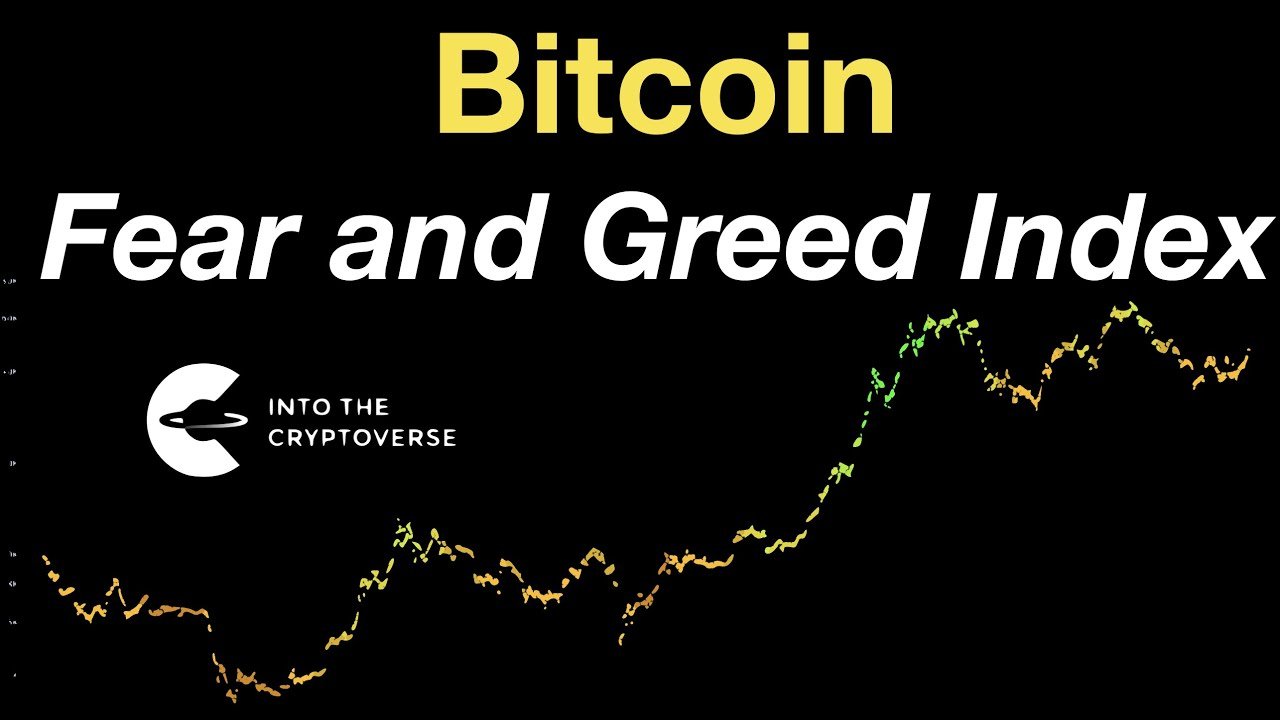

Fear Index Flashes. The Bitcoin Greed & Fear Index has plunged to some of its lowest readings of the cycle, signalling extreme pessimism across the crypto market. According to research firm 10x Research, the index has dropped to below 5 points, with its 21-day moving average hovering near 10%—levels that historically aligned with tactical bottoms in Bitcoin’s price. This sharp collapse in crypto market sentiment comes after a brutal sell-off that dragged Bitcoin from record highs above $120,000 down into the low–mid $80,000 region in November 2025, erasing more than 30% from its recent peak and over $1 trillion in overall crypto market value. Massive leveraged liquidations, waning ETF inflows, and rising macro uncertainty have fuelled a wave of fear, capitulation, and risk aversion.

What Is the Bitcoin Greed & Fear Index?

The Bitcoin Greed & Fear Index is a sentiment indicator that attempts to quantify the emotional state of Bitcoin investors on a scale from 0 to 100, where 0 represents maximum fear and 100 represents maximum greed. Similar versions exist under names like the Crypto Fear and Greed Index, but the logic is broadly the same: compress various sentiment drivers into a single, easy-to-read gauge.10x Research’s proprietary “Greed & Fear” gauge, which is in focus right now, aggregates similar factors and then smooths them using a 21-day simple moving average to identify more persistent shifts in sentiment. The idea is simple but powerful: when most people are terrified and selling, forward returns often improve; when everyone is euphoric and chasing parabolic gains, risk tends to be under-priced. Fear Index Flashes.

The Bitcoin Greed & Fear Index is a sentiment indicator that attempts to quantify the emotional state of Bitcoin investors on a scale from 0 to 100, where 0 represents maximum fear and 100 represents maximum greed. Similar versions exist under names like the Crypto Fear and Greed Index, but the logic is broadly the same: compress various sentiment drivers into a single, easy-to-read gauge.10x Research’s proprietary “Greed & Fear” gauge, which is in focus right now, aggregates similar factors and then smooths them using a 21-day simple moving average to identify more persistent shifts in sentiment. The idea is simple but powerful: when most people are terrified and selling, forward returns often improve; when everyone is euphoric and chasing parabolic gains, risk tends to be under-priced. Fear Index Flashes.

Historical Patterns: How Extreme Fear Has Played Out Before

Over multiple cycles, sentiment crashes have tended to cluster around major inflection points: Analyses of the Bitcoin Greed & Fear Index and its cousins show that very low readings have historically aligned with oversold conditions, elevated volatility, and market capitulation—the kind of environment in which new buyers with a long-term mindset begin to step in.

That said, history never repeats perfectly. The current cycle features new variables like spot Bitcoin ETFs, greater institutional participation, and more complex derivatives markets, all of which can change how quickly sentiment turns and how violent each leg of the cycle becomes. Fear Index Flashes.

How Traders Use the Bitcoin Greed & Fear Index in Practice

Common Mistakes With Sentiment Indicators

Key Takeaways as the Bitcoin Greed & Fear Index Hits Lows

Right now, the Bitcoin Greed & Fear Index is sending a loud and clear message: extreme pessimism dominates the market. With readings below 5 points and a 21-day average near 10%, sentiment is at record-low levels for this cycle, historically associated with tactical lows and interim bottoms. Fear Index Flashes.

Right now, the Bitcoin Greed & Fear Index is sending a loud and clear message: extreme pessimism dominates the market. With readings below 5 points and a 21-day average near 10%, sentiment is at record-low levels for this cycle, historically associated with tactical lows and interim bottoms. Fear Index Flashes.

For traders, this may be a period to watch closely for signs of stabilization, manage risk carefully, and look for technical confirmation before making big bets. For long-term investors, it’s another reminder that Bitcoin’s path is rarely smooth and that some of the best opportunities have historically appeared when the crowd is most afraid. Nothing in this article is financial advice, but understanding the psychology behind metrics like the Bitcoin Greed & Fear Index can help you navigate the emotions of the crypto cycle with more clarity and less panic.

Conclusion

A rapid drop from record highs, huge liquidations, and negative ETF and sentiment flows have driven investors into maximum pessimism. Analysts from 10x Research and others argue that such conditions often coincide with tactical bottoms, where the downside momentum begins to fade and the probability of a short-term BTC price rebound increases. History supports the idea that when fear is at its peak, forward returns tend to improve—at least over shorter time horizons.

Yet the line between a tactical bottom and a full cycle bottom remains uncertain. Macro factors, regulatory headlines, and large institutional flows can still push Bitcoin lower or prolong volatility. That’s why the smartest way to use the Bitcoin Greed & Fear Index is as a contextual guide—a way to understand where emotions sit on the spectrum—rather than a do-or-die signal. Whether you are a short-term trader or a long-term believer in Bitcoin, being aware of crowd psychology can help you avoid buying into hype at the top and panic-selling at the bottom. The index might be telling us that fear is peaking.

FAQs

Q. What exactly is the Bitcoin Greed & Fear Index?

The Bitcoin Greed & Fear Index is a sentiment gauge that scores market emotion on a scale from 0 (maximum fear) to 100 (maximum greed). When readings are very low, it signals extreme fear; very high readings signal extreme greed.

Q. Why do analysts say extreme fear can signal a tactical bottom?

Analysts view extreme fear as a potential sign that capitulation has taken place—many weak hands have already sold, leveraged positions have been liquidated, and selling pressure may be close to exhaustion. Historically, such environments have often preceded short-term rebounds in BTC price, which is why they are associated with tactical bottoms.” signal?

A low reading is not a guaranteed buy signal, but rather a contrarian indicator. It tells you that the crowd is extremely pessimistic, which historically has improved forward returns on average. Still, the index should be used together with other tools—such as technical analysis, on-chain data, and macro context. Sensible position sizing and risk management remain crucial, and any investment decision should reflect your time horizon and risk tolerance, not just the index value.

Q. How often does the index reach extreme pessimism?

The Bitcoin Greed & Fear Index enters extreme fear territory periodically during sharp corrections, bear markets, or major liquidation events. It doesn’t stay there constantly; instead, it tends to spike to ultra-low levels near episodes of panic selling and then gradually recover as prices stabilize and confidence returns. The current readings—below 5 points with a 21-day average near 10%—are rare and indicate some of the most negative sentiment seen in the current cycle.

Q. How should beginners use the Bitcoin Greed & Fear Index?

For beginners, the index is best used as an educational compass. It can help you see how sentiment swings from fear to greed, highlight how emotional markets can be, and remind you not to blindly follow the crowd. Instead of using it as a stand-alone signal, use it to: By viewing the Bitcoin Greed & Fear Index as a way to understand market psychology—rather than a magic predictor—you can make more rational decisions in a very emotional market.