Once more, Elon Musk’s departure, the creative CEO of Tesla and SpaceX, generates news following his departure from the Trump government advisory role. Considering the increasing volatility in bitcoin markets that have reacted violently to world events, Elon Musk’s departure marks a significant shift in the political arena. As Musk goes, his decision resonates in the financial and business domains; it equally draws interest from political insiders, investors, and international markets.

Musk’s Role in Government

Several years ago, during extreme political upheaval in the United States, Elon Musk was named to a special advisory post within President Donald Trump’s government. Renowned for his innovative ideas in artificial intelligence, electric cars, and space exploration, Musk has taken up a position inside the Department of Government Efficiency (DOGE). His clear directives included restructuring government inefficiencies, reducing bureaucratic red tape, and implementing extensive changes across federal agencies.

Still, his stay in the government was not without controversy. Musk received both accolades and criticism for his unusual approach to governing since it resulted in thousands of federal workers being fired under cost-cutting initiatives. While some on the right praised Musk as a much-needed outsider in a government system sometimes regarded as bloated and ineffective, many on the political left attacked him for allegedly ignoring labor rights.

Crypto Market Turbulence

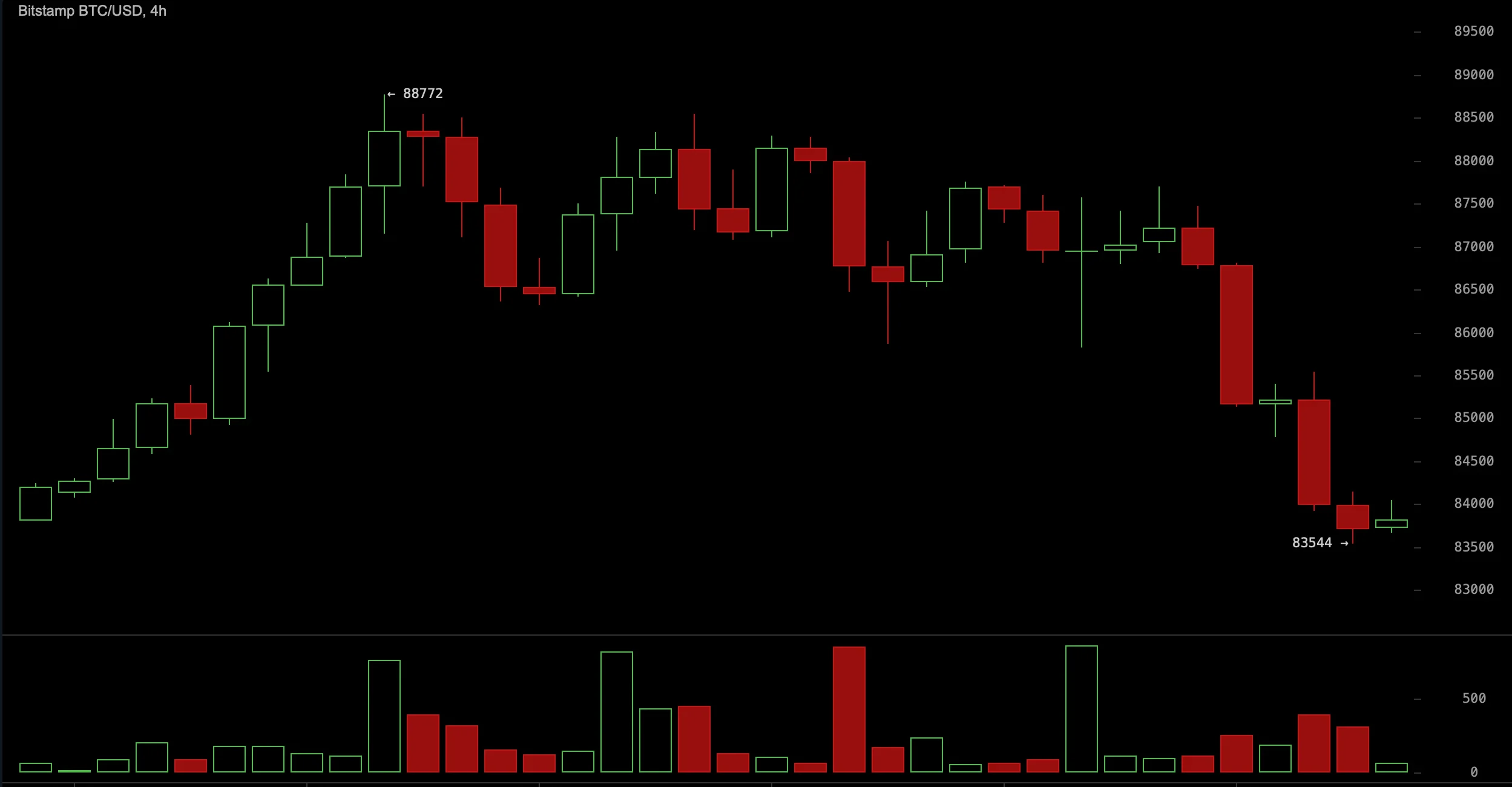

As Musk left his advisory role, the Crypto Market displayed clear turbulence. On April 3, 2025, President Trump declared fresh trade tariffs, rattling markets. The government said tariffs would rise from 10% to 49% on imports from numerous numerous crucial foreign trade partners, including China and the European Union. Although this action addresses trade imbalances, it immediately raises questions regarding the possible effects on world economic stability.

Markets for cryptocurrencies, which are progressively seen as high-risk, high-reward investments, responded accordingly. The biggest cryptocurrency in the world, Bitcoin, dropped 1.6% and came to about $83,136. Having been trading close to the $90,000 level for some weeks, this was a fall. The second and third biggest cryptocurrencies, Ethereum and XRP, followed suit with declines of 2.9% and 3.6%, respectively.

The response of the Bitcoin markets reflects the growing awareness among investors that, although not directly connected to conventional markets, digital currencies are also subject to the broader economic climate. Cryptocurrencies have long been a counterpoint against economic uncertainty and inflation. The most recent developments, however, reveal that they are not exempt from geopolitical elements such as trade policy and tariffs, which might have a domino effect on investor mood.

Tariffs and Market Volatility

The escalating volatility within the cryptocurrency space does not occur in isolation. Reaction to the tariff announcement also resulted in significant drops in conventional financial markets, especially U.S. stock futures. Reflecting the uncertainty of the larger market over the possible impact of the tariffs on foreign trade, S&P 500 futures fell by almost 3% and Nasdaq 100 futures fell by 3.6%.

Quick to criticize the tariff rises, European officials voiced worries about the strain this would cause on transatlantic relations. Germany and France, among other nations, have cautioned that these tariffs would cause job losses, higher consumer prices, and general economic uncertainty. Similar worries have been expressed by the European Central Bank (ECB), which warns that protectionist measures of the United States could have a dire knock-on effect on world markets.

Musk Markets Uncertainty

With Elon Musk leaving the Trump government and continuous volatility in world markets, the next months will be crucial for political and financial stability. Musk’s return to emphasizing his businesses might allow him to keep stretching the bounds of space exploration and technology. However, his leaving the political scene can leave a hole in the way the present government approaches creativity and government change.

Things seem hazy regarding the bitcoin market. Although some investors still have confidence in the long-term prospects of digital currencies, the current market drop reminds us of how susceptible these assets are to political and financial developments. Cryptocurrency investors must remain vigilant and flexible as the world’s biggest economies negotiate changing trade policy and foreign ties.

Final thoughts

Emphasizing Elon Musk’s departure from his advising post in the Trump administration, the paper presents a provocative analysis of the junction of high-profile political actions, economic instability, and the changing bitcoin scene. Musk’s leaving coincides withsignificantjor period of political unrest and economic upheaval, especially in the bitcoin markets, which are magnifying.

The paper does a good job of stressing how Musk’s leaving affects the political and business spheres. On one hand, Musk’s involvement in the Trump government was divisive, marked by a drive for governmental efficiency but at the expense of notable job losses, generating polarized responses from all political spectrums. Conversely, his choice to resign might have more general consequences, particularly on the direction of government reform’s innovation. His withdrawal from political power probably means a return of attention to his technological activities, which could benefit Tesla and SpaceX but also cause a void in political reform.