With new statistics showing that their selling pressure has reached its lowest point since 2024, Bitcoin miners are showing a notable change in their selling behavior. Given the difficulties miners encountered earlier in the year, this is particularly significant. Among several elements influencing this evolution are increased profitability, strategic reserve building, and a decrease in network activity.

Miners Reduce Sales

On-chain analytics company CryptoQuant claims Bitcoin miners have drastically cut daily revenues. Miners sold about 800 BTC daily in late 2023, but by early 2024 this figure had dropped to less than 300 BTC daily. This decline in selling activity points to miners keeping rather than selling their reserves for running expenses.

Measures of miner selling activity, the Miner Position Index (MPI), have also dropped, suggesting less demand to sell. The MPI dropped considerably from past levels in February 2025 to -0.027.

Bitcoin Mining Strategy

Many miners are choosing to build reserves of Bitcoin despite diminishing profitability. Large American mining companies like Marathon Digital Holdings, Riot Platforms, and CleanSpark—who have financed over $3.7 billion since November 2024 to buy more Bitcoin—show very clear evidence of this approach. These businesses want to strengthen their positions against growing operating expenses, including high energy prices and more competition from artificial intelligence (AI) developers for computing resources.

The choice to build reserves instead of selling fits the Puell Multiple, a measure of miner income against annual average. Early 2025 saw the Puell Multiple remain constant at 1.1, implying that miners view current pricing as negative for mass selling.

Bitcoin Miner Challenges

A further element affecting miner selling behavior is the drop in Bitcoin network activity. From a peak of 731,000 in late December 2023 to a three-month low of 278,000, daily transactions have dropped. Reduced involvement in Ordinal inscriptions and BRC-20 token transactions—especially those using Taproot addresses, which have seen a 76% drop—contributes to this drop in activity.

Bitcoin transaction fees have therefore dropped by 90% from mid-December 2023 to early February 2025, so reducing a major source of income for miners. Miners have kept their shares in the face of these difficulties, suggesting belief in the long-term worth of Bitcoin.

Bitcoin Price Drivers

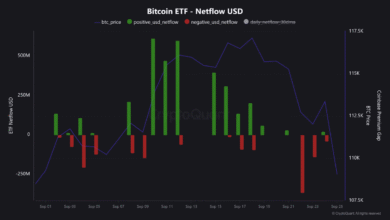

The reduced selling pressure from miners could have positive implications for Bitcoin’s price stability and potential growth. With fewer coins entering the market from miner sales, the supply-side pressure diminishes, which could support upward price movement, especially if demand increases.

While strong fiat currencies or rising rates can lessen its appeal, high inflation or interest rate reduction can stimulate demand for Bitcoin as a hedge. Major institutions’ growing curiosity about ETFs or custodial services helps to validate Bitcoin and promote higher pricing. While rigorous crackdowns can lower the price, favorable laws like ETF licenses or clear legal status help to increase investor confidence.

Enhancements to the Bitcoin network or scalable alternatives like the Lightning Network can increase adoption and price potential.Halving events limit supply, which traditionally results in price increases months later, when fewer new coins enter circulation. Crises like conflicts or sanctions can drive more Bitcoin use, particularly in areas with capital restrictions, hence driving demand.

Whether based on facts, changes in investor mood, or viral narratives can lead to quick swings in the price of Bitcoin.

Additionally, the strategic accumulation of reserves by miners suggests a bullish outlook on Bitcoin’s future price potential. By holding onto their assets, miners are positioning themselves to benefit from any future price appreciation, indicating confidence in Bitcoin’s long-term value proposition.

Final thoughts

With decreased network activity, strategic reserve building, and lower selling pressure, the present scene of Bitcoin mining exposes a notable change in miner behavior. These elements point to miners using a more careful and long-term attitude toward their holdings. Driven by lower supply-side pressure and more miner confidence, the present patterns show a perhaps more stable environment for Bitcoin’s price, even if obstacles still exist.

With a 0.054% rise from the last close, Bitcoin’s price as per the most recent figures is $104,437. The low was $103,719; the intraday high came at $105,525. These numbers highlight the continuous dynamics of the market shaped by miner operations and more general economic conditions.