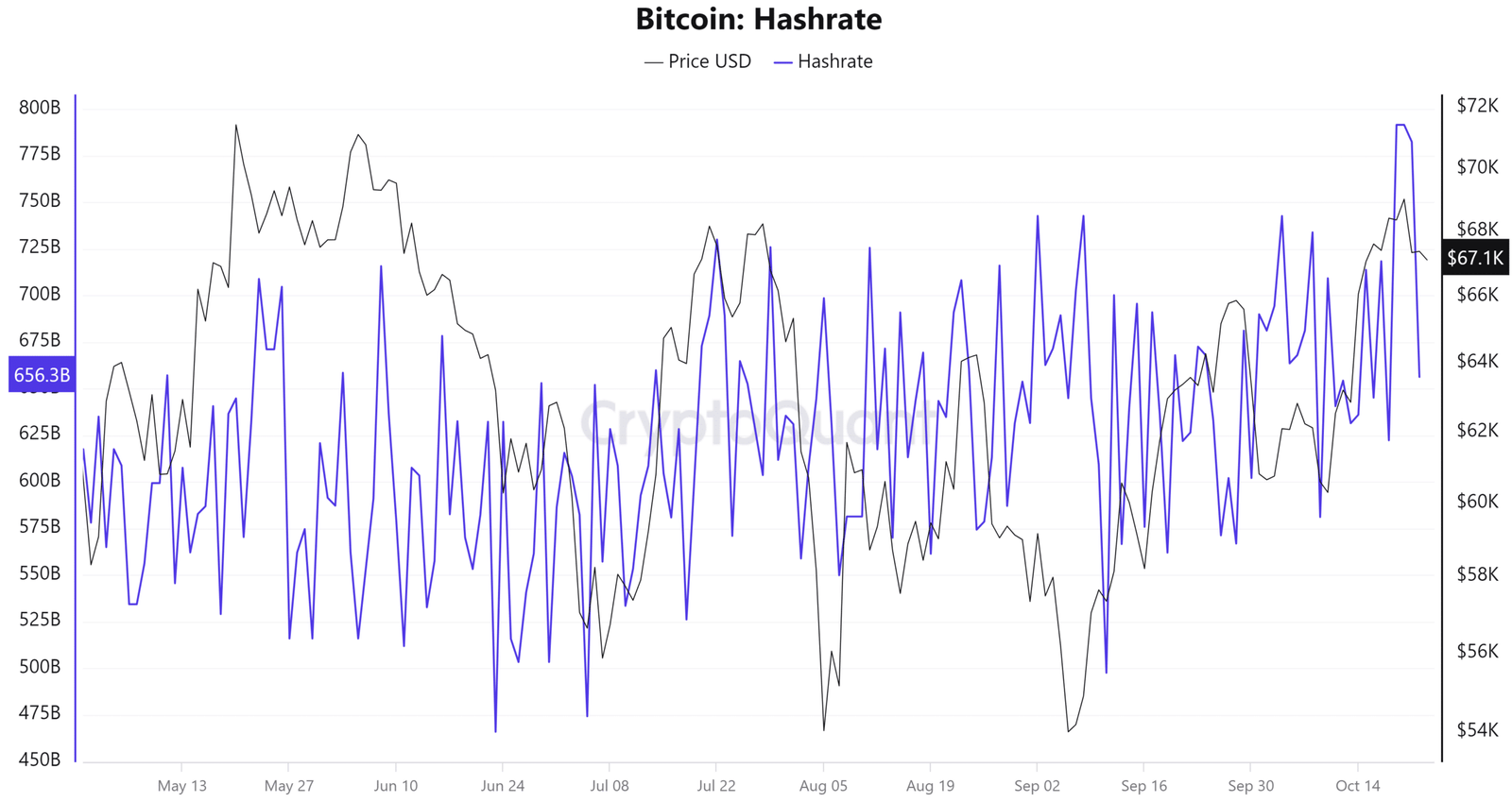

Although volatility has traditionally defined the realm of Bitcoin Mining, recent events suggest that miners remain strong even in the face of major price swings. Rising to new record highs, Bitcoin’s hashrate—the total computing capacity utilized to mine and process transactions on the network—indicates that miners are unconcerned by the continuous price fall.

The hashrate keeps rising even if Bitcoin’s price dropped and its worth dropped to $26,000. In October 2024 it will reach an all-time high of 698 exahashes per second (EH/s).

Bitcoin Hashrate Surge Continues

For the network, the tremendous increase in Bitcoin’s hashrate marks a major turning point emphasizing miners’ relentless dedication to their business. With a 698 EH/s reading on October 10, 2024, Bitcoin’s network reached a fresh peak over its old record of 693 EH/s recorded just one month earlier. This 73 EH/s spike in less than two weeks marks a 4% increase in the general computing capacity of the network. The expansion reflects the ongoing expenditure of the mining community in the infrastructure required to enable the blockchain of Bitcoin, therefore guaranteeing and verifying transactions.

Although the price of Bitcoin has dropped significantly, miners have not wavers in their dedication. With the hope that Bitcoin’s price will eventually rise, this contradiction of rising hashrate in the face of declining prices reveals that miners are giving long-term benefits top priority above transient market volatility. Their eagerness to keep funding mining equipment and operations highlights the sector’s rising faith in Bitcoin as a store of value independent of transient market patterns.

U.S. Bitcoin Dominance

One clear trend in the scene of Bitcoin mining is the growing importance of U.S.-listed mining businesses. These businesses have lately greatly enlarged their activities, and their network domination shows in the proportion of the total hashrate they under control. Recent JPMorgan data shows that, in October 2024, U.S.-listed Bitcoin miners accounted for 28.9% of Bitcoin’s worldwide hashrate, therefore setting a new high.

Since the start of the year, this marks a 70% rise in their combined hashrate, therefore contributing 80 EH/s to the network. Leading mining firms such Marathon Digital Holdings, Riot Platforms, and Core Scientific have been front and foremost in this growth. Their growing network control is evidence of their financial resources and deliberate investments in increasingly effective mining technologies, including the newest generation of ASIC (application-specific integrated circuit) equipment.

Rising U.S.-listed miners mirror a larger trend in the sector. The scene of Bitcoin mining worldwide has changed recently as American businesses now occupy a commanding presence. Positive legislative environments, inexpensive energy availability, and a rising institutional interest in the bitcoin field fuel this change. These businesses’ effect on Bitcoin’s hashrate and general network dynamics is becoming more significant as they expand in scope and power.

Bitcoin Mining Struggles

Though the price of Bitcoin is declining, the mining industry generally is seeing unprecedented activity. That does not always translate, though, into more profitability. Despite the increase in hashrate, mining profitability—often directly related to the market Price of Bitcoin—has only experienced a meager rise of less than 1%. This implies that given growing operational expenses like hardware investment and energy prices, miners are under great pressure to keep profitability.

One of the biggest mining businesses in the United States, Marathon Digital Holdings, for example, reported a net loss of $124.8 million in the third quarter of 2024 even raising its hashrate to 40.2 EH/s. Higher operational expenses and the April 2024 Bitcoin halving event, which lowers the block rewards miners get for confirming transactions, were mostly blamed for this loss. Miners must so compete with more efficiency to guarantee they remain profitable. As bigger, more funded companies progressively drive out smaller, less efficient operations, this can cause industry consolidation.

Notwithstanding these difficulties, the will to protect the network stays strong. The increasing hashrate directly reflects miners’ continuous investments, which show their faith in the long-term possibilities of Bitcoin and the larger cryptocurrency ecosystem.

Bitcoin Hashrate Dynamics

The relationship between hashrate and price of Bitcoin is complicated. The price of Bitcoin dropped recently to less than $26,000, a level usually discouraging new mining investments. Nevertheless, the fact that hashrate keeps increasing in spite of this price collapse suggests that miners are looking ahead and toward the long-term security and health of the network rather than depending just on transient changes.

Many elements could be responsible for this behavior. Some miners may have made investments in extremely efficient mining equipment or locked in advantageous electricity costs, which lets them run economically even in low Bitcoin prices. Others might be depending on the conviction that the price of Bitcoin will increase in the future, hence their present investments make sense over long run.

Still, the rising hashrate affects mining profitability as well. Individual miners’ earnings could drop as more miners fight for the same block rewards unless they are among the most efficient. Less effective miners may be pushed to scale back their activities or completely leave the market by this heightened competitiveness. Given only the best qualified players can keep profitable, this could result in more consolidation.

Final thoughts

Looking ahead, miners of Bitcoin will have to strike a careful balance between growing their activities and keeping profitability. Although the continuous rise in hashrate indicates hope for the future of the network, it also draws attention to the growing difficulties miners experience with regard to operational expenses and competitiveness. Miners will have to be creative and efficient in their operations if the sector adjusts to these shifting dynamics in order to be viable.

All things considered, Bitcoin miners have showed amazing fortitude against a difficult market. The hashrate of the network is rising to unprecedented heights even while the price of the bitcoin collapses. This is evidence of the constant will of miners to guarantee the security and integrity of the network as well as of the ongoing conviction in Bitcoin’s possible global store of value.