The cryptocurrency market in 2025 has become a battlefield of innovation, regulation, and unprecedented volatility. As we navigate through the first three quarters of this transformative year, the digital currency ecosystem continues to evolve at breakneck speed, leaving investors, traders, and industry experts scrambling to keep pace with the rapid developments.

The crypto news trends emerging in 2025 are fundamentally different from previous years, characterized by mainstream institutional adoption, revolutionary technological breakthroughs, and comprehensive regulatory frameworks that are reshaping how we perceive and interact with digital assets. From the rise of decentralized finance (DeFi) protocols to the integration of artificial intelligence in blockchain networks, the landscape has become increasingly complex and sophisticated.

What makes 2025 particularly remarkable is the convergence of multiple technological and economic factors. The blockchain technology infrastructure has matured significantly, enabling more scalable and efficient networks. Meanwhile, traditional financial institutions have moved beyond cautious observation to active participation, creating a bridge between conventional finance and the crypto ecosystem.

This comprehensive analysis explores the most shocking crypto news trends that are currently rocking the market, examining their implications for investors, the broader financial system, and the future of digital currencies. From regulatory developments that could reshape entire markets to technological innovations that promise to solve long-standing scalability issues, these trends are not just making headlines – they’re fundamentally altering the trajectory of the cryptocurrency industry.

The Regulatory Revolution: Government Policies Transforming Crypto Markets

Central Bank Digital Currencies (CBDCs) Go Mainstream

The most significant crypto regulatory news of 2025 has been the widespread rollout of Central Bank Digital Currencies (CBDCs) across major economies. The European Central Bank’s digital euro pilot program has exceeded expectations, with over 50 million users adopting the digital currency within the first six months of launch. This development has created a paradigm shift in how governments view digital currencies, moving from skepticism to active participation in the crypto ecosystem.

The CBDC adoption has had profound implications for traditional cryptocurrencies. While some analysts predicted that government-issued digital currencies would compete directly with Bitcoin and Ethereum, the reality has been more nuanced. Instead, CBDCs have legitimized the broader concept of digital money, leading to increased acceptance and integration of all forms of digital currencies.

China’s digital yuan has also expanded internationally, with several African and South American countries piloting cross-border payment systems using the digital currency. This expansion has sparked discussions about monetary sovereignty and the future of international trade settlements, making it one of the most-watched cryptocurrency trends of 2025.

Comprehensive Crypto Regulation Framework

The United States has finally implemented a comprehensive cryptocurrency regulation framework, ending years of regulatory uncertainty that had plagued the industry. The Digital Asset Framework Act of 2025 provides clear guidelines for crypto exchanges, wallet providers, and institutional investors, creating a more stable environment for innovation and investment.

This regulatory clarity has unleashed a wave of institutional investment, with major banks and investment firms launching cryptocurrency trading desks and offering crypto custody services to their clients. The regulation distinguishes between different types of digital assets, providing tailored approaches for utility tokens, security tokens, and stablecoins.

Technological Breakthroughs Reshaping the Crypto Landscape

Ethereum 3.0 and the Scalability Solution

The launch of Ethereum 3.0 has been one of the most anticipated developments in the blockchain news cycle of 2025. The upgrade promises to solve the network’s long-standing scalability issues through innovative sharding technology and proof-of-stake consensus mechanisms. Early testing indicates transaction speeds of up to 100,000 transactions per second, a massive improvement over the current network capacity.

This technological leap has reinvigorated interest in decentralized applications (DApps) and smart contracts, with developers rushing to build more complex and resource-intensive applications. The improved scalability has also reduced transaction fees significantly, making DeFi protocols more accessible to retail investors.

AI-Powered Blockchain Networks

The integration of artificial intelligence with blockchain technology has emerged as a game-changing trend in 2025. Several new blockchain networks now utilize AI algorithms to optimize transaction processing, enhance security protocols, and improve network governance. These AI-powered networks can adapt to changing conditions in real-time, making them more efficient and resilient than traditional blockchain systems.

Machine learning algorithms are being used to predict network congestion, automatically adjust gas fees, and identify potential security threats before they can cause damage. This technological fusion is creating a new category of intelligent blockchain networks that could revolutionize how we think about decentralized systems.

Market Dynamics and Investment Trends

Institutional Adoption Reaches New Heights

The institutional crypto adoption story of 2025 has been remarkable, with pension funds, insurance companies, and sovereign wealth funds allocating significant portions of their portfolios to digital assets. Norway’s Government Pension Fund Global, the world’s largest sovereign wealth fund, announced a 5% allocation to cryptocurrencies, signaling a major shift in institutional sentiment.

Corporate treasury adoption has also accelerated, with companies beyond the tech sector adding Bitcoin and Ethereum to their balance sheets as inflation hedges and alternative stores of value. This trend has provided significant price stability and reduced the extreme volatility traditionally associated with cryptocurrency markets.

The Rise of Sustainable Crypto Mining

Environmental concerns have driven significant innovation in crypto mining practices throughout 2025. The industry has witnessed a massive shift toward renewable energy sources, with over 70% of Bitcoin mining operations now powered by sustainable energy. This transition has been facilitated by new mining technologies that are more energy-efficient and the development of carbon-neutral mining pools.

Several countries have established green mining zones, offering tax incentives and renewable energy access to cryptocurrency miners who meet strict environmental standards. This development has helped address one of the most significant criticisms of the crypto industry and improved its public perception.

Emerging Technologies and Innovation

Quantum-Resistant Blockchain Security

One of the most shocking crypto developments of 2025 has been the race to develop quantum-resistant blockchain networks. As quantum computing technology advances, the cryptographic security that underpins current blockchain systems faces potential threats. Several blockchain projects have successfully implemented quantum-resistant algorithms, ensuring long-term security against future quantum attacks.

This development has created a new category of “quantum-safe” cryptocurrencies that are attracting significant investment from institutions concerned about long-term security. The transition to quantum-resistant systems is expected to be a multi-year process that will reshape the entire crypto security landscape.

Cross-Chain Interoperability Solutions

The blockchain interoperability challenge has seen significant progress in 2025, with several successful implementations of cross-chain protocols that allow seamless asset transfers between different blockchain networks. These solutions are enabling a truly connected multi-chain ecosystem where users can interact with multiple blockchains without the technical complexity traditionally associated with such operations.

Cross-chain bridges and atomic swap technologies have become more sophisticated and secure, reducing the risks associated with moving assets between different blockchain networks. This development is crucial for the maturation of the DeFi ecosystem and the broader adoption of blockchain technology.

Global Market Impact and Economic Implications

Cryptocurrency Market Capitalization Milestones

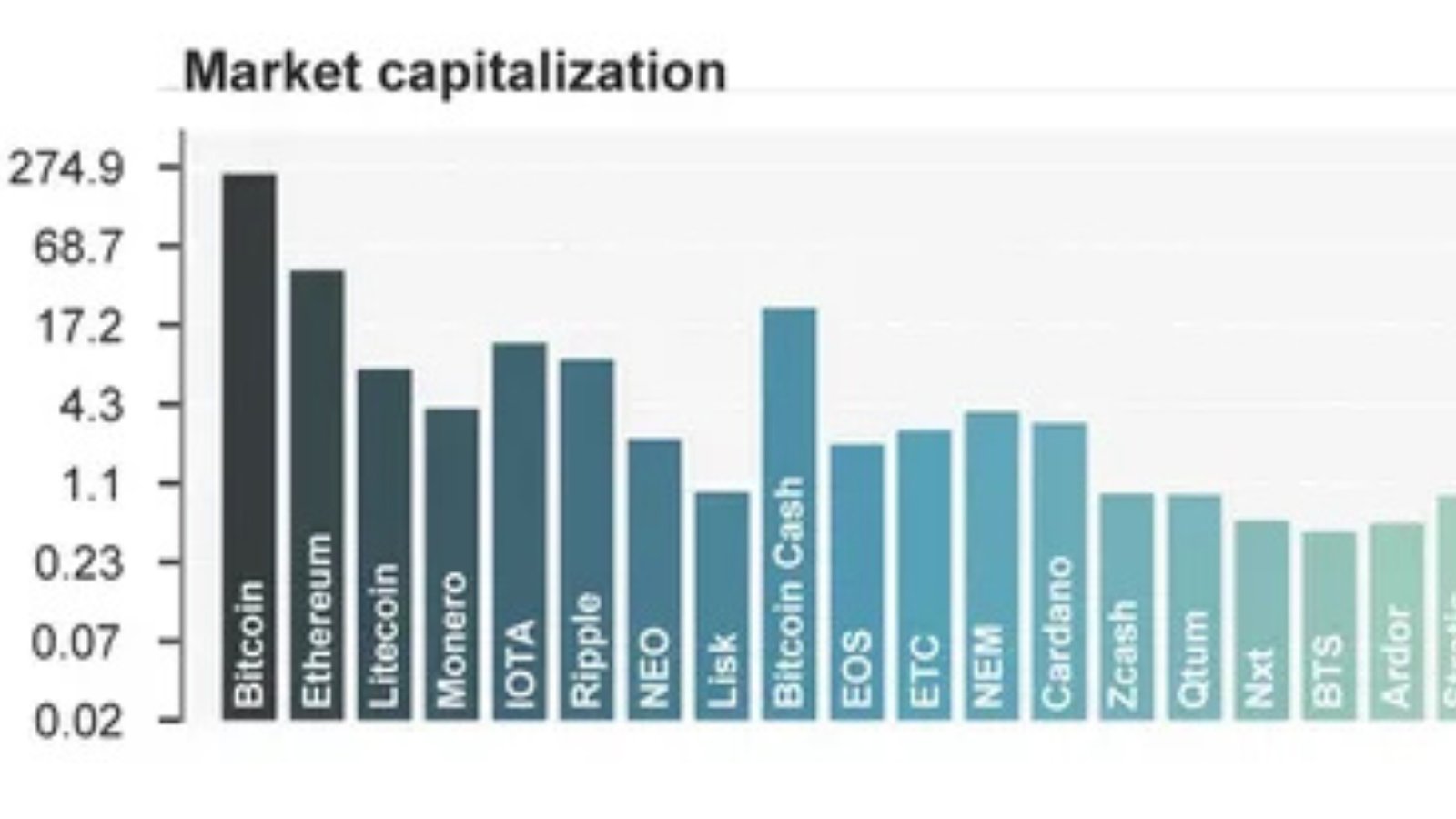

The total cryptocurrency market capitalization has reached unprecedented levels in 2025, surpassing $5 trillion for the first time in history. This milestone reflects not just price appreciation but also the addition of new projects and increased institutional participation. The market has also become more diversified, with altcoins gaining significant market share relative to Bitcoin.

Stablecoin adoption has exploded, with the total market cap of stablecoins exceeding $500 billion. These digital currencies have become essential infrastructure for international trade and cross-border payments, providing a more efficient alternative to traditional banking systems for many businesses and individuals.

Impact on Traditional Financial Systems

The growing influence of cryptocurrency markets has begun to impact traditional financial systems in measurable ways. Central banks around the world are adjusting monetary policies to account for the increasing role of digital currencies in their economies. Some economists argue that the widespread adoption of cryptocurrencies is creating a parallel financial system that operates independently of traditional banking infrastructure.

Payment processors and fintech companies have rushed to integrate cryptocurrency payment options, with major retailers now accepting various digital currencies as payment methods. This mainstream adoption has created a positive feedback loop, driving further innovation and investment in the sector.

Future Outlook and Market Predictions

Emerging Market Opportunities

The crypto market trends of 2025 point toward significant opportunities in emerging markets, where traditional banking infrastructure is less developed. Countries in Africa, Southeast Asia, and Latin America are experiencing rapid cryptocurrency adoption as citizens seek alternatives to unstable local currencies and inefficient financial systems.

Mobile-first crypto solutions are gaining traction in these markets, with simplified wallet applications and low-fee payment networks making digital currencies accessible to populations previously excluded from the formal financial system. This trend could drive the next wave of global crypto adoption.

Technological Convergence and Innovation

The convergence of blockchain technology with other emerging technologies like IoT, 5G networks, and edge computing is creating new possibilities for decentralized applications and services. Smart cities are beginning to integrate blockchain-based identity systems, supply chain management, and governance mechanisms.

Web3 development is accelerating, with more user-friendly interfaces and applications making decentralized services accessible to mainstream users. The transition from Web2 to Web3 is expected to be one of the defining technological shifts of the next decade.

For More: Best Crypto News Websites in 2024: Your Ultimate Info Guide

Conclusion

The shocking crypto news trends of 2025 have fundamentally transformed the digital currency landscape, creating new opportunities while addressing long-standing challenges. From comprehensive regulatory frameworks to revolutionary technological breakthroughs, the cryptocurrency industry has matured significantly while maintaining its innovative edge.

The convergence of institutional adoption, regulatory clarity, and technological advancement has created a more stable and sophisticated cryptocurrency market that is better positioned for sustainable growth. As we move forward, the trends established in 2025 will likely continue to shape the industry for years to come.