight upcoming unlock events, their followers often react immediately, creating cascading selling pressure even before tokens actually enter circulation. The altcoin price volatility resulting from these anticipatory movements can exceed the impact of the actual unlock event itself.

Strategic Approaches for Navigating Token Unlock Events

Sophisticated investors employ various strategies when confronting cryptocurrency unlock events of this magnitude. Understanding these approaches can help retail investors make more informed decisions about their holdings during high-risk periods.

The first strategy involves temporary position reduction ahead of known unlock dates. Investors who believe in a project’s long-term prospects but want to avoid short-term volatility might sell portions of their holdings before the unlock, planning to repurchase at lower prices post-event. This approach requires careful timing and acceptance of potential opportunity cost if prices don’t decline as expected.

Another approach focuses on identifying projects where unlock events are already priced into current valuations. When the market anticipates a token distribution event and prices adjust downward in advance, the actual unlock may trigger relief rallies as realized selling pressure proves less severe than feared. Contrarian investors sometimes accumulate during pre-unlock weakness, positioning for post-unlock recovery.

Diversification becomes particularly important during periods of concentrated unlock activity. Rather than maintaining heavy exposure to projects facing imminent unlocks, investors can rebalance toward assets with favorable unlock calendars or those that have already absorbed their major distribution events. This approach reduces portfolio vulnerability to crypto supply inflation across multiple holdings simultaneously.

Some investors adopt options-based strategies when available, using derivatives to hedge against downside risk while maintaining upside exposure. Though options markets remain less developed for altcoins compared to major assets like Bitcoin and Ethereum, they provide valuable tools for managing altcoin investment risks during unlock events.

Fundamental Analysis: Separating Quality Projects from Overvalued Tokens

While token supply release altcoins events create short-term volatility, fundamental analysis helps investors distinguish between temporary price dislocations and structural overvaluation. Projects with strong fundamentals often present buying opportunities during unlock-driven selloffs, while weaker projects may never recover their pre-unlock valuations.

Key fundamental metrics include development activity, network usage, revenue generation, and competitive positioning. Projects that demonstrate consistent growth in on-chain metrics, active developer communities, and real-world adoption often rebound quickly from unlock-related price declines. The temporary crypto market dump creates entry points for long-term investors who focus on underlying value rather than short-term price movements.

Revenue-generating protocols deserve particular attention during unlock periods. Projects that capture meaningful value through fees, with clear paths to sustainability, typically recover faster than purely speculative tokens. The ability to generate cash flow provides fundamental support that eventually overpowers temporary selling pressure from token vesting schedule expirations.

Competitive analysis also matters significantly. Projects operating in crowded sectors with numerous competitors face greater challenges during unlock events, as investors have multiple alternatives. Conversely, projects with unique value propositions or dominant market positions can weather supply inflation more effectively, as demand remains relatively inelastic despite increased token availability.

Technical Analysis: Identifying Support Levels During Token Releases

Technical analysis provides valuable tools for navigating token supply release altcoins events, helping investors identify key price levels where buying interest might emerge. Understanding chart patterns and support zones becomes crucial when fundamental catalysts like unlocks drive price action.

Support levels established during previous trading ranges often serve as targets during unlock-driven selloffs. Traders monitor these levels closely, as they represent prices where substantial buying interest previously emerged. If unlock selling pressure drives prices toward historical support, these levels frequently attract buyers willing to bet on reversal.

Volume analysis reveals important insights about unlock event severity. Unusually high volume during price declines suggests extensive distribution occurring, while low volume selloffs indicate relatively light selling pressure. Projects experiencing high-volume dumps during cryptocurrency unlock events may require longer recovery periods, as the extensive distribution indicates broad selling interest rather than isolated profit-taking.

Momentum indicators like the Relative Strength Index help identify oversold conditions during unlock events. When altcoin price volatility drives indicators into extreme oversold territory, mean reversion becomes increasingly likely. Contrarian traders use these signals to identify potential entry points, though they remain cautious about catching falling knives.

Moving averages provide dynamic support and resistance levels during unlock periods. Projects trading significantly below major moving averages face steeper recovery challenges, as these levels often act as resistance during bounce attempts. Conversely, projects that maintain positions above key moving averages despite unlock pressure demonstrate relative strength that may attract accumulation.

The Role of Market Makers and Institutional Investors

Understanding how professional market participants approach token supply release altcoins events provides insight into likely price action. Market makers and institutional investors employ sophisticated strategies that retail investors should recognize to avoid becoming exit liquidity.

Market makers often reduce their activity or widen spreads ahead of major unlock events, recognizing the increased risk these events create. This reduced liquidity amplifies price movements in both directions, as smaller order sizes create larger percentage changes. The blockchain token economics of reduced liquidity during high-volatility periods creates challenging trading conditions for retail participants.

Institutional investors typically research unlock schedules thoroughly during their due diligence process, factoring expected supply increases into their valuation models. When institutions identify projects where current prices fail to reflect upcoming token distribution events, they may take short positions or reduce holdings ahead of anticipated declines. This institutional front-running creates downward pressure even before tokens actually unlock.

Some sophisticated investors employ strategies that profit from unlock-driven volatility regardless of price direction. Volatility trading approaches, market-neutral strategies, and other advanced techniques allow professionals to generate returns from the increased price swings without taking directional bets. Retail investors competing against these strategies face disadvantages in information, execution speed, and risk management capabilities.

Long-Term Implications of Token Unlocks for Project Development

Beyond immediate price impacts, cryptocurrency unlock events carry long-term implications for project development and sustainability. How projects and their communities navigate major unlock periods often reveals important information about their long-term viability and governance quality.

Projects that successfully weather major unlocks without catastrophic price declines demonstrate strong fundamental support and community conviction. This resilience attracts additional investors who view the project as having passed a significant stress test. The ability to maintain relatively stable prices despite substantial crypto supply inflation signals healthy demand that can absorb increased token circulation.

Conversely, projects experiencing severe, sustained price declines following unlocks may face challenges attracting future investment and partnership opportunities. Damaged price charts and holder disappointment create negative momentum that proves difficult to reverse. These projects must work harder to rebuild credibility and demonstrate value to overcome the shadow cast by poorly received unlock events.

The token vesting schedule itself provides insights into project founders’ long-term commitment and alignment with token holders. Projects with extended vesting periods for team tokens demonstrate founder confidence and commitment to long-term success. Short vesting periods or front-loaded distribution schedules may indicate founders prioritizing short-term liquidity over sustained project development.

Treasury management during unlock periods also reveals governance quality. Projects that communicate clearly about their response to unlock events, potentially implementing buyback programs or other support mechanisms, demonstrate sophisticated understanding of altcoin investment risks and commitment to price stability. Lack of communication or reactive panic measures suggests weaker governance that may struggle with future challenges.

Regulatory Considerations and Token Classification

The regulatory environment surrounding token supply release altcoins events continues evolving, with potential implications for how projects structure their distribution schedules and how investors should approach these events. Understanding the regulatory landscape helps investors assess risks beyond pure price volatility.

Securities regulators in various jurisdictions increasingly scrutinize token distribution mechanisms, particularly when significant portions of supply remain locked and controlled by project teams and early investors. The token distribution structure can influence whether regulators classify tokens as securities, with major implications for trading restrictions, investor protection requirements, and compliance obligations.

Projects operating in jurisdictions with clear regulatory frameworks face different risk profiles than those in regulatory gray areas. Investors should consider regulatory clarity as a factor when evaluating exposure to tokens facing major unlock events. Projects with transparent compliance programs and proactive regulatory engagement generally present lower long-term risk despite short-term altcoin price volatility.

Tax implications of unlock events also deserve attention, particularly for team members and early investors receiving vested tokens. The tax treatment of newly unlocked tokens varies by jurisdiction but often creates additional selling pressure as recipients liquidate portions to cover tax obligations. This tax-driven selling adds to normal profit-taking, amplifying the crypto market dump effect.

Building a Resilient Portfolio Amid Token Unlock Uncertainty

Creating a cryptocurrency portfolio resilient to token supply release altcoins events requires intentional strategy and ongoing monitoring. Investors who incorporate unlock schedules into their portfolio construction process can reduce vulnerability to these predictable volatility events.

Position sizing becomes crucial when holding tokens with upcoming major unlocks. Rather than maintaining oversized positions in any single asset, diversification across multiple projects with staggered unlock schedules reduces concentration risk. This approach ensures that even if several holdings experience unlock-related declines, the portfolio impact remains manageable.

Regular portfolio rebalancing around unlock events helps maintain desired risk levels. As unlock dates approach for portfolio holdings, investors can systematically reduce positions to predetermined target levels, removing emotion from the decision-making process. This disciplined approach prevents the paralysis that often accompanies significant unrealized losses.

Monitoring blockchain token economics metrics across portfolio holdings helps identify early warning signs of problematic unlock events. Projects with unusually large percentages of supply scheduled for near-term unlock relative to current circulation deserve closer scrutiny. High unlock-to-circulation ratios indicate elevated risk that may warrant position reduction or hedging strategies.

Maintaining a portion of portfolio value in stablecoins provides flexibility to capitalize on unlock-driven price dislocations. When quality projects experience exaggerated selloffs during cryptocurrency unlock events, having dry powder available allows investors to add positions at favorable prices. This opportunistic approach transforms unlock volatility from pure risk into potential opportunity.

Conclusion

Investors holding affected tokens should review their positions carefully, considering their investment timeframes, risk tolerance, and conviction in underlying project fundamentals. Those with short-term orientations or lower risk tolerance might consider reducing exposure ahead of major unlocks, accepting potential opportunity cost in exchange for certainty. Long-term investors with strong fundamental conviction may view unlock-driven weakness as accumulation opportunities, though they should prepare psychologically for potential volatility.

The key to successfully navigating cryptocurrency unlock events lies in combining multiple analytical approaches. Technical analysis identifies potential support levels and oversold conditions, fundamental analysis separates quality projects from overvalued tokens, and awareness of market participant psychology helps anticipate behavior during high-stress periods. Investors who integrate these perspectives position themselves to make informed decisions rather than reactive emotional choices.

As the cryptocurrency market matures, token supply release altcoins events will continue presenting both challenges and opportunities. Projects that navigate major unlocks successfully demonstrate resilience that attracts long-term investment, while those that stumble reveal weaknesses that may persist. For investors, understanding these dynamics and preparing accordingly represents essential skill development in the evolving digital asset landscape.

Stay informed about upcoming token unlock schedules, monitor your portfolio’s exposure to near-term unlock events, and develop clear strategies for managing positions during high-volatility periods. The $321 million token release approaching represents just one event in an ongoing series of supply inflations that characterize cryptocurrency markets. Those who master these recurring challenges position themselves for long-term success regardless of short-term market turbulence.

See more;Here’s What to Watch Out for in Altcoins This Week | 2026 Guide