USDC stablecoin announces its exploration of launching a native token for its newly unveiled Arc blockchain. This development represents more than just another token launch—it signals a fundamental transformation in how institutional-grade blockchain infrastructure is designed, governed, and incentivized. With over 100 major financial institutions already participating in the Arc testnet, including industry giants like Goldman Sachs, BlackRock, Visa, and Amazon Web Services, Circle’s move could reshape the landscape of stablecoin-based blockchain networks and accelerate mainstream adoption of digital finance infrastructure.

The announcement, disclosed in Circle’s Q3 2025 earnings report, comes at a time when the company is experiencing exceptional financial growth. Circle reported $740 million in Q3 2025 revenue, representing a 66% year-over-year increase, with net income soaring to $214 million, up 202% from the same period last year. This robust financial performance provides the foundation for Circle’s ambitious expansion into blockchain infrastructure development, positioning the company to capture a larger share of the rapidly evolving digital payments ecosystem.

The proposed native token for Arc represents a strategic evolution in Circle’s approach to blockchain governance and network participation. While Arc initially launched with USDC serving as the native gas token for transaction fees, the introduction of a dedicated network token would enable new mechanisms for stakeholder alignment, governance participation, and ecosystem growth. This dual-token model could provide the best of both worlds: the stability and regulatory clarity of USDC for payments, combined with the growth potential and governance capabilities of a native network token.

Understanding Circle’s Arc Blockchain Architecture

Circle’s Arc blockchain represents a purposeful departure from general-purpose blockchain networks. The Arc Network is an open layer 1 blockchain optimized for stablecoin transactions with features like stablecoin gas payments and sub-second transaction finality. This specialized design addresses persistent challenges that have prevented wider institutional adoption of blockchain technology—unpredictable transaction costs, the need to hold volatile cryptocurrencies for gas fees, and concerns about transaction privacy on public networks.

The architectural foundations of Arc prioritize enterprise requirements without sacrificing the openness and composability that make blockchain technology powerful. By maintaining compatibility with the Ethereum Virtual Machine, Arc enables developers to leverage existing tools, frameworks, and smart contract code while benefiting from performance optimizations specifically tailored for stablecoin finance applications. This approach reduces the friction typically associated with building on new blockchain platforms and accelerates the onboarding of developers and applications.

One of Arc’s most innovative features is its use of stablecoins for gas fee payments. Unlike traditional blockchains, where users must acquire and hold native tokens to pay transaction fees, Arc allows participants to transact entirely in familiar stablecoin denominations. This seemingly simple innovation removes a significant barrier for institutional treasurers and compliance teams who cannot justify holding volatile crypto assets on their balance sheets. The sub-second transaction finality further enhances Arc’s appeal for time-sensitive financial operations, enabling use cases that require immediate settlement assurance.

The blockchain’s privacy controls represent another critical differentiator. While maintaining transparency for regulatory compliance, Arc offers optional privacy features that allow institutions to shield sensitive commercial information from competitors while still operating on a public blockchain. This balance between transparency and confidentiality addresses one of the primary concerns financial institutions express about conducting business on open ledgers.

The Strategic Rationale Behind a Native Token

Circle’s exploration of a native token for Arc reflects careful strategic thinking about blockchain network economics and governance models. Circle stated the potential native token could “foster network participation to drive adoption, further align the interests of Arc stakeholders, and support the long-term growth and success of the Arc network”. This language signals that the token would serve multiple complementary purposes within the Arc ecosystem.

From a network participation perspective, a native token creates economic incentives for validators, developers, and other ecosystem participants to contribute to Arc’s growth and security. Traditional proof-of-stake mechanisms require validators to stake native tokens, aligning their financial interests with the network’s long-term health. By introducing a native token, Circle can distribute ownership and decision-making authority across a broader base of stakeholders, moving toward the decentralized governance model that has become increasingly important for regulatory clarity and community trust.

The alignment function of a native token is equally significant. When developers, institutions, and service providers hold native tokens, they have direct exposure to the network’s success. This creates a virtuous cycle where stakeholders are incentivized to build valuable applications, attract users, and improve the infrastructure—activities that increase the token’s utility and value. This model has proven effective for other layer-1 blockchain platforms that have successfully built vibrant ecosystems around their native tokens.

For Circle specifically, a native token offers a mechanism to share in the value creation that Arc enables without relying solely on USDC transaction volumes. As Arc attracts more enterprise adoption and processes increasing volumes of tokenized assets beyond USDC, a native token captures this broader value creation. The token could also serve as a governance mechanism, allowing stakeholders to vote on protocol upgrades, fee structures, and other critical network parameters—a capability that USDC, as a stablecoin, cannot provide.

Institutional Momentum and Testnet Success

The level of institutional participation in Arc’s testnet phase has exceeded expectations and validates Circle’s strategic approach. The Arc testnet has attracted over 100 major institutions, including BlackRock, Visa, Amazon, and Goldman Sachs. This roster of participants spans multiple sectors of the financial industry, from traditional banking and asset management to payments processing and technology infrastructure providers.

The breadth of institutional involvement signals that Arc is addressing real pain points in enterprise blockchain adoption. Financial institutions have historically been cautious about committing to blockchain platforms, concerned about sustainability, regulatory compliance, and technical reliability. The fact that industry leaders are dedicating resources to testing Arc during its early phases suggests they see potential for the platform to become foundational infrastructure for their digital transformation initiatives.

Beyond the headline names, the diversity of participants is equally telling. The testnet includes stablecoin issuers from multiple jurisdictions seeking to issue local currency-pegged tokens, digital wallet providers integrating Arc connectivity, cryptocurrency exchanges adding support for Arc-based assets, and specialized infrastructure providers building the tools necessary for enterprise deployment. This ecosystem diversity creates network effects that can accelerate Arc’s evolution from testnet to production readiness.

The participation of market makers and liquidity providers is particularly significant for Arc’s long-term viability. Efficient markets require deep liquidity, and the presence of major market-making firms suggests confidence that Arc will process sufficient transaction volumes to justify their operational investment. Similarly, the involvement of custody providers indicates that the secure storage solutions necessary for institutional-scale operations are being developed in parallel with the blockchain itself.

Financial Performance Driving Innovation

Circle’s decision to explore a native token launch comes from a position of financial strength. The company’s Q3 2025 results demonstrate exceptional business momentum across multiple metrics. Revenue growth of 66% year-over-year reflects increasing adoption of USDC and Circle’s broader platform services. The dramatic 202% increase in net income signals improving operational efficiency and economies of scale as the business expands.

This financial performance is underpinned primarily by the yield generated from the U.S. Treasury securities backing USDC reserves. Roughly 96% of Circle’s revenue came from yield generated by the U.S. Treasury bills backing the stablecoin. As interest rates have remained elevated, this revenue stream has grown substantially, providing Circle with significant resources to invest in strategic initiatives like Arc development and potential token launches.

The growth in USDC circulation has been equally impressive, with the stablecoin’s market capitalization expanding significantly. This expansion reflects both macroeconomic factors—such as increased global demand for dollar-denominated digital assets—and Circle’s success in onboarding new institutional users. Each new institution that adopts USDC creates potential demand for Arc infrastructure, as these organizations seek efficient, compliant platforms for conducting stablecoin-based transactions.

Circle’s willingness to invest heavily in Arc development, despite the substantial costs associated with building and maintaining blockchain infrastructure, demonstrates management’s confidence in the long-term market opportunity. The company increased its workforce by 14% and saw distribution and transaction costs rise significantly as it scaled operations to support growth. This aggressive investment stance suggests Circle views Arc not as an experimental side project but as a central pillar of its future business strategy.

Application-Specific Blockchain Strategy

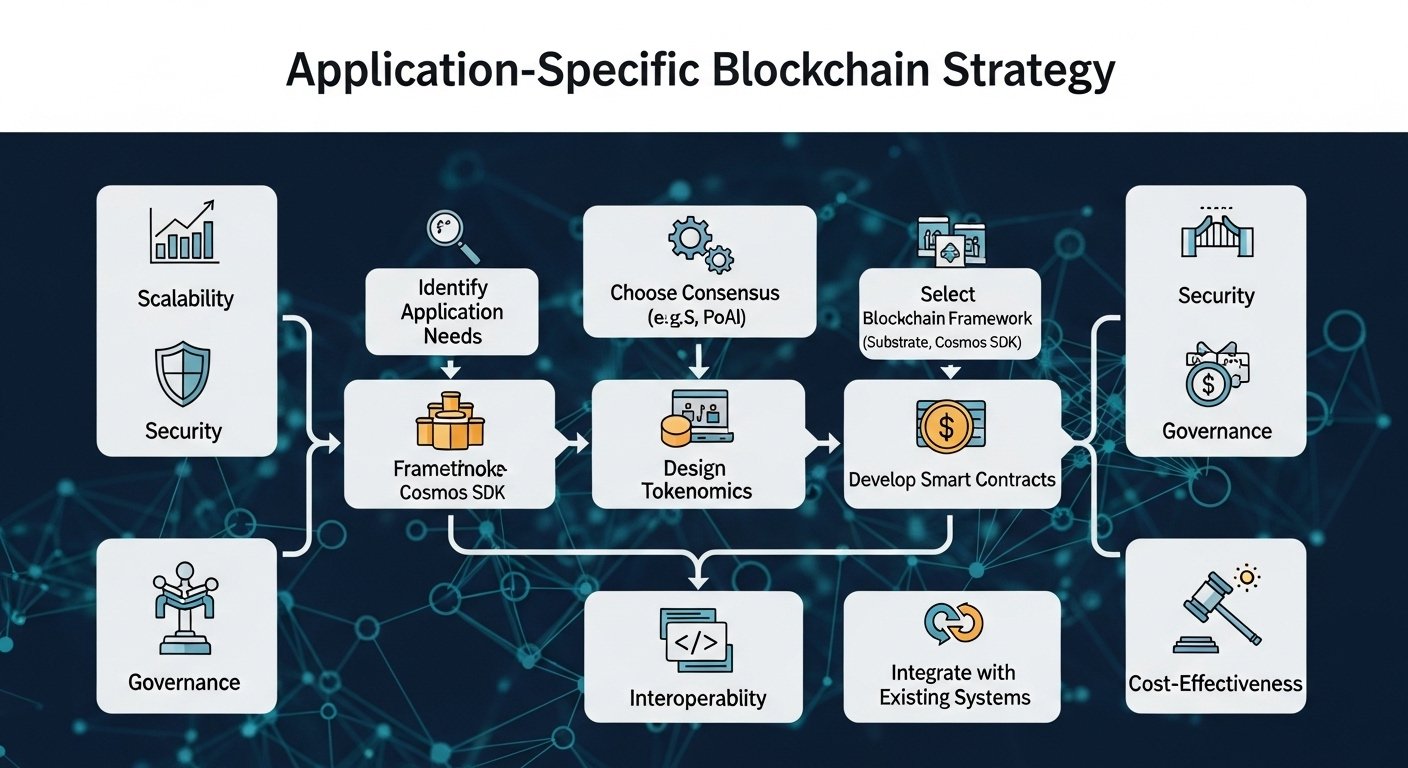

Arc exemplifies the growing trend toward application-specific blockchains or “appchains”—platforms designed and optimized for particular use cases rather than attempting to serve all possible applications equally well. This architectural philosophy acknowledges that different applications have fundamentally different requirements and that specialized infrastructure can deliver superior performance, economics, and user experience.

For stablecoin and tokenized asset applications, the advantages of specialization are compelling. General-purpose blockchains must balance the needs of DeFi protocols, NFT marketplaces, gaming applications, and countless other use cases, often resulting in compromises that satisfy no constituency perfectly. By focusing exclusively on stablecoin finance, Arc can optimize every aspect of its design—from consensus mechanisms to fee structures to privacy features—for this specific domain.

Critics of the appchain approach raise valid concerns about liquidity fragmentation and ecosystem sustainability. When every application launches its own blockchain, liquidity becomes dispersed across incompatible platforms, reducing efficiency and increasing costs. Security also becomes a concern, as smaller networks with fewer validators may be more vulnerable to attacks compared to established platforms with broad validator distribution.

However, proponents argue that improved interoperability protocols are addressing these challenges. Cross-chain communication standards enable assets and data to move seamlessly between different blockchain networks, allowing specialized platforms to benefit from specialization while maintaining connectivity to the broader ecosystem. Circle’s commitment to maintaining USDC availability across multiple blockchain platforms demonstrates this multi-chain approach in practice.

Regulatory Context and Compliance Advantages

Circle’s arc development and potential token launch occur within an evolving regulatory landscape that increasingly favors compliant, regulated players. The company has positioned itself as a leader in stablecoin compliance, maintaining reserve transparency, undergoing regular attestations, and working proactively with regulators globally. This compliance-first approach differentiates Circle from some competitors and aligns with the requirements that major financial institutions demand from their technology partners.

The recent passage of comprehensive stablecoin regulations in several jurisdictions has created greater clarity for the industry. These frameworks typically establish reserve requirements, disclosure obligations, and licensing standards for stablecoin issuers. Circle’s existing compliance infrastructure positions it to meet these requirements efficiently, potentially creating competitive advantages as smaller or less compliant competitors face regulatory pressure.

For Arc specifically, being developed by a regulated entity could accelerate institutional adoption. Financial institutions conducting due diligence on blockchain platforms examine not only technical capabilities but also the regulatory standing and compliance track record of platform operators. Circle’s regulatory relationships and demonstrated commitment to operating within established frameworks reduce adoption friction for risk-conscious institutions.

The potential native token introduces additional regulatory considerations. Depending on its design and distribution mechanisms, the token could face classification questions under securities laws. However, if structured primarily as a utility and governance token with clear use cases within the Arc network, Circle may be able to navigate these regulatory waters successfully, particularly given its experience and relationships with regulatory authorities.

Competitive Landscape and Market Positioning

Circle’s move into blockchain infrastructure places it in competition with established layer-1 platforms while simultaneously creating potential partnerships. Ethereum, Solana, and other major blockchain networks already support USDC and compete for stablecoin-based transaction volumes. Arc’s success will depend partly on attracting applications and liquidity away from these established platforms or capturing new use cases that existing platforms serve poorly.

However, Circle’s approach differs fundamentally from pure blockchain platforms. Rather than competing directly with Ethereum for all possible applications, Arc targets a specific segment—institutional stablecoin finance—where Circle’s regulatory standing, institutional relationships, and domain expertise create defensible advantages. This focused strategy allows Circle to compete on dimensions beyond raw technical performance.

Other stablecoin issuers have also recognized the strategic value of controlling blockchain infrastructure. Tether, the largest stablecoin by market capitalization, has invested in projects like Plasma and Stable that share Arc’s focus on stablecoin-optimized infrastructure. These parallel developments suggest that major stablecoin issuers increasingly view blockchain control as strategically important rather than viewing blockchains merely as neutral distribution rails.

Circle’s public company status adds another competitive dimension. As a publicly traded entity following its successful IPO, Circle faces different incentives and constraints compared to privately held competitors. The company must balance aggressive growth investments with profitability expectations from public market investors. The strong financial performance demonstrated in recent quarters gives management credibility with investors to pursue longer-term strategic initiatives like Arc development.

Technical Innovation and Developer Experience

Arc’s technical architecture reflects lessons learned from earlier blockchain platforms while introducing innovations specific to its stablecoin finance focus. The decision to maintain EVM compatibility ensures that the vast existing base of Solidity developers can build on Arc without learning entirely new programming paradigms. This approach significantly reduces the barriers to developer adoption and accelerates the availability of applications on the platform.

The sub-second finality that Arc achieves represents substantial technical advancement over many existing platforms. Finality—the point at which a transaction becomes irreversible—is critical for financial applications where uncertainty about transaction status creates risk. By achieving finality in under one second, Arc enables instant settlement patterns that closely approximate the user experience of traditional payment systems while maintaining the transparency and programmability advantages of blockchain technology.

Circle’s integration of Arc with its existing platform services creates additional developer advantages. Rather than forcing developers to integrate separately with multiple providers for wallets, payments, cross-chain transfers, and other core services, Arc offers these capabilities as native platform features. This integrated approach reduces technical complexity and accelerates time-to-market for applications built on Arc.

The platform’s privacy features deserve particular attention in the context of institutional requirements. While complete transaction transparency is valuable for certain use cases, enterprise applications often require selective disclosure—revealing information to counterparties and regulators while shielding it from competitors. Arc’s opt-in privacy controls allow developers to implement this selective disclosure, enabling use cases that would be impossible on fully transparent blockchains.

Implications for the Broader Stablecoin Ecosystem

Circle’s Arc initiative carries implications that extend beyond Circle itself, potentially influencing how the entire stablecoin industry evolves. If Arc succeeds in attracting significant institutional adoption and transaction volumes, it could establish a template for purpose-built financial infrastructure that other players may replicate. This could accelerate the trend toward specialization in blockchain design and away from general-purpose platforms attempting to serve all use cases.

The potential native token also introduces interesting dynamics into stablecoin economics. Historically, stablecoin issuers have captured value primarily through the spread between yields earned on reserves and interest paid to stablecoin holders—essentially operating as narrow banks. A native token for Arc creates an additional revenue and value capture mechanism tied to platform usage rather than just stablecoin issuance, potentially enabling new business model innovations.

For USDC holders and users, Arc’s success could strengthen the stablecoin’s competitive position. As more applications and institutions build on Arc, demand for USDC to use within this ecosystem should increase, supporting USDC market capitalization growth. The circular relationship between Circle’s stablecoin business and its blockchain infrastructure business creates strategic reinforcement effects that benefit both business lines.

Competing stablecoins face pressure to respond to Circle’s infrastructure investments. Simply issuing a stablecoin without supporting ecosystem infrastructure may prove increasingly inadequate as users and developers gravitate toward platforms offering integrated services and optimized performance. This could drive consolidation around a smaller number of stablecoin platforms with the resources and strategic vision to build comprehensive ecosystems.

Risk Factors and Challenges Ahead

Despite the promising momentum behind Arc, several significant risks and challenges could impede its success. The blockchain infrastructure space remains intensely competitive, with well-funded competitors and established network effects protecting incumbent platforms. Convincing developers and institutions to adopt a new platform requires overcoming substantial switching costs and inertia.

Technical execution risks are inherent in any complex blockchain platform development. Security vulnerabilities, performance issues, or interoperability failures could undermine confidence in Arc and slow adoption. Circle must successfully navigate the challenging transition from testnet to mainnet while maintaining the reliability and security standards that institutional users demand.

The token launch itself introduces additional risks. Market reception of the native token will depend on factors partially outside Circle’s control, including broader cryptocurrency market conditions, regulatory developments, and competitive token offerings. Poorly executed tokenomics could fail to create the intended incentive structures or could introduce unintended consequences that hinder rather than help Arc’s growth.

Regulatory risks remain significant despite Circle’s compliance focus. Changes in how regulators view stablecoins, blockchain platforms, or native tokens could require substantial adjustments to Arc’s design or Circle’s business model. International regulatory fragmentation, where different jurisdictions impose conflicting requirements, could complicate Circle’s efforts to build Arc into global infrastructure.

Future Roadmap and Strategic Evolution

Looking ahead, Circle faces critical decisions about Arc’s evolution and the timing and structure of any native token launch. The company must determine optimal tokenomics that balance various stakeholder interests while creating sustainable incentives for network growth. Distribution mechanisms for the token will require careful design to ensure regulatory compliance while achieving sufficient decentralization to realize governance benefits.

The roadmap from testnet to mainnet represents another crucial phase. Circle must expand the validator set, stress-test the network under production conditions, and demonstrate the reliability required for institutions to commit significant transaction volumes. Success in this phase will determine whether Arc becomes foundational infrastructure or remains a interesting but underutilized platform.

Integration with traditional financial systems represents both an opportunity and a challenge. For Arc to achieve its full potential, it must connect seamlessly with existing payment rails, banking systems, and financial market infrastructure. Circle’s relationships with major financial institutions position it well for these integrations, but execution will require sustained effort and coordination across multiple organizations.

The evolution of the broader digital asset ecosystem will significantly influence Arc’s trajectory. As tokenization of real-world assets accelerates—with securities, commodities, and real estate increasingly represented on blockchain—Arc’s specialized infrastructure for tokenized value transfer could capture substantial market share. Success in attracting diverse asset issuers beyond stablecoins would validate Arc’s platform strategy and justify the development investments.

Conclusion

Circle’s exploration of a native token launch for its Arc blockchain marks a pivotal moment in the evolution of institutional blockchain infrastructure. By combining a successful stablecoin business with purpose-built blockchain technology and now potentially a native network token, Circle is constructing an integrated ecosystem designed to capture significant value in the emerging digital finance landscape. The impressive roster of institutional participants in Arc’s testnet phase, combined with Circle’s strong financial performance and regulatory positioning, suggests the initiative has substantial potential to reshape how institutions conduct blockchain-based transactions.

The strategic logic behind a native token is compelling—it enables stakeholder alignment, decentralized governance, and value capture beyond stablecoin issuance while complementing rather than replacing USDC’s role within the ecosystem. However, execution risks remain substantial, and Circle must navigate technical, competitive, and regulatory challenges successfully to realize Arc’s full potential. The coming months will reveal whether Circle can translate testnet interest into mainnet adoption and whether the proposed native token becomes a catalyst for ecosystem growth or introduces unforeseen complications.

As the blockchain industry matures and institutional adoption accelerates, infrastructure providers like Circle that can combine regulatory compliance, technical innovation, and strong institutional relationships are well-positioned to capture significant market opportunities. Arc’s success or failure will offer important lessons about the viability of application-specific blockchain strategies and the role of stablecoin issuers in shaping blockchain infrastructure. For observers of the crypto and blockchain space, Circle’s ambitious expansion into layer-1 infrastructure represents one of the most significant strategic moves of 2025 and merits close attention as it unfolds.

FAQs

Q: What is Circle’s Arc blockchain, and how does it differ from other blockchain platforms?

Arc is Circle’s layer-1 blockchain specifically designed and optimized for stablecoin transactions and institutional financial applications. Unlike general-purpose blockchains that attempt to serve all types of applications, Arc focuses exclusively on financial use cases, offering features like stablecoin-based gas fees, sub-second transaction finality, and optional privacy controls.

Q: Why is Circle considering launching a native token when USDC already serves as the gas token?

While USDC functions effectively as the gas token for transaction fees, a native token would serve complementary purposes that a stablecoin cannot fulfill. The proposed native token would enable decentralized governance, allowing stakeholders to participate in decisions about protocol upgrades and network parameters.

Q: Which major institutions are participating in the Arc testnet?

Arc’s public testnet has attracted over 100 major institutions spanning multiple sectors of the financial industry. Notable participants include investment banks like Goldman Sachs, asset managers such as BlackRock and Invesco, payment companies including Visa and Mastercard, and technology providers like Amazon Web Services.

Q: What are the main risks and challenges facing Arc’s development and adoption?

Arc faces several significant challenges despite its promising start. Technical execution risks include potential security vulnerabilities, performance issues during scaling, and integration complexities with existing systems. The competitive landscape is intense, with established blockchain platforms benefiting from network effects and substantial developer ecosystems.

Q: How does Arc’s launch align with Circle’s overall business strategy and financial performance?

Arc represents a strategic evolution of Circle’s business model from stablecoin issuer to comprehensive blockchain infrastructure provider. The company’s strong financial performance—including 66% revenue growth and 202% net income increase in Q3 2025—provides the resources necessary to invest aggressively in platform development.

![Bitcoin vs Altcoins Who Wins the Breakout [2026 Analysis]](https://spearcrypto.com/wp-content/uploads/2026/01/Bitcoin-vs-Altcoins-Who-Wins-the-Breakout-2026-Analysis-390x220.jpg)